Will your insurance policy cover you if you contract the novel coronavirus?

SINGAPORE — The outbreak of the novel coronavirus, known by its scientific name by 2019-nCoV, has raised questions about insurance coverage should a person become infected with the disease.

The General Insurance Association of Singapore has said that claims arising from travel insurance will be determined by several factors, including the cut-off date for coverage and the reason for travel disruption.

Yahoo Finance Singapore spoke to five insurers to look at the scope of coverage under health insurance and travel insurance for policyholders, whether premiums have surged, and if demand for insurance has increased.

Coverage (Hospitalisation and travel)

While the government has announced that it will be footing the hospital bills for all suspected and confirmed cases in Singapore, policyholders who have existing insurances with certain firms will also be covered under their respective policies.

Tokio Marine will be providing a lump sum of $5,000 as financial assistance for its in-force individual life policyholders should they contract the virus. The assistance, however, is limited to the first 50 submissions before 30 April and will require a proof of diagnosis in the form of medical certification from hospitals.

AXA said that its health insurance policies cover medical expenses such as hospitalisation and outpatient expenses for customers who need to seek treatment for the coronavirus infection.

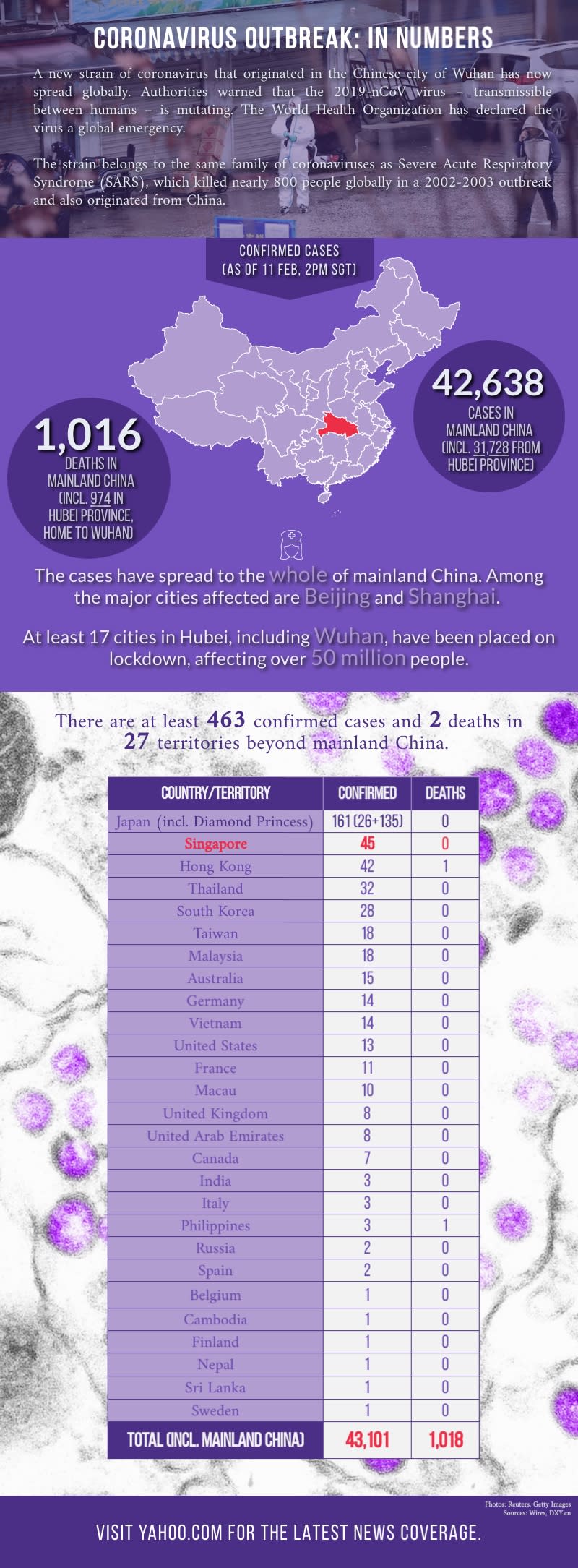

Customers can claim for trip cancellations if they purchased travel insurance plans and booked their trips to Wuhan before 11 January, or mainland China before 27 January, AXA said. Customers are eligible for travel-related claims arising from the coronavirus outbreak if they departed Singapore for Wuhan before 11 January or mainland China before 27 January.

As for AIA, its Integrated Shield Plan, known as AIA HealthShield Gold Max, covers claims related to the infection in its policy coverage. It also provides a travel insurance plan, called the AIA Around the World Plus, which covers related claims according to policy coverage.

According to Great Eastern, policyholders of its hospitalisation plans will have their hospitalisation expenses in Singapore covered, depending on their plan and ward type.

“Our focus is to ensure our policyholders are able to seek the medical treatment they require, if the unforeseen occurs, and that they do not have to worry about medical expenses unnecessarily,” the insurer said.

Policyholders of Great Eastern who have purchased health insurance plans, which cover overseas hospitalisation and medical treatment, will also be covered.

While the 2019-nCoV is not one of the critical illnesses under its policies, Great Eastern said it would cover any complications resulting from the coronavirus which leads to a critical illness.

Under its life insurance policies, Great Eastern covers death from the coronavirus.

Aviva’s MyShield health insurance policyholders can claim costs associated with hospital stays should they contract the coronavirus, subject to terms and conditions.

Non-coverage

Since the Ministry of Foreign Affairs (MFA) issued a travel advisory on 25 January advising against travel to Hubei, the province where the virus originated from, insurance firms have accordingly stopped covering visitors who travelled there.

Tokio Marine said that its travel insurance policy TM Xplora will not cover any claims arising from the outbreak if the policyholder were to travel to a destination against the advice of the authorities, unless the trip began before the travel advisory was issued. It will not cover any cancellation claims arising from the outbreak for travel policy purchased and/or expenses incurred after 11 January, as the outbreak is deemed a “known event” since then.

Similarly, AIA will not cover any claims arising from a policyholder if its travel policy AIA Around the World Plus was purchased on or after 22 January for travel to Wuhan, and on 27 January for travel to the rest of mainland China.

Great Eastern will not cover claims for policies and trips bought after 24 January, 9.30am, for travel to Hubei province, and those bought after 28 January, 11.59pm to mainland China.

Aviva said that travel insurance policies purchased on or after 20 January will not cover any claims directly or indirectly related to the Wuhan virus as it was a known event.

Premiums

None of the insurance firms has adjusted its premiums, pointing out that price adjustments were not pegged to a single factor.

Tokio Marine said its premiums, which covered business employees, were determined by a variety of factors such as the size and health of its employees, claims history, types of coverage, age profile, and the type of industry.

“With the government footing the hospital bills for all suspected and confirmed cases due to the virus, we do not expect that the group health insurance premium needs to be increased solely due to the virus,” it said. The firm added that it was finding ways to support insured members such as tele-consultation with drug delivery services for common illnesses to minimise clinic visits.

AXA similarly said that it did not have current plans to adjust health insurance premiums due to the coronavirus.

According to AIA, the firm adjusts its premiums based on age, medical inflation, and general cost of treatment, among other factors.

Aviva said that its premiums have not changed currently.

Demand

As the coronavirus was only announced by the World Health Organization on 31 December, firms said that they have not seen a surge in new business or clients. More clients, however, have been enquiring about insurance coverage under existing policies, stated Tokio Marine and AXA.

Aviva said, "We do not expect a sudden surge in the purchase of Aviva’s health insurance due to the Wuhan virus, as buying insurance policies is a long term commitment rather than an impulse purchase."

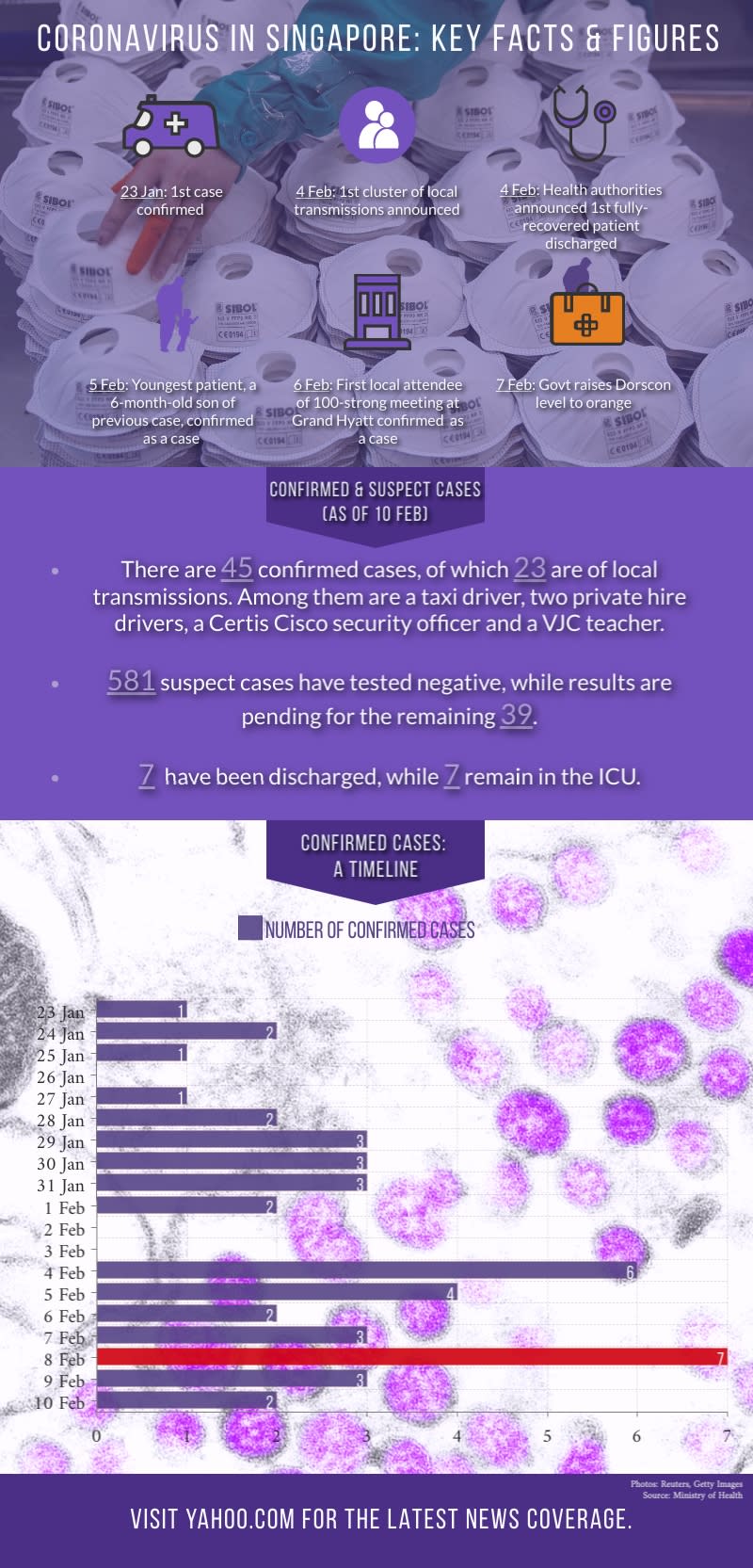

Singapore’s authorities last Friday raised the Disease Outbreak Response System Condition (Dorscon) alert level from yellow to orange amid the increase in confirmed cases of the coronavirus.

They also announced a series of measures to be taken, including the suspension of inter-school and external activities for schools until the end of the March school holidays and advising event organisers to cancel or defer non-essential large-scale events.

Stay in the know on-the-go: Join Yahoo Singapore's Telegram channel at http://t.me/YahooSingapore

Related stories

Coronavirus: MOM revokes work passes of 4 holders for breaching 14-day leave of absence rule

Coronavirus: FairPrice sets purchasing limits on essential items

Coronavirus: Fear can do more harm than the virus, says PM Lee

Coronavirus: Discharged patient thought she caught the common flu

Coronavirus: Lockheed Martin pulls out of Singapore Airshow

Coronavirus: Do not hoard items unnecessarily as it will create ‘undue panic’ – Chan Chun Sing

Coronavirus: Singapore raises Dorscon response level to ‘orange’

Yahoo Finance

Yahoo Finance