What will strengthen the US dollar

Yahoo Finance contributor Jake Moore is a former hedge fund manager for Caxton, Tudor and Citadel. He now runs a new firm called Kaiseki Systems.

Following the passage of President Donald Trump’s tax bill in December a number of market analysts put forward the case that it would lead to a stronger dollar. This has merit, but the dollar has slid ever since. Why were so many expecting a stronger dollar?

A combination of loose-money and loose-fiscal policy is often the worst combination for currencies, while tight-money, loose-fiscal policies can be temporarily very positive, as capital flows into the country. In the current environment of an already strong U. S. economy, even higher growth will lift wages, inflation expectations and interest rates. Combined with a $1.5 trillion estimated widening of the federal budget deficit over the next decade, the dollar could be moving into a loose-fiscal and tighter-monetary policy regime.

The tax cuts could incentivise a large repatriation of cash held by U.S. corporations, similar to the impact of the Homeland Investment Act. Trump has mooted the $4 trillion of repatriation figure. Even one-tenth of this in a year would negate most of the U.S. current account deficit.

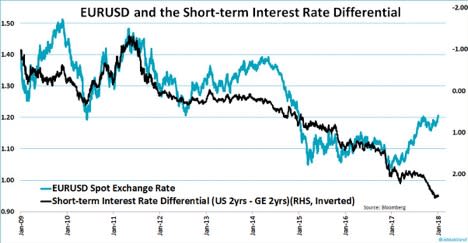

One explanation for the weakening dollar could be that the market has already discounted the expected impacts of tax reform. Logically this makes sense, but it does not fit with what is happening in other markets. Stocks have rallied in anticipation of more buybacks and dividends, and interest rates are doing exactly what one would expect. The gap between U.S. and Eurozone yields, for example, has moved in the dollar’s favor by around 50bps while the dollar has depreciated. We often see a situation in non-emerging market currency pairs where the relative magnitude of moves between interest rate spreads and currencies look out of alignment. But it is unusual to see them move in opposite directions. Rate spreads are not the be-all and end-all of currencies, my models include other factors, but there are clearly very powerful forces at work.

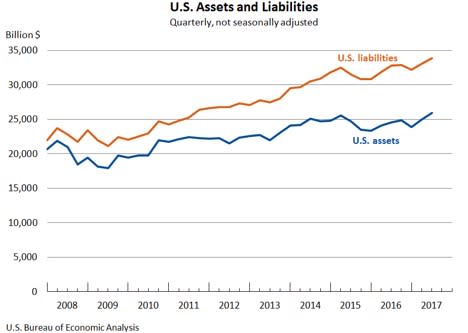

There are structural challenges for the dollar. In particular, long term bears on the dollar point to the ever-worsening net international investment position (NIIP) of the U.S. This number represents the claims held by foreigners on U.S. assets, which can be thought of as the cumulative historical current account deficit of the U.S. The numbers involved are staggering – the NIIP is now at negative $8 trillion. This large stock of claims on the U.S. combined with a continued large negative flow of dollars caused by the current account are like the force of gravity – very small and hard to detect, but always there.

Of course, exchange rates are about relative forces. If we look at the major blocs’ competition for capital, we can see that dollar weakness could be occurring de facto because of relative strength overseas. Japan’s economic recovery is really taking hold and economic conditions there are improving very significantly. In Europe, economic conditions are also strong while concerns about the peripheral countries have abated substantially.

A truly remarkable development is that Greek two-year yields are now below U.S. two-year yields. Emerging markets, in general, are seeing large increases in their stock markets and most analysts remain very bullish. These buoyant conditions internationally combined with a healthy U.S. economic environment mean that massive capital flows are causing correlations to break down in what can only be described as a melt up scenario.

The dollar tends to depreciate in this kind of environment, not due to trade flows but due to the intricacies of the global financial system and the money markets. The dollar is still the world’s reserve currency, a positon strengthened by the Eurozone crisis, and the U.S. has the deepest financing markets. In this melt up, non-U.S. financial institutions will be borrowing in dollars to create leverage for themselves and their customers. The US has the largest asset management industry in the world, which is also putting money to work overseas, adding to dollar selling.

Among all this euphoria it is worth remembering that these money market forces on the dollar can become just as powerful when they go into reverse. By taking on USD liabilities in the money markets through the creation of leverage, non-U.S. financial institutions are creating a structural short dollar position for themselves. Unlike the current account and the NIIP, which are very long-term capital commitments, these financial sector USD liabilities are leverage. Leverage needs to be funded in short-term money markets that can freeze up very rapidly. This was most obviously the case in the ’08 crisis but even since then basis swaps have remained almost permanently 20bps-40bps in favor of the dollar. While this might sound technical, it is a useful paradigm to explain the complex interaction between long-term and short-term USD flows. Long term, the US’ negative current account and large net international investment position are headwinds for the dollar. But leverage in the financial system creates a need to fund dollars. This can be very difficult in times of market stress or rising interest rates.

What could cause this to happen? Barring the geo-political shocks, in my opinion the factor needed to push the dollar higher is inflation, or a recognition that asset price inflation is becoming a problem. For years, markets have been basking in the glow of very low consumer price inflation and still today disinflation forces seem to be firmly in the driving seat. Wage growth remains contained, which, in my view, has been caused by potentially temporary forces. When we look at the share of the spoils of economic activity that go to each factors of production – labor and capital – an increasing share has been going to capital. This both benefits the owners of capital and therefore equity prices, while it pushes down the bargaining power of labor.

However, this can only happen for so long and in due course I expect this trend to stop, and partially reverse. The most important indicators to watch in 2018 for the FX markets will be all linked with inflation. If inflation ticks up, we will see a far stronger dollar.

Yahoo Finance

Yahoo Finance