Why Stryker Has Greatly Outperformed Its Sector

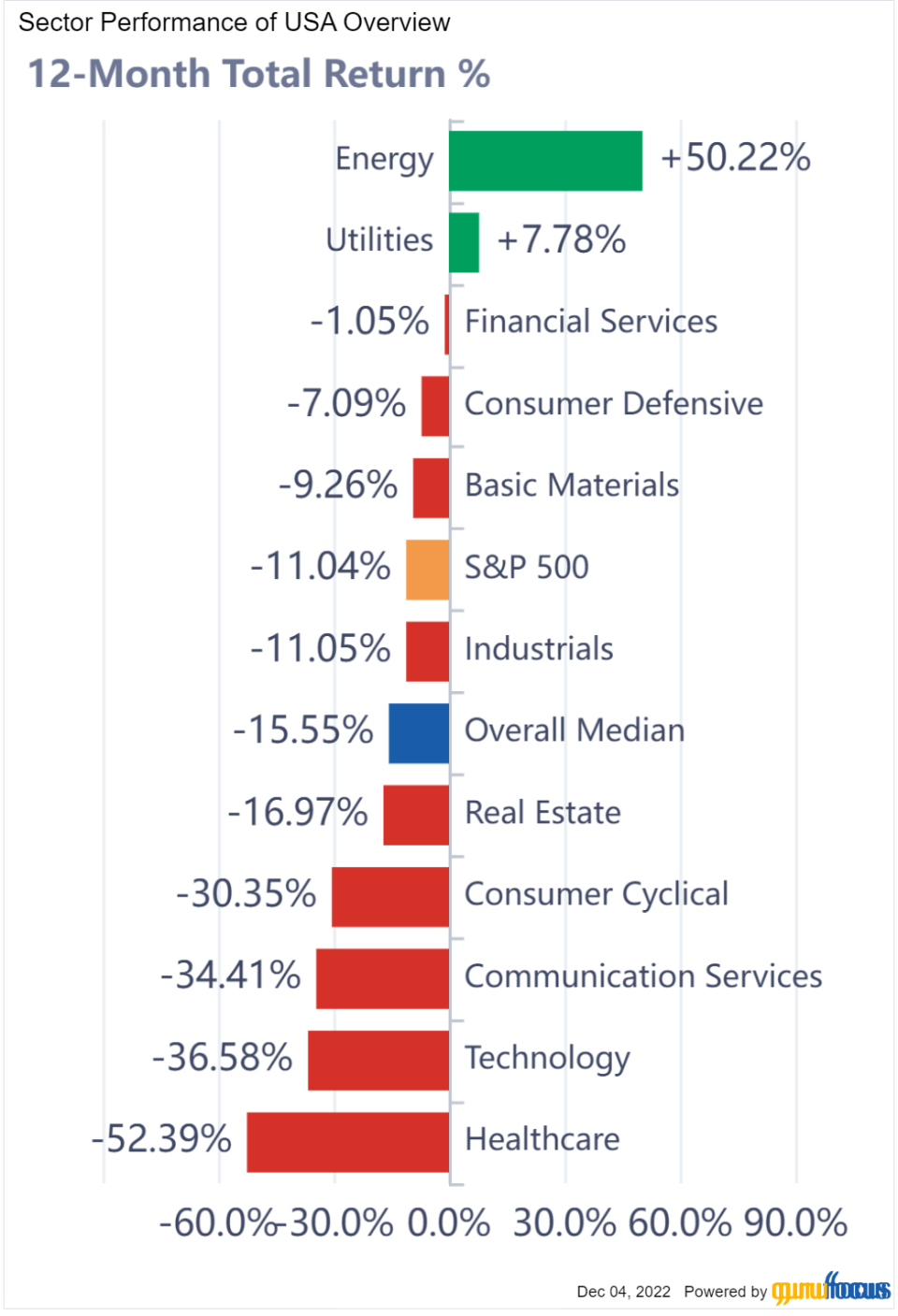

The health care sector has been the worst place to invest over the last year, with the sector down more than 52% over the last 12 months. Granted, a large part of this has been due to unprofitable biotech startups that went public at sky-high prices and then tanked, but even the big pharma companies haven't been doing too hot for the most part.

Yet, shares of Stryker Corp. (NYSE:SYK) have declined by just 4% over this same period.

This speaks to the strength of the company and its leadership in the industry. Lets dig deeper into the company to see why Stryker has outperformed its sector by such a wide margin.

Takeaways from recent earnings results

Stryker reported third-quarter earnings figures on Oct. 31, with the company showing mixed results. Revenue grew 7.7% to $4.48 billion and topped estimates by $16 million. Adjusted earnings per share of $2.12 compared unfavorably to $2.20 in the prior year and was 11 cents below expectations.

This follows on the heals of the second quarter, where the company missed on both the top and bottom lines. Considering how the market tends to treat results that dont live up to expectations, it can be argued that Strykers stock should be much lower than it is. But shares are higher by almost 18% in the last three months even as the company has turned in disappointing or mixed headline numbers.

It would appear that not only is the market giving Stryker the benefit of the doubt, but investors are looking past just what was reported over the past few quarters and are bidding up shares.

There are several reasons why this has taken place. Over the long-term, Stryker has been very consistent at growing revenue, and earnings growth has been high at nearly 12% annually over the last decade.

Currency exchange has been a headwind all year for Stryker, with the most recent quarter seeing a stronger U.S. dollar lowering reported sales by 3.7%. Management now expects that unfavorable currency exchange rates, along with ongoing supply chain constraints, to be a 35 cent to 40 cent impairment to adjusted earnings per share for 2022. This compares to prior guidance of a headwind of 25 cents to 30 cents and 10 cents to 15 cents.

Accordingly, Stryker lowered its forecast for the rest of the year, with the company now expecting to produce adjusted earnings per share of $9.15 to $9.25 for 2022. This is down from prior guidance of $9.30 to $9.50 and $9.60 to $10.00.

Looking beyond this, third-quarter results were actually more of what investors have come to expect from Stryker. Organic growth was 9.9% for the period, including a 10.8% increase for MedSurg and Neurotechnology and an 8.7% improvement for Orthopaedics and Spine. A slight increase in prices in MedSurg and Neurotechnology didnt hurt demand as volume grew almost 10%. Orthopaedics and Spine had a 2.9% decrease in pricing, but this was more than offset by an 11.6% increase in volume. Helping results was the fact that elective procedures are normalizing in most regions, outside of China, which still has strict Covid-19 policies in place.

U.S. organic sales were higher by 9.2% while international was up 11.8%. In both segments, international growth ran ahead of domestic gains. Due to the gains in the most recent quarter, Stryker raised its guidance for organic growth to 8.5% to 9.0%, up from 8% to 9% and 6% to 8% previously.

Many areas of the business are seeing growth. For example, Mako installations were down for the period, but hip and knee procedures were up double-digits as the recovery of elective procedures continues. Stryker is also expanding its reach for Mako, with applications for spine and shoulder in development. If successful, the addition of these areas for use with Mako will greatly expand the devices reach. Mako has a very impressive customer retention rate of 99%.

Other businesses experienced double-digit organic growth, including Endoscopy, Sports Medicine and Medical. The latter grew even as supply chain issues impacted emergency care products. New product offerings drove a 10.4% improvement in Trauma and Extremities in the U.S.

Higher labor costs and the acquisition of electronic components at higher market prices led to a 370-basis point contraction in adjusted gross margin to 62.6%. A tight labor market has meant employers paying more for workers, and the lack of electronic components has meant price increases for these goods. The good news is that perhaps the worst of this impact on the gross margin is occurring, as the adjusted grow margin was lower by 70 basis points sequentially.

Another reason Stryker likely has gotten a reprieve from the market is its long history of making acquisitions to augment the companys foothold in its areas of operation. The most recent addition was completed in February, when Stryker acquired Vocera Communications for $3.1 billion. Vocera offers software and hardware needed for remote communications, which will compliment Strykers advanced digital health care business. Stryker has been aggressive on the acquisition front, folding in 16 separate businesses over the last five years.

While the reduction in guidance for the second time this year is disappointing, it is mostly due to the impact of currency exchange. The underlying businesses have performed quite well as evidenced by the increase in guidance of organic revenue growth. Most businesses continue to act well as the pace of elective surgeries continues to improve and are almost back to pre-Covid-19 levels. In the short-term, a strong U.S. dollar could limit earnings growth, but the overall strength of Strykers product portfolio remains near the top of the medical device industry.

Valuation analysis

Stryker has a GF Score of 92 out of 100, implying the potential for outperformance going forward based on a historical study from GuruFocus. The company receives high scores for growth, profitability and momentum that are offset by weaker scores for value and financial strength.

Using revised guidance for the year, Stryker is trading with a forward price-earnings ratio of just over 26. According to Value Line, the 10-year average price-earnings ratio is 25.8, so shares of Stryker are close to their long-term average valuation.

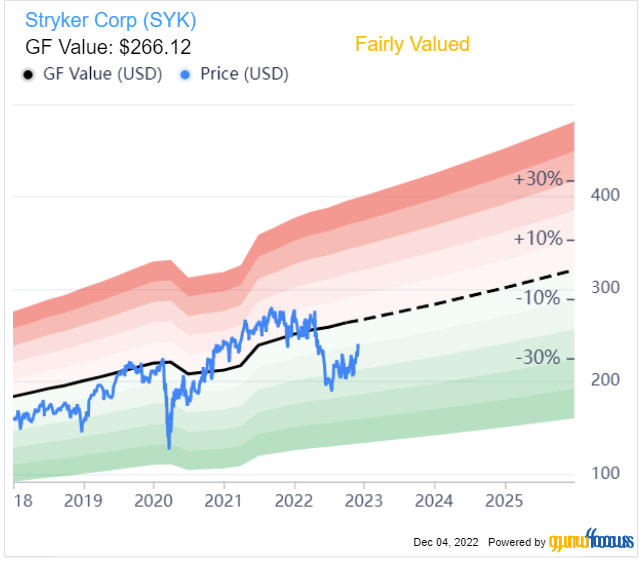

The GF Value chart shows that the stock is trading at a slight discount to fair value.

With a price-to-GF-Value ratio of 0.91, shares could return 10.4% if they were to reach their GF Value. This would be in addition to the current dividend yield of 1.2%, which is on the low side, but has been increased for almost three decades.

Final thoughts

Stryker has been negatively impacted by a stronger U.S. dollar, worker shortages and supply chain constraints, which has led to the lowering of guidance for 2022. And yet, shares have surged over the last three months and are barely down over the last year. This stands in stark opposition to the health care sector as a whole.

The stock has performed so well because the company has a long track record of growth and has seen organic sales results that have been very high. Most individual areas of the company are performing well, something that should continue as the number of elective procedures improve to be more in line with pre-pandemic figures.

Even after the gain in the last three months, shares of Stryker sit just near their long-term average price-earnings ratio and the stock could still see double-digit returns if it were to reach its GF Value. For investors looking for exposure to the medical device industry, I believe Stryker could represent an excellent name to consider.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance