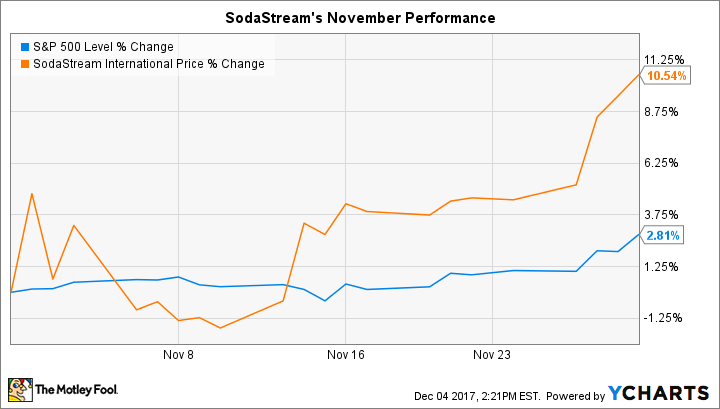

Why SodaStream Stock Gained 10.5% in November

What happened

SodaStream (NASDAQ: SODA) stock rose just under 11% last month, according to data provided by S&P Global Market Intelligence, compared to a 2.8% increase for the broader stock market.

The surge added to market-thumping returns for shareholders, who have seen their investment rise by over 80% so far in 2017 and by over 230% in the last three years.

So what

November's rally followed strong third-quarter earnings numbers that the company released early in the month. In that report, SodaStream revealed accelerating sales gains and a solid uptick in profitability. Carbon dioxide canister refill sales, a key indicator of customer engagement, improved by 9%.

Image source: Getty Images.

Now what

CEO Daniel Birnbaum and his executive team raised their full-year guidance and now believe sales will rise 13% in 2017 to $536 million with help from fast-growing international markets over the holiday season.

While that revenue mark would leave the company well below the record it set in 2013, SodaStream is on pace to achieve its highest annual profit result yet thanks to a more efficient production process and higher pricing on its sparkling water machines. If the company succeeds on that score while expanding its market share, its recent stock price gains will be justified.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Demitrios Kalogeropoulos has no position in any of the stocks mentioned. The Motley Fool owns shares of SodaStream. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance