Why your PayPal account may be delaying your mortgage application

Concerns about “hidden loans” are causing delays for mortgage borrowers as lenders raise queries about often innocent account transactions, such as payments through PayPal.

It comes as well-known technology firms including PayPal and Amazon have launched flexible payment options for customers in response to the rising popularity of “buy now, pay later” (BNPL) schemes.

PayPal launched a “Pay In 3” scheme in October 2020, letting users spread the cost of a purchase.

Payments are split into three equal payments made over three consecutive months.

Unlike other BNPL schemes, there are no fees or interest charged if an instalment is missed, but your payment history may show on certain credit reports and you could struggle to get other credit or PayPal services as a result.

But whether you are making a full purchase or through instalments, Gary Bush, managing director of the MortgageShop.com, said he is seeing increased negativity from lenders at the sight of transactions marked “PayPal”, creating queries from underwriters and delaying applications.

He said: “We believe the background to this is the new Pay In 3 arrangements that can be offered by Paypal, which are seen by lenders as potentially hidden loans now.”

Why are lenders concerned about PayPal transactions?

The issue, according to mortgage brokers, is that it is unclear when a PayPal transaction appears on a bank statement whether it is for an outright purchase or its Pay In 3 scheme.

When you use the Pay In 3 scheme, the retailer is still paid in full, and you enter into a credit agreement with PayPal.

“It seems that lenders have issued guidance to their underwriters to investigate potential non-disclosed three-month loan arrangements using the company,” Mr Bush added.

He said one colleague recently had an underwriter query a £4.99 PayPal payment.

Mr Bush said: “If a lender saw my family’s PayPal spend they’d go into a tailspin; we use it as another layer of protection online.

“Advisers across the country are seeing lots of picky mortgage underwriting going on at a time when you would historically see more lenient criteria being wheeled out.

“What is going to happen when the market gets back to full steam? The whole system is going to explode with this nonsense.”

Mr Bush said he hasn’t seen any applications collapse due to this yet, but suggests the “uncertainty” could be the “final nail that we aren’t made aware of in refusals”.

PayPal only carries out a “soft search” on your credit file if you apply for its Pay In 3 service, which Scott Taylor-Barr, principal adviser at Barnsdale Financial Management, said can create issues as lenders have always had concerns with loans that do not appear on credit files.

He said: “PayPal is not the only facility that this applies to, but it is one of the largest and newest.

“It means lenders need to rely on more traditional methods of underwriting, such as looking at bank statements for payments going to lenders that do not seem to appear on the client’s credit file.

“It just needs to be factored into the affordability assessment. It would however be a very serious issue if someone made an application and failed to declare a debt, such as PayPal, in the hope that lenders wouldn’t find it.”

Karen Noye, mortgage expert at Quilter, agrees that a PayPal payment is not in itself problematic but it is more about context.

She said: “PayPal transactions are certainly something that is considered by lenders. As a broker, if there are PayPal transactions on a bank statement it’s worth investigating further and checking with the client if it’s a credit facility or one-off payment facility. If it’s the former it can slow down an offer of a mortgage or impact affordability.

“While PayPal transactions themselves aren’t hidden loans, lenders may scrutinise any unusual or large transactions to ensure there are no outstanding debts that you haven’t disclosed.”

PayPal has been asked for comment.

The rise of flexible finance and ‘buy now, pay later’

Flexible payment options have become more popular since the rise of BNPL.

More than a quarter of adults had used a BNPL scheme as of 2023, according to Financial Conduct Authority (FCA) data.

There are proposals for the FCA to regulate BNPL brands such as Clearpay and Klarna amid concerns about a lack of transparency and high fees.

In contrast, companies such as PayPal and Amazon, which provide flexible payment schemes, are regulated. This gives mortgage lenders more to consider during applications.

Andrew Montlake, managing director of Coreco mortgage brokers, said: “In a world where there is now a plethora of BNPL schemes many prospective borrowers do not realise that these are often classed as loans by mortgage lenders, which can directly affect the amount that can be borrowed.

“This is where the skill of a mortgage broker can come into play, helping to present a case in the most open and best way to the most suitable lender. Simply ignoring these could well trip up an application as lenders’ underwriting techniques and technology get more advanced. To a lender these could be early warning signs of financial issues.”

Mr Bush suggests lenders are mistakenly conflating BNPL schemes, such as Klarna, as well as short-term payment options offered by PayPal and Amazon, with payday loans.

He added: “If they are short-term loan arrangements they’ll be mostly paid off for the completion date.”

Suzanne Homewood, managing director of data platform Moneyhub, said the growing use of options like Paypal and BNPL can be a benefit if used correctly.

She suggested that queries and delays could be avoided if lenders made more use of open banking technology to get an idea of a borrower’s finances in real time.

Ms Homewood said: “This way, PayPal and BNPL become less of an unknown risk, allowing lenders to understand the habits and the customer’s ability to afford monthly payments.”

How should mortgage borrowers prepare?

As with any mortgage application, it is important to have all your finances in order.

Lenders will assess your affordability based on your income, expenditure and level of debt so it is important to be transparent about your liabilities.

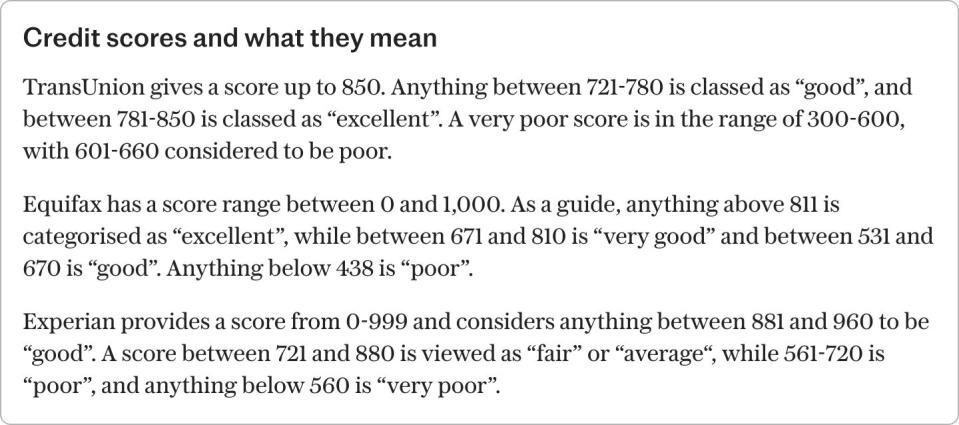

Since BNPL is not currently regulated, lenders aren’t required to share the account information with credit reference agencies, but PayPal shares repayment history data with the agency TransUnion.

John Webb, consumer affairs manager at Experian, said flexible payment schemes won’t impact your Experian credit score yet but may be factored into affordability checks by lenders.

Mr Webb said: “If you’re using BNPL then you need to ensure you’re making all your repayments on time, so you avoid missed payments, and that it’s affordable. If the lender thinks you’re taking on too much debt, that could affect the outcome of an application.

“If you are applying for new credit soon, then it’s a good idea to stop taking out new credit agreements. Each lender will view BNPL accounts differently, but having multiple new short-term loans may be seen as slightly risky. So, you’ll put yourself in a stronger position by avoiding new credit accounts for a few months before you apply.”

It can be hard to predict the level of detail a lender will require and what transactions will be queried, especially as each lender will have its own criteria, while needing to follow regulatory rules on assessing affordability.

Karina Hutchins, mortgage policy principal at UK Finance, said: “Lenders will be sensible when reviewing an applicant’s spending; someone taking out short-term loans for low amounts which they repay on time is unlikely to affect their application.

“Mortgage advisers are also expected to review customers’ bank statements as part of their due diligence and query anything that might represent committed spending, such as payments made using buy now pay later schemes. This will happen before they calculate how much a customer can afford to borrow and apply to the chosen lender.

“I would encourage anyone who is worried about qualifying for a mortgage to speak to an independent mortgage adviser, who will be able to provide them with tailored advice specific to their circumstances.”

Yahoo Finance

Yahoo Finance