Why Metro Holdings Limited (SGX:M01) Is An Attractive Investment

Metro Holdings Limited (SGX:M01) is a company with exceptional fundamental characteristics. Upon building up an investment case for a stock, we should look at various aspects. In the case of M01, it is a company with great financial health as well as a a strong track record of performance. Below, I’ve touched on some key aspects you should know on a high level. For those interested in understanding where the figures come from and want to see the analysis, read the full report on Metro Holdings here.

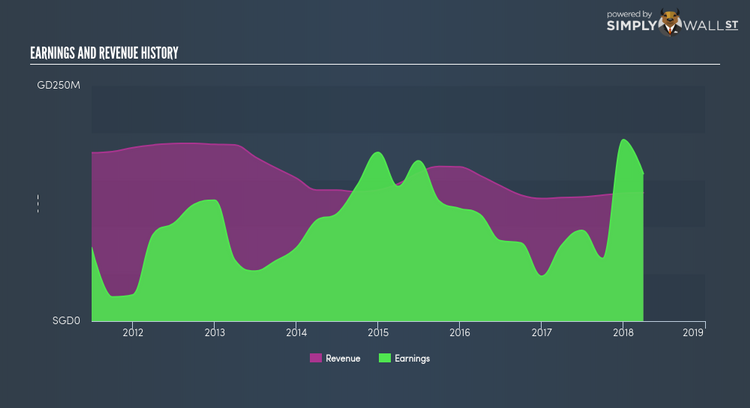

Adequate balance sheet with proven track record

In the previous year, M01 has ramped up its bottom line by 93.94%, with its latest earnings level surpassing its average level over the last five years. Not only did M01 outperformed its past performance, its growth also surpassed the Multiline Retail industry expansion, which generated a 48.49% earnings growth. This is an optimistic signal for the future. M01 is financially robust, with ample cash on hand and short-term investments to meet upcoming liabilities. This indicates that M01 has sufficient cash flows and proper cash management in place, which is a key determinant of the company’s health. With a debt-to-equity ratio of 9.23%, M01’s debt level is reasonable. This means that M01’s capital structure strikes a good balance between low-cost debt funding and maintaining financial flexibility without overly restrictive terms of debt.

Next Steps:

For Metro Holdings, I’ve compiled three fundamental aspects you should further research:

Future Outlook: What are well-informed industry analysts predicting for M01’s future growth? Take a look at our free research report of analyst consensus for M01’s outlook.

Valuation: What is M01 worth today? Is the stock undervalued, even when its growth outlook is factored into its intrinsic value? The intrinsic value infographic in our free research report helps visualize whether M01 is currently mispriced by the market.

Other Attractive Alternatives : Are there other well-rounded stocks you could be holding instead of M01? Explore our interactive list of stocks with large potential to get an idea of what else is out there you may be missing!

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance