Here’s why Google won’t give up on mobile payments

Google revealed a new mobile payments service called Android Pay on Thursday at Google I/O, its annual developers conference. Android Pay lets you make purchases in stores by simpy tapping your phone on a special pad, or in applications like Lyft and Groupon, by selecting “Buy with Android Pay.” There’s no need to open a separate payments app, and it doesn’t share any of your card information with merchants.

This isn’t Google’s first foray into the mobile payments industry. In 2011, it introduced Google Wallet, a similar service that never really took off, after failing to win the support of wireless carriers and retailers. Android Pay, by contrast, will soon be available in over 700,000 US retailers and more than 1,000 apps, Google said, and it’s also in talks with major phone carriers and credit card companies.

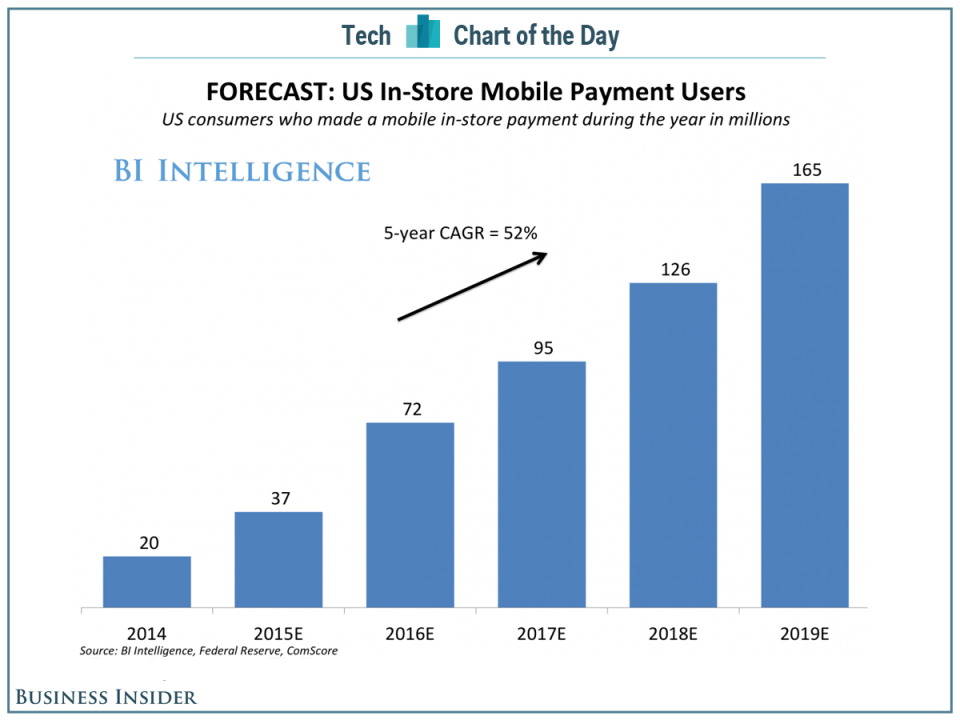

Google revamped its mobile payment system because the mobile in-store payment market is just about to take off. According to BI Intelligence, the number of US consumers with at least one mobile in-store payment in a given year will reach 165 million in 2019, nearly 62% of the projected US consumer population. That’s a compound annual growth rate of 52% a year, expanding the mobile payment user base by almost 8 times the size of 2014.

BI Intelligence

The post Here’s why Google won’t give up on mobile payments appeared first on Business Insider.

Yahoo Finance

Yahoo Finance