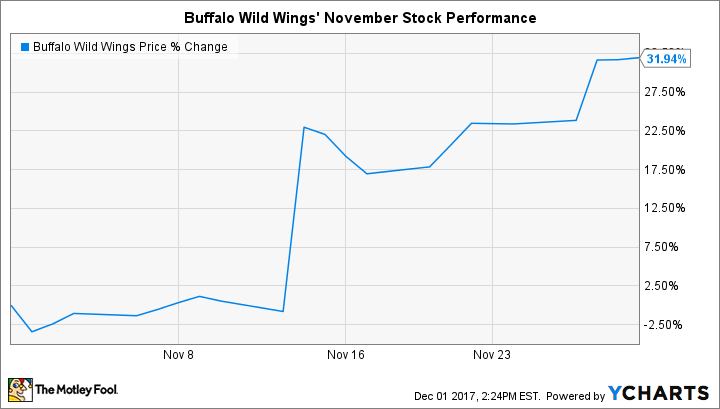

Why Buffalo Wild Wings Stock Soared 32% in November

What happened

Buffalo Wild Wings (NASDAQ: BWLD) stock gained 32% last month, according to data provided by S&P Global Market Intelligence, to significantly outperform the broader market's 2.8% increase.

The boost sent the restaurant chain's shares into just barely positive territory for the year after having been down by as much as 35%.

So what

November's rally was powered by rumors of an impeding acquisition that were then confirmed by the company later in the month. Private equity firm Roark Capital, owner of the Arby's fast food chain, approached B-Dubs with a purchase offer, and management agreed to merge with the company for $157 per share.

Image source: Buffalo Wild Wings.

That price translates into a 38% premium since shares began rising in response to takeover rumors on Nov. 13.

Now what

Buffalo Wild Wings CEO Sally Smith, who had previously announced her retirement, said the $2.9 billion deal was a win for the chain. "We are excited about this merger and confident Arby's represents an excellent partner for Buffalo Wild Wings," she explained in a press release.

Roark Capital arguably secured a good deal, though, as the stock was trading above the buyout price as recently as May. In any case, shareholders can expect the acquisition to close by March 2018, at which point they should receive $157 in cash for each share they own as B-Dubs becomes the latest restaurant chain to choose to go private.

More From The Motley Fool

6 Years Later, 6 Charts That Show How Far Apple, Inc. Has Come Since Steve Jobs' Passing

Why You're Smart to Buy Shopify Inc. (US) -- Despite Citron's Report

Demitrios Kalogeropoulos owns shares of Buffalo Wild Wings. The Motley Fool owns shares of and recommends Buffalo Wild Wings. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance