Why you should always manage your CPF account!

Many know the Central Provident Fund (CPF) as that savings instrument that deducts 20% off our monthly wages. However, we suspect a only smaller percentage know what the actual differences are between the Ordinary Account (OA), Special Account (SA) and Medisave Account (MA). By actively making sure that excess amounts in OA is transferred to the SA, you and your spouse stand to accumulate an extra S$46,000 when you both reach 55 years old.

Assumptions (We take a Base Case for illustration purposes):

Both spouse earn S$2,000 per month every month until 55 years old (No wage growth)

No change in CPF contribution and allocation rates (as of Apr 2015)

For simplicity, both spouse are healthy and did not use the MA until 55 years old

They choose to purchase a three-room HDB flat

They choose to pay the mortgage entirely from their CPF OA

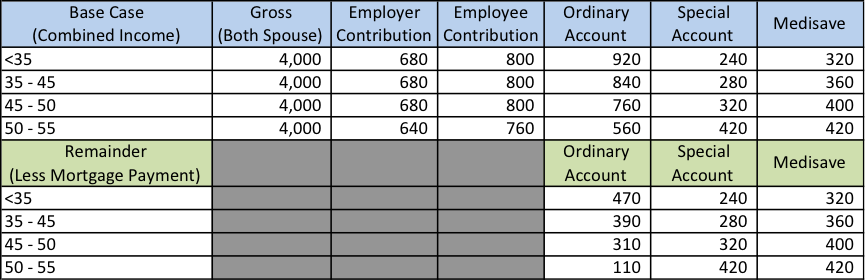

Exhibit 1: CPF contribution and allocation, remainder after mortgage payment

Source: CPF, HDB, DollarsAndSense

We would advocate that this couple (and any couple) should transfer the remainder of their OA balances, after the deduction for the mortgage, to the SA after accounting for other possible payments using their OA account (such as children’s education). In this example, this couple has accounted other expenses using cash because they already expensed their entire mortgage using CPF OA balances.

Results (Base Case):

Does not transfer OA balances to SA (at 55 years old for the couple)

OA balance: S$158,000

SA balance: S$259,000

Medisave: S$97,000 (cap at $48,500/person)

Total (ex. MA): S$417,000

Transfers OA balances to SA (at 55 years old for couple)

OA balance: S$0

SA balance: S$463,000

Medisave: S$97,000

Total (ex. MA): S$463,000

By transferring the remainder of the OA balances to the SA, after paying for the HDB flat, this couple would have an additional S$46,000. This is only possible because the SA provides a higher interest rate compared to the OA.

Also note that this amount of S$463,000 is a conservative amount because the first S$60,000 in your OA and SA will enjoy an additional 1% return, which will grow the amount larger.

How about the minimum sum?

The current Basic Retirement Sum (BRS) is S$80,500 and with inflation of 3% per year, we should expect the BRS at 55 years old for this couple to be at S$168,600. This means that they would require a combine of S$337,200.

If you do not actively transfer the OA balances into the SA, you can withdraw S$79,800. Instead, you would be able to withdraw S$125,800 at age 55 if you do transfer your OA balances to the SA together.

Again a difference of S$46,000!

Conclusion

The more you earn, the greater the difference you would be able to transfer from the OA to the SA. This example assumes zero wage growth, however, we understand that wage will grow over the span of 25 years.

For those who are earning more (as compared to the example), you might want to consider the Full Retirement Sum or even the Enhanced Retirement Sum. By being active with your transfers, you will have a higher probability of meeting these higher requirement sums as well as drawing out more in CASH!

After reading this, do you still intend to leave your excess monies in your OA? Do let us know your thoughts about transferring excess monies to the SA.

DollarsAndSense.sg is a website that aims to provide interesting, bite-sized financial articles which is relevant to the average Singaporean.

Yahoo Finance

Yahoo Finance