Why airlines don’t make for a good investment

In light of recent plane crashes, it may seem obvious that investing in airlines is a terrible idea. Even without the risk of such awful tragedies, the business faces tremendous challenges, as one stock market expert explains.

“They are a notoriously difficult business for a bunch of reasons,” says Roger Montgomery, author of stock market guide book Value.able and founder of Montgomery Investment Management Pty Ltd. based in Sydney, Australia.

“One of them is that they are capital intensive. Two, they are labour intensive. Three, they have no control of the price of their inputs, oil, for example,” he said in an interview with Yahoo Singapore Friday last week.

He also pointed out that the industry suffers from irrational competition “where the price to fly from Singapore to, say, Bali or Bangkok is less than what it would cost to swim there”.

In the US, airlines can continue to compete even after entering bankruptcy and having its debts forgiven, he noted.

On top of all that, airlines are selling a commodity, as people tend to buy seats based on price alone, he added.

Overall, members of Montgomery’s investment team of seven tend to avoid capital-intensive businesses with irrational competition. Given that, they also don’t like the car manufacturing industry.

“That’s a capital-intensive, highly-tooled annual fashion contest,” Montgomery said, adding that in the US, local car manufacturers still exist because they had been bailed out.

Business they like

Businesses that the team, which has about AUD$500 million under management, do like include online businesses, gaming, retail and telecommunications.

“The most successful online businesses in the world are merely lists. Zillow in the US is a list of real estate. Seek in Australia is a list of job ads. Google is a list of web sites. Even Amazon was a list of books and now it’s pretty much a list of everything,” he said.

“All it requires first is popularity and then you benefit from what is called the network effect, so it’s a winner takes all dynamic. Once you’re the biggest, you’ve captured the market, there’s really nowhere else for anyone else to go,” he said.

The investment managers also like businesses that supply poker machines, large supermarkets where there’s a monopoly or oligopoly situation, some banks, and firms that supply networks and internet cabling for the telecommunications industry.

Currently, Montgomery’s boutique investment management office manages two funds, The Montgomery [Private] Fund and The Montgomery Fund, with the former requiring AUD$1 million and the latter AUD$25,000 as minimum investments. The philosophy for both, he said, is the same, though they are also investigating the effectiveness of their approach in an absolute return fund.

Assessing companies

“Our view is your best return is going to come from a business with great economics, bright prospects, available at a cheap price and has first class management running it,” Montgomery said.

Some factors, however, cannot offset others. Back in 2010, when asked whether the hiring of John Borghetti, a highly-regarded manager and business leader, as CEO of Virgin Australia Holdings would change his mind about the business, Montgomery said the conditions in the airline industry would stymie the efforts of even the new executive.

“It’s very, very difficult for management to actually swim upstream against poor economics and poor industry dynamics,” said Montgomery last Friday.

Ten years ago, Virgin Australia’s share price was AUD$2.40 and today its AUD$0.40, he noted.

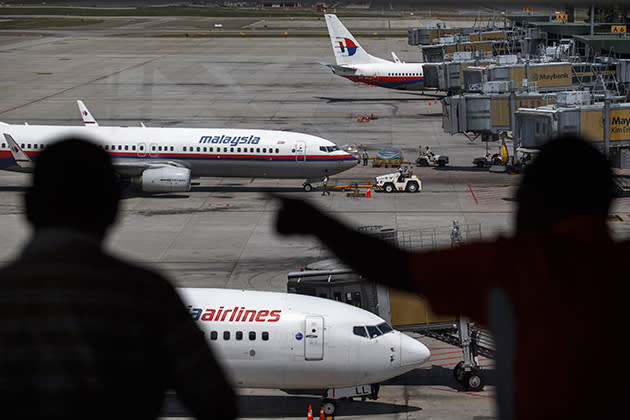

Montgomery didn’t mention it, but one may also very well look at the case of Malaysia Airlines, which had already been struggling before the fatal crash of flight MH17 in Ukraine last week, just months after the global-headline grabbing disappearance of flight MH370. The publicly-listed airline’s share price has plunged since the latest catastrophe and may be taken private or placed under bankruptcy.

When looking at a company, Montgomery’s view is to be invested in it for at least a decade, though it might not always turn out that way. He explained they stay invested provided the company’s “prospects remain bright and the price doesn’t vary too much from our estimate of its value”.

If the price goes well ahead of the value, then they will take advantage of that, he added.

Helping it assess companies, Montgomery’s investment office has developed a software package called Skaffold, which covers global markets, rating companies and calculating up to 13 years of intrinsic value estimates every day. The software will be rolled out in Singapore under a joint venture with Thomson Reuters.

Timing, pricing

After investing in a company, when do they know it's time to pull out?

“The timing is implicit in the pricing. Once the price is well below intrinsic value then that’s the right time. So you could call it timing or you could call it pricing,” Montgomery said.

“The wonderful thing about the stock market is that it regularly supplies periods of excessive reactions to things that don’t bear any weight on the performance of the underlying businesses. So in other words, the market is regularly swinging from bouts of excessive exuberance to periods of undue pessimism,” he pointed out. “All that’s required from the investor is a bit of patience to wait for those periods, and they happen with monotonous regularity.”

In concluding the interview, Montgomery had one message for retail investors.

“Trading and speculating using technical analysis is very, very popular, but I think both of those things are made more effective and more profitable if the investor also considers using a sound understanding of business economics, and instead of treating the stock market as a place to bet up or down, think about it as buying pieces of businesses. It will work very well for them and it’s a lot less effort,” he said.

Roger Montgomery will be speaking at INVEST Fair 2014, which takes place on the 2nd and 3rd of August at Suntec Singapore Convention & Exhibition Centre.

More From Yahoo! Finance Singapore

Yahoo Finance

Yahoo Finance