What's in Store for Dream Finders Homes (DFH) in Q1 Earnings?

Dream Finders Homes, Inc. DFH is expected to have generated higher earnings and revenues in first-quarter 2024 on a year-over-year basis.

In the last reported quarter, earnings and revenues topped the Zacks Consensus Estimate by 49.3% and 36.3%, respectively. On a year-over-year basis, earnings and revenues increased 28.2% and 3.5%, respectively.

The company’s earnings topped analysts’ expectations in the trailing four quarters, the average being 144.9%.

Trend in Estimate Revision

For the quarter to be reported, the Zacks Consensus Estimate for earnings per share (EPS) has increased to 70 cents from 65 cents over the past 30 days. The estimated figure indicates a rise of 55.6% from the year-ago quarter.

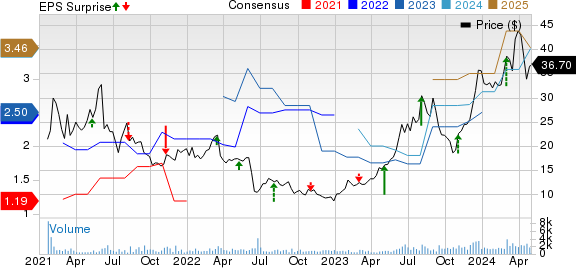

Dream Finders Homes, Inc. Price, Consensus and EPS Surprise

Dream Finders Homes, Inc. price-consensus-eps-surprise-chart | Dream Finders Homes, Inc. Quote

The consensus mark for revenues is pegged at $934.2 million, suggesting an increase of 21.4% from the year-ago reported figure.

Key Factors to Note

DFH’s first-quarter revenues are expected to have increased from the year-ago level on improving demand trends. The upside is mainly backed by the low supply of existing homes, decreased average selling prices that have sparked new order growth rates, and decreasing cancelation rates. Also, a strong business model and a stabilizing economy are likely to have aided the company’s results to some extent.

For the quarter to be reported, the consensus mark for Home closings is expected to increase to 1,790 units from 1,517 homes on a year-over-year basis. The same for average sales price is likely to increase to $521,896 year over year from $490,553.

The consensus estimate for Net new orders is currently pegged at 1,810 homes, up from 1,448 units reported in the prior year.

Meanwhile, the bottom line of DFH is quite likely to have been pressurized by variability in product mix, higher financing and closing costs, as well as purchase accounting amortization from its recent acquisitions.

What the Zacks Model Unveils

Our proven model predicts an earnings beat for Dream Finders Homes for the quarter to be reported. The company has the right combination of the two key ingredients — a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) — to increase the odds of an earnings beat.

Earnings ESP: The company has an Earnings ESP of +7.14%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: DFH currently sports a Zacks Rank #1.

Other Stocks With the Favorable Combination

Here are some other companies in the Zacks Construction sector that, according to our model, have the right combination of elements to post an earnings beat in the quarter to be reported.

Louisiana-Pacific Corporation LPX has an Earnings ESP of +3.56% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

LPX’s earnings for the to-be-reported quarter are expected to increase 232.4% year over year. The company reported better-than-expected earnings in three of the last four quarters and missed on one occasion, the average surprise being 106.2%.

Boise Cascade Company BCC has an Earnings ESP of +0.36% and carries a Zacks Rank of 3.

BCC’s earnings for the to-be-reported quarter are expected to decline 5.4%. The company reported better-than-expected earnings in three of the last four quarters but missed on one occasion, the average surprise being 20.4%.

Fluor Corporation FLR has an Earnings ESP of +1.23% and a Zacks Rank #3.

FLR’s earnings for the to-be-reported quarter are expected to grow 92.9%. The company reported better-than-expected earnings in three of the last four quarters and missed on one occasion, the average surprise being 47.9%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Louisiana-Pacific Corporation (LPX) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

Dream Finders Homes, Inc. (DFH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance