Western Digital (WDC) Q3 Earnings & Revenues Beat Estimates

Western Digital Corporation WDC reported third-quarter fiscal 2024 non-GAAP earnings of 63 cents per share, much ahead of the Zacks Consensus Estimate of earnings of 21 cents. The company reported a loss of $1.36 per share in the prior-year quarter.

Management anticipated fiscal third-quarter non-GAAP net income in the range of a loss of 10 cents to earnings of 20 cents.

Revenues of $3.457 billion beat the Zacks Consensus Estimate by 3.9%. The top line increased 23% year over year owing to strong performance across Cloud end markets. On a sequential basis, revenues increased 14%.

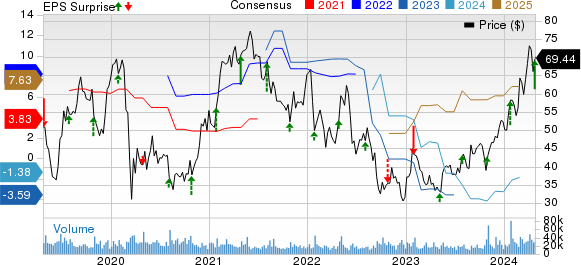

Western Digital Corporation Price, Consensus and EPS Surprise

Western Digital Corporation price-consensus-eps-surprise-chart | Western Digital Corporation Quote

For third-quarter fiscal 2024, the company expected non-GAAP revenues in the range of $3.2-$3.4 billion.

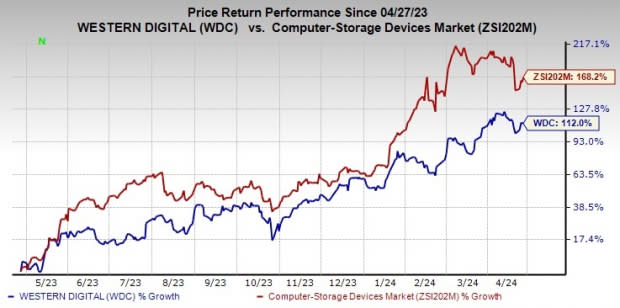

Following the announcement, shares of WDC are up 0.9% in the pre-market trading on Apr 26. In the past year, shares have gained 112% compared with the sub-industry’s growth of 168.2%.

Image Source: Zacks Investment Research

Quarter in Detail

At the beginning of first-quarter fiscal 2022, Western Digital started reporting revenues under three refined end markets — Cloud (includes products for public or private cloud), Client (includes products sold directly to OEMs or through distribution) and Consumer (includes retail and other end-user products).

Revenues from the Cloud end market (45% of total revenues) rose 29% year over year to $1,553 million. The upside was mainly driven by higher nearline shipments, an increase in flash revenues and improved nearline per unit pricing. On a sequential basis, cloud revenues were up 45%.

Revenues from the Client end market (34%) were up 20% year over year to $1,174 million. The uptick was due to higher flash and HDD average selling prices (ASP), and flash bit shipments. Client revenues were up 5% sequentially.

Revenues from the Consumer end market (21%) were up 17% year over year to $730 million. The year-over-year growth was driven by an increase in flash bit shipments and higher ASP. Revenues declined 13% on a sequential basis. Sequential performance was affected by seasonal downturn in both HDD and flash segments.

Considering revenues by product group, Flash revenues (49.3%) increased 30.5% year over year to $1.705 billion owing to higher bit shipments and ASP. Sequentially, flash revenues rose 2%.

HDD revenues (50.7%) grew 17% year over year to $1.752 billion owing to higher exabyte shipments and average price per unit. Revenues increased 28% quarter over quarter.

In the first quarter of fiscal 2024, the company announced that it plans to separate its HDD and Flash businesses and create two independent and public companies. The separation is likely to be structured in a tax-free manner and is scheduled for the second half of 2024.

Key Metrics

WDC shipped 11.7 million HDDs at an ASP of $145. The reported shipments declined 7.1% year over year.

Total exabytes sales (excluding licensing, royalties and non-memory products) grew 27% sequentially. On a quarter-over-quarter basis, HDD exabytes sales increased 41%. Flash exabytes sales were down 15%.

ASP/Gigabytes (excluding licensing, royalties and non-memory products) were up 18% sequentially.

Margins

Non-GAAP gross margin was 29.3% compared with 10.6% in the year-ago quarter. The improvement was driven by better pricing, cost discipline and lower underutilization charges.

HDD’s gross margin expanded 680 bps year over year to 31.1%. Flash gross margin came in at 27.4% compared with (5%) in the prior-year quarter.

Non-GAAP operating expenses increased 5% year over year to $632 million.

Non-GAAP operating income totaled $380 million against a non-GAAP operating loss of $304 million in the prior-year quarter.

Balance Sheet & Cash Flow

As of Mar 29, 2024, cash and cash equivalents were $1.894 billion compared with $2.481 billion as of Dec 29, 2023.

Long-term debt (including the current portion) was $7.768 billion as of Mar 29.

Western Digital generated $58 million in cash from operations in the reported quarter. It used $381 million of cash from operations in the prior-year quarter.

Free cash flow amounted to $91 million in the quarter under review against the free cash outflow of $527 million reported in the prior-year quarter.

Fiscal Q4 Guidance

The company expects non-GAAP revenues in the range of $3.6-$3.8 billion. The Zacks Consensus Estimate is currently pegged at $3.66 billion.

Management projects non-GAAP earnings in the range of 90 cents to $1.20 per share. The Zacks Consensus Estimate is currently pegged at 83 cents.

WDC expects non-GAAP gross margin in the range of 32-34%. Non-GAAP operating expenses are expected to be between $670 million and $690 million.

Zacks Rank

Currently, Western Digital carries a Zacks Rank #3 (Hold).

Stocks to Consider

Some stocks worth consideration in the broader technology space are Badger Meter BMI, Blackbaud BLKB and Manhattan Associates MANH. While BMI and MANH sport a Zacks Rank #1 (Strong Buy) each, BLKB carries a Zacks Rank of 2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Badger Meter’s 2024 EPS is pegged at $3.89, up 9.9% in the past 60 days. The long-term earnings growth rate is 15.6%.

BMI’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 12.7%. Shares of BMI have soared 38.3% in the past year.

The Zacks Consensus Estimate for BLKB’s 2024 EPS is pegged at $4.22. Blackbaud’s earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 8.7%. Shares of BLKB have gained 13.8% in the past year.

The Zacks Consensus Estimate for MANH’s 2024 EPS has increased 0.8% in the past 60 days to $3.79. Manhattan Associates’ earnings beat the Zacks Consensus Estimate in each of the last four quarters, the average surprise being 26.4%. Shares of MANH have gained 23.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Manhattan Associates, Inc. (MANH) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance