Western Digital (WDC) and Kioxia Accelerate Merger Talks

Western Digital Corporation WDC and Kioxia Holdings Corp have accelerated talks to merge their flash memory businesses, according to a report from Reuters. Both companies are struggling with falling demand and oversupply in the market. This has led to declining prices and profit margins for flash memory makers, prompting consolidation moves, such as the proposed merger between Kioxia and Western Digital.

The merger between Kioxia and Western Digital aims to increase their competitiveness against rivals, such as Samsung Electronics, added Reuters. Citing sources familiar with the matter, Reuters notes that Kioxia will hold 43% of the merged entity, Western Digital will be holding 37%, and existing shareholders will hold the remaining shares under the proposed merger structure. However, the sources caution that the details are still being worked out and could change, added Reuters.

As part of the deal, Western Digital is likely to spin off its flash unit and integrate it with Kioxia to create a new publicly traded company in the United States.

Western Digital Corporation Price and Consensus

Western Digital Corporation price-consensus-chart | Western Digital Corporation Quote

The planned merger is also expected to face extensive regulatory scrutiny in several countries, including the United States and China, as a united Kioxia-Western Digital would approximately control a third of the world's NAND flash market, matching the market leader, Samsung, added Reuters. Per a report from Mordor Intelligence, the NAND flash memory market is expected to reach $94.24 billion by 2027, registering a CAGR of 5.33% from 2022 to 2027.

Quoting various market analysts, Reuters also highlighted that Western Digital and Kioxia are more vulnerable to NAND flash market volatility than Samsung and SK Hynix Inc. Nevertheless, Kioxia and Western Digital are moving forward with talks in a bid to improve their competitive position and weather the current market pressures. Following the report, shares of the WDC increased 11.3% on May 15, 2023, and closed at $36.75 per share.

In March 2023, the two companies jointly introduced their latest 3D flash memory technology using advanced scaling and wafer bonding technologies. This technology is ideal for managing exponential data expansion and data-centric applications like smartphones, IoT devices and data centers.

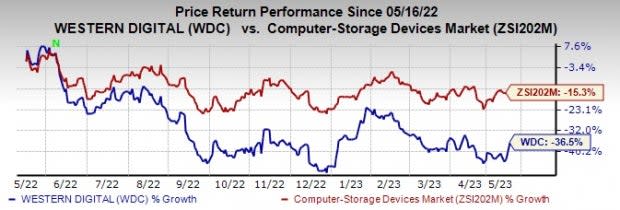

At present, WDC carries a Zacks Rank #3 (Hold). Shares of the company have lost 36.5% compared with the sub-industry’s decline of 15.3%.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks in the broader technology space are Dropbox DBX, Badger Meter BMI and Blackbaud BLKB. Dropbox and Blackbaud each presently sport a Zacks Rank #1 (Strong Buy), whereas Badger Meter holds a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Dropbox’s 2023 earnings has increased 4.8% in the past 60 days to $1.76 per share. The long-term earnings growth rate is anticipated to be 12.3%.

Dropbox’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 10.4%. Shares of DBX have increased 4.5% in the past year.

The Zacks Consensus Estimate for Badger Meter’s 2023 earnings has increased 4.7% in the past 60 days to $2.69 per share.

Badger Meter’s earnings beat the Zacks Consensus Estimate in all the last four quarters, the average being 5.3%. Shares of BMI have increased 75.3% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2023 earnings has increased 7.3% in the past 60 days to $3.68 per share.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average surprise being 10.4%. Shares of the company have increased 28.5% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Badger Meter, Inc. (BMI) : Free Stock Analysis Report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Blackbaud, Inc. (BLKB) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance