Webull’s Wealth Management Tool and Regular Savings Plan—The Lazy Investor’s Dream Team?

If you’re not investing, your savings are kind of doomed.

According to Channel NewsAsia, the rate of inflation is currently 3.4%. With our cash earning just 0.05% p.a. (in a DBS savings account), our hard-earned money is slowly getting eaten alive.

Having said that, we get it; active investing isn’t for everyone. After a long day at work, who wants to look at stocks, charts, and profit/loss statements? No, thank you.

Here’s the good news: There’s a dynamic duo you can utilise to put your money to work with zero hassle.

Meet The Lazy Investor’s Dream Team

A powerful wealth management tool and a regular savings plan can be the dynamic duo you need to build your wealth—without the stress or hassle. Let’s meet the first member of your dream team.

Moneybull: Invest Without Lifting a Finger

Moneybull is a wealth management tool that automatically invests your idle cash into low-risk cash funds with juicy yields, earning you up to 5.4%^ 7-Day USD Yield (p.a.).

You can start investing from just S$10, and there are zero platform fees*.

If you’re a noobie, you’ll love the user-friendly Moneybull app. It makes keeping track of your returns a piece of cake.

Here are some screenshots of the Moneybull interface on a sample account that has invested in both SGD and USD cash funds.

On the app, you can clearly view which products you’re invested in and how they’ve performed.

If you want to get an even broader overview (for truly lazy investors), you can head to the wealth tab.

Here, you can monitor your 7-day yield at a glance. It doesn’t get simpler than that.

Webull’s Regular Savings Plans: Slow and Steady Wins the Race

The next member of your dream team is all about slow and steady wealth building.

Webull’s Regular Savings Plan allows you to easily dollar-cost average into stocks, ETFs, and mutual funds.

All you need to do is build a simple portfolio, specify how much you want to invest, and at what interval. You can then take your hands off the wheel and let the Webull Regular Savings Plan work its magic.

Whenever you have a free moment, you can easily check how your investments have performed.

Now, why is dollar-cost averaging perfect for lazy investors?

Dollar-cost averaging involves investing a fixed amount of money at a regular interval, say once a month (when you receive your pay cheque). This way, you’re not trying to time the market. Dollar-cost averaging helps smooth out market volatility, so your investing journey won’t be a roller coaster ride.

The Dynamic Duo: Moneybull and Webull’s Regular Savings Plan in Action

Imagine this: Moneybull keeps your idle cash working hard, while Webull’s Regular Savings Plan ensures you stay on track with your contributions.

Sounds like an unstoppable duo, eh?

Let’s dive into an example

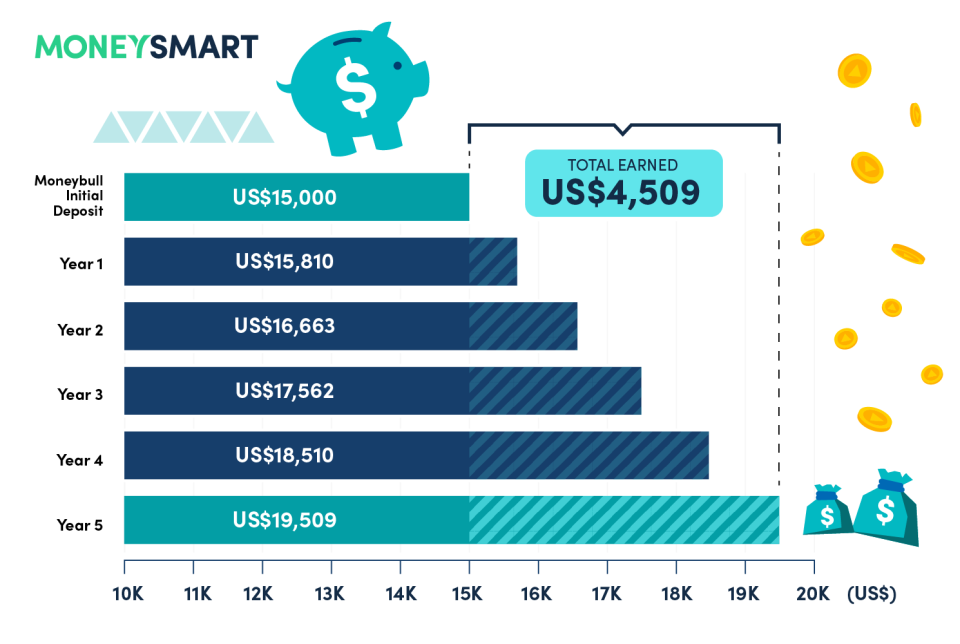

You’re a lazy investor who has 15,000 USD in savings. But you’re a smart, lazy investor. So you channel your savings into Moneybull, assuming yearly returns of 5.40% USD yield (p.a.) and returns are reinvested yearly.

In addition, you also automatically contribute 5% of your pay cheque each month to Webull’s Regular Savings Plan. Your portfolio is made up of safe stocks, ETFs, and mutual funds, giving your investment the best chance of steady growth.

Together, these wealth management tools can help stave off the effects of inflation and get you started on building your retirement fund. As you can see, we lazy investors can grow our wealth too—we’ve just got to find more efficient ways to do it.

Signing up for Moneybull and Webull’s Regular Savings Plan requires you to first create a Webull account. After which, you will need to provide some background information before getting started with your investing. But don’t worry; most of the tedious form filling can be pre-filled by Singpass (if you’re Singaporean).

If you’re keen to begin your lazy investing journey, then get off your bum. We’ve got an exciting welcome promotion for you.

Just for MoneySmart readers

Get cash rewards worth up to USD2000* when you activate Moneybull, meet the funding requirements by 30 Nov 2023 and maintain your deposit until 29 Feb 2024. T&Cs apply.

MoneySmart Exclusive

No commission

Webull Singapore

MoneySmart Exclusive:

[GIVEAWAY | FLASH DEAL]

Get S$100 Cash via PayNow* when you successfully open a Webull Account and fund any amount! T&Cs apply.

What's more? We're giving away an Apple Watch SE (worth S$379) to 2 customers weekly when you apply now! T&Cs apply.

Get 10 free shares worth US$80-5000* when you use MoneySmart's link to fund and maintain any amount! T&Cs apply.

Plus, get cash rewards worth up to USD3000* when you activate Moneybull, meet the funding requirements by 29 Dec 2023 and maintain your deposit until 31 March 2024. T&Cs apply.

Valid until 30 Nov 2023

More Details

Key Features

0 Platform Fee for US Options & HK Trades*

Regular Savings Plan: Dollar-Cost Average your favourite US Stocks, ETF & Mutual Funds at your own pace.

Earn up to 5.18%* 7-Day USD Yield (P.A.) with Moneybull

Own a fractional share for as little as USD5

Invest in wide range of funds with different strategies like Equity, Fixed Income and Multi Asset with 0* subscription and redemption fee.

Full extended hours trading - 16 hours of trading in the US markets

Licensed and regulated by MAS

Click here to start your lazy investing journey today with Webull today.

^Figures shown are based on the 7-Day USD Yield (P.A.) of the USD Cash Fund in Moneybull as of 13 Oct 2023 and not indicative of future performance.

^^Calculated based on the potential 5.4% 7-day USD yield (P.A.) of the USD Cash Fund in Moneybull as of 13 Oct 2023 after 90 days and only apply to Clients with USD cash balances. Returns are not guaranteed and not indicative of future performance.

Disclaimer:

*Terms and conditions apply. For detailed terms and conditions and full disclaimer, please refer to our website at https://www.webull.com.sg/. This advertisement has not been reviewed by the Monetary Authority of Singapore.

This post was written in collaboration with Webull. While we are financially compensated by them, we nonetheless strive to maintain our editorial integrity and review products with the same objective lens. We are committed to providing the best information in order for you to make personal financial decisions with confidence. You can view our Editorial Guidelines here.

The post Webull’s Wealth Management Tool and Regular Savings Plan—The Lazy Investor's Dream Team? appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post Webull’s Wealth Management Tool and Regular Savings Plan—The Lazy Investor’s Dream Team? appeared first on MoneySmart Blog.

Original article: Webull’s Wealth Management Tool and Regular Savings Plan—The Lazy Investor’s Dream Team?.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance