Will Weak Volumes Hurt International Paper's (IP) Q1 Earnings?

International Paper Company IP is scheduled to report first-quarter 2024 results before the opening bell on Apr 25.

Q1 Estimates

The Zacks Consensus Estimate for IP’s first-quarter sales is pegged at $4.45 billion, suggesting an 11.4% fall from the year-ago quarter’s reported figure.

The consensus mark for earnings is pegged at 22 cents per share, indicating a year-over-year slump of 58.5%. Earnings estimates have moved up 5% in the past 30 days.

Q4 Performance

In the last reported quarter, International Paper witnessed a year-over-year decline in earnings and revenues due to lower volumes. While the top line missed the Zacks Consensus Estimate, the bottom line beat the same.

IP’s earnings have surpassed the consensus estimate in each of the last four trailing quarters, delivering an earnings surprise of 19.4%, on average.

International Paper Company Price and EPS Surprise

International Paper Company price-eps-surprise | International Paper Company Quote

Factors to Note

The company anticipates lower earnings in the first quarter of 2024 due to seasonally low volumes, low prices, higher costs and unfavorable impacts from the January winter freeze (with an expected impact of $40 million). Lower maintenance outage compared with the first quarter of 2023 is expected to have offset some of the impacts.

International Paper has been witnessing weak packaging demand recently as inflationary pressures have weighed on consumers, leading to lower demand for goods. This had a great impact on packaging demand as consumer priorities have shifted toward non-discretionary goods and services. The company’s customers and the broader retail channel have also been lowering their elevated inventories, leading to year-over-year declines in volumes over the past few quarters. This inventory correction has resumed normal levels lately. However, the first quarter’s volumes are likely to have been impacted by seasonal factors, partially offset by two more shipping days.

Overall, volumes for the Industrial Packaging segment are projected to be 3,777 thousand short tons in the first quarter of 2024, which indicates a 3.5% year-over-year decline. We expect corrugating packaging volumes to decline 7.5% year over year to 2,201 thousand short tons. Our estimate for containerboard volumes is 594 thousand short tons, which represents year-over-year growth of 9.4%.

The Industrial Packaging segment is likely to have witnessed a slight year-over-year improvement in volume in Saturated Kraft (0.6%) that is likely to have been offset by a decline in Gypsum /Release Kraft (2.8%) and EMEA Packaging (0.5%).

The impact of lower volumes and reduced prices in the quarter, owing to prior index movement in North America, are expected to have impacted the Industrial Packaging segment’s top-line performance in the first quarter. We expect a 10.3% year-over-year decline in the Industrial Packaging segment’s first-quarter revenues to $3.66 billion due to lower volumes and a 7.1% dip in prices.

The Industrial Packaging segment’s margin is likely to have been hurt by higher input costs (mainly old corrugated container costs and energy) as well as seasonally higher costs. However, a lower maintenance outage of $79 million compared with the first quarter of 2023 is expected to have negated some of the impact. Per our model, the segment’s operating profit for the quarter is projected to plunge 35% year over year to $209 million.

Volume is expected to have remained stable for the Global Cellulose Fibers business in the first quarter. Seasonally lower shipments in China and the Middle East due to Chinese New Year and Ramadan are expected to have been offset by improved demand in other regions. We expect the segment’s volumes to be 693 thousand metric tons, indicating a 0.7% year-over-year rise. Pricing is expected to decline 17.3% year over year. The segment’s first-quarter revenues, per our model, are estimated to be $675 million, suggesting a decline of 16.7% from the year-ago quarter’s reported level due to low prices.

The Zacks Consensus Estimate for the segment’s operating profit is at a loss of $23.7 million against the operating profit of $30 million in the first quarter of 2023. This reflects higher seasonal costs and higher energy and chemical costs that are likely to have been offset by lower fixed costs and lower year-over-year maintenance outage costs.

What the Zacks Model Unveils

Our proven model does not conclusively predict an earnings beat for International Paper this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat. You can see the complete list of today's Zacks #1 Rank stocks here.

Earnings ESP: International Paper has an Earnings ESP of 0.00%.

You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 2.

Recent Major Development

International Paper, on Apr 16, announced it has entered into an agreement to acquire the entire issued share capital of DS Smith DITHF. This marks a strategic move to strengthen its corrugated packaging business in Europe and prioritize sustainable packaging. The buyout is expected to have been accretive to IP’s earnings in the first year of closure and provide at least $514 million of pre-tax cash synergies on an annual run-rate basis by the end of the fourth year following the close.

The offer values DS Smith's entire issued and to-be-issued share capital at around £5.8 billion ($7.4 billion) on a fully diluted basis and DS Smith's enterprise value at approximately £7.8 billion ($9.9 billion).

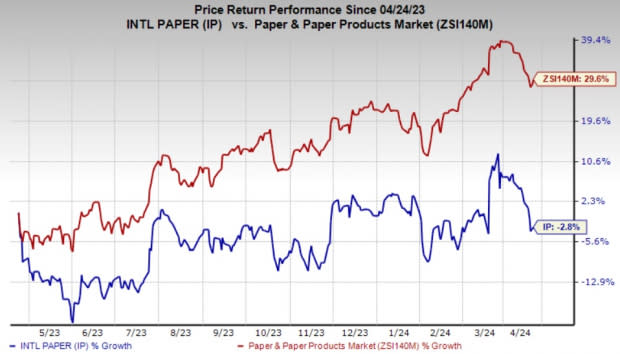

Price Performance

Shares of International Paper have dipped 2.8% in the past year against the industry's 29.6% growth.

Image Source: Zacks Investment Research

Stocks to Consider

Here are some companies in the basic materials space, which according to our model, have the right combination of elements to post an earnings beat this quarter:

Avient AVNT, scheduled to release first-quarter earnings on May 7, currently has an Earnings ESP of +1.16% and a Zacks Rank of 2.

The Zacks Consensus Estimate for AVNT's earnings for the first quarter is pegged at 69 cents per share, which projects a 9.5% increase from the year-ago quarter’s reported figure. AVNT has a trailing four-quarter average surprise of 7.1%.

Agnico Eagle Mines Limited AEM, scheduled to release earnings on Apr 25, presently has an Earnings ESP of +4.91% and a Zacks Rank of 3.

The Zacks Consensus Estimate for AEM’s earnings for the first quarter is currently pegged at 58 cents per share. The estimate indicates year-over-year growth of 1.75%. AEM has a trailing four-quarter average surprise of 13.3%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Paper Company (IP) : Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM) : Free Stock Analysis Report

D S SMITH (DITHF) : Free Stock Analysis Report

Avient Corporation (AVNT) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance