Watch These 5 Insurance Stocks for Q1 Earnings: Beat or Miss?

The insurance industry players are likely to have gained from continued improved pricing, exposure growth, portfolio streamlining, solid retention, renewals, reinsurance agreements and accelerated digitalization. Catastrophe losses and an increase in claims frequency are likely to have weighed on the upside. Some of the insurers due to report their first-quarter results on Apr 25 are Arthur J. Gallagher & Co. AJG, Willis Towers Watson plc WTW, The Hartford Financial Services Group, Inc. HIG, Cincinnati Financial Corporation CINF and Kinsale Capital Group KNSL.

Factors Likely to Shape Insurers’ Q1 Performance

Exposure growth across business lines and improved pricing are likely to have fueled premiums in the first quarter of 2024. Solid retention added to the upside. Catastrophes continued to provide impetus to policy renewal rates and aided in better pricing in the first quarter. Per a report in Insurance Journal, global commercial insurance rates improved by 1% on average in the first quarter of 2024 per Marsh.

Gallagher Re’s National Catastrophe and Climate Report estimates global insured losses from natural catastrophes to be $20 billion in the first quarter of 2024, a decline from $33 billion incurred in the year-ago quarter, per a report published in Risk and Insurance.

Underwriting profit is likely to have benefited from better pricing, reinsurance arrangements, portfolio repositioning, reinsurance covers and favorable reserve development.

Auto premiums are likely to have improved, given increased travel across the world. A low unemployment rate is likely to have aided commercial insurance and group insurance.

A larger investment asset base, a higher reinvestment rate given an improved rate environment as well as alternative investments are expected to have aided net investment income.

Accelerated digitalization is expected to have saved costs, driving margins. A solid capital position aided insurers in strategic mergers and acquisitions to sharpen their competitive edge, build on a niche, expand geographically and diversify their portfolio. Sustained wealth distribution to shareholders via dividend hikes, special dividends and share repurchases instill confidence in the insurers.

Let’s find out how the following insurers are placed before their first-quarter 2024 results on Apr 25.

According to the Zacks model, a company needs the right combination of two key ingredients — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — to increase the odds of an earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Arthur J. Gallagher’s first-quarter results are likely to benefit from better performance in both segments, aided by new business, strong retention and increasing renewal premiums across its business lines. Revenues associated with acquisitions, the organic change in base commissions and fee revenues are likely to have favored commission and fee revenues. However, total expenses are likely to have increased mainly because of higher compensation, operating costs, interest expenses, amortization and changes in estimated acquisition earnout payables.

The Zacks Consensus Estimate for the bottom line is pegged at $3.40, indicating a 12.2% increase from the year-ago quarter’s reported figure. The company has an Earnings ESP of +0.14% and a Zacks Rank #3.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

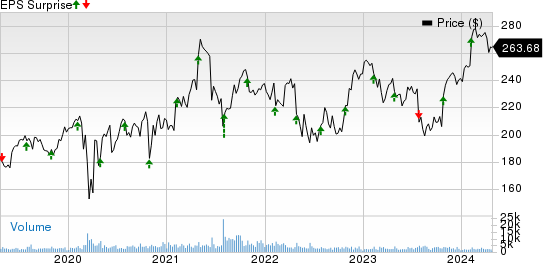

AJG’s earnings beat estimates in the last four reported quarters. The same is depicted in the chart below:

Arthur J. Gallagher & Co. Price and EPS Surprise

Arthur J. Gallagher & Co. price-eps-surprise | Arthur J. Gallagher & Co. Quote

Willis Tower’s revenues in the first quarter are likely to have benefited from the increasing impact of ongoing investments in talent and technology and strong performances across all the segments. Expenses in the first quarter are likely to have increased, attributable to higher salaries and benefits, other operating expenses, restructuring costs, depreciation and amortization. The company’s margins are likely to have improved on higher savings from its transformation program. (Read more: Will Willis Towers' Beat Streak Continue in Q1 Earnings?)

The Zacks Consensus Estimate for WTW’s first-quarter earnings per share of $3.21 indicates a 13% increase from the year-ago quarter reported figure. The company has an Earnings ESP of +1.03% and a Zacks Rank #3.

WTW’s earnings surpassed estimates in three of the last four reported quarters while missing one. This is depicted in the chart below:

Willis Towers Watson Public Limited Company Price and EPS Surprise

Willis Towers Watson Public Limited Company price-eps-surprise | Willis Towers Watson Public Limited Company Quote

Hartford Financial’s revenues are expected to have benefited from improved premiums across its Commercial Lines, Personal Lines and Group Benefits businesses in the first quarter. While persistent rate increases, new business growth, expanding policies in force and higher retention rates are expected to have benefited the Commercial Lines business, the Personal Lines business is expected to have benefited from renewal written price increases in the first quarter. (Read more: Will Rate Hikes Aid Hartford Financial's Q1 Earnings?)

The Zacks Consensus Estimate for HIG’s first-quarter bottom line is pegged at $2.43, indicating a 44.6% increase from the year-ago quarter reported figure. The company has an Earnings ESP of +0.81% and a Zacks Rank #3.

HIG’s earnings surpassed estimates in the last four quarters. This is depicted in the chart below:

The Hartford Financial Services Group, Inc. Price and EPS Surprise

The Hartford Financial Services Group, Inc. price-eps-surprise | The Hartford Financial Services Group, Inc. Quote

Cincinnati Financial’s first-quarter premiums are likely to have benefited from increased exposure, better pricing, increased property casualty agency and new business written premiums, higher standard lines new business and higher premiums from Cincinnati Re. Premiums at Personal Lines are likely to have benefited from high net worth clients and an agent-centric model. An increase in agency new business and renewal written premiums are likely to have aided Excess and Surplus lines premiums. Despite catastrophe losses that induce volatility in profits, underwriting results are likely to benefit from better pricing. (Read more: Will Cincinnati Financial Beat Estimates in Q1 Earnings?)

The Zacks Consensus Estimate for the bottom line is pegged at $1.69, indicating an 89.9% increase from the year-ago quarter reported figure. The company has an Earnings ESP of +2.50% and a Zacks Rank #2.

CINF’s earnings beat estimates in the last four quarters and missed in one. This is depicted in the chart below:

Cincinnati Financial Corporation Price and EPS Surprise

Cincinnati Financial Corporation price-eps-surprise | Cincinnati Financial Corporation Quote

Kinsale Capital’s first-quarter results are likely to benefit from its strategy of prudent underwriting, combined with technology-driven low costs and a focus on the E&S market. Better pricing and high retention rates arising from contract renewals favored premiums. Management's continued focus on controlling costs and thus investing in technological upgrades is likely to have lowered expense ratio.

The Zacks Consensus Estimate for KNSL’s bottom line is pegged at $3.33, indicating a 36.5% decrease from the year-ago quarter reported figure. The company has an Earnings ESP of +4.35% and a Zacks Rank 2.

KNSL’s earnings surpassed estimates in the last four quarters. This is depicted in the chart below:

Kinsale Capital Group, Inc. Price and EPS Surprise

Kinsale Capital Group, Inc. price-eps-surprise | Kinsale Capital Group, Inc. Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Hartford Financial Services Group, Inc. (HIG) : Free Stock Analysis Report

Cincinnati Financial Corporation (CINF) : Free Stock Analysis Report

Arthur J. Gallagher & Co. (AJG) : Free Stock Analysis Report

Willis Towers Watson Public Limited Company (WTW) : Free Stock Analysis Report

Kinsale Capital Group, Inc. (KNSL) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance