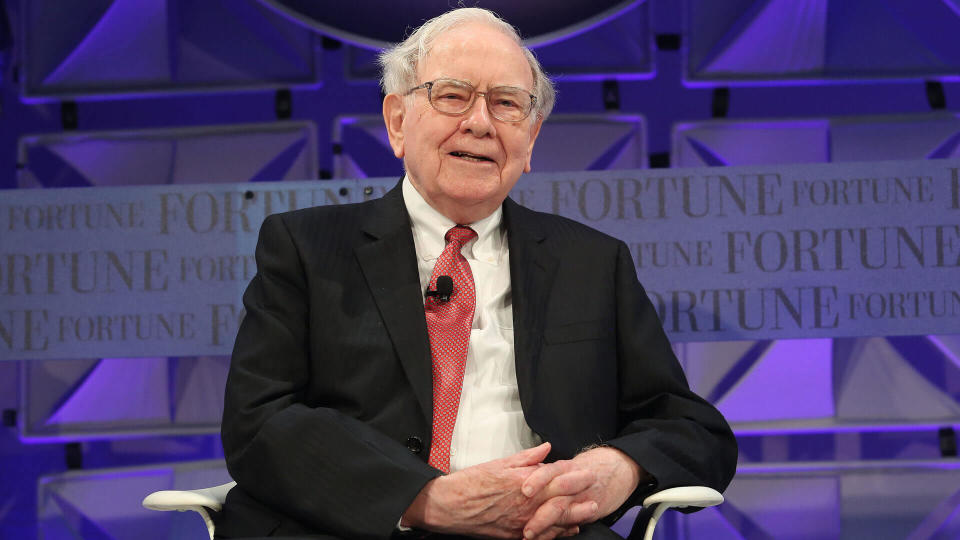

Warren Buffett Invested $74 Billion in This Stock — Should You Invest Too?

Known as the Oracle of Omaha, Warren Buffett is one of the most successful investors of all time. He started his first investment partnership in 1956 with a few friends and family. An investment in Berkshire Hathaway, then a struggling textile company, eventually resulted in Buffett controlling the company as CEO. Berkshire Hathaway started investing in and acquiring businesses and went on to become a massive holding company worth over $800 billion.

Read Next: Warren Buffett: 10 Rules for Young People Who Want to Get Rich

Find Out: 4 Genius Things All Wealthy People Do With Their Money

For obvious reasons, Buffett’s investment moves have been watched very closely over the years, with countless investors looking to copy his portfolio choices. Fortunately for them, this has been relatively easy to do, as Berkshire is required by the Securities and Exchange Commission to file a form 13F every quarter, disclosing its portfolio contents. Currently, Berkshire’s top holdings include companies like Apple, Bank of America, American Express, Coca-Cola and Chevron.

There is, however, one stock Buffett has been buying that doesn’t get reported on the 13F. In fact, Berkshire has spent about $74 billion since the middle of 2018 buying shares of itself in what is called a stock buyback. So why has Berkshire been buying back its own stock, and should you invest in the stock too?

What Is a Stock Buyback?

A stock buyback is the term for when a publicly traded company purchases shares of its own stock, either at the market price via the stock exchange it trades on or with a tender offer (which is when a company announces a fixed price at which it will purchase shares from any existing shareholders).

Like paying a dividend, buying back stock is a way of returning capital to shareholders. Because they reduce the total number of shares outstanding, buybacks increase the ownership stake represented by each remaining share. Unlike with dividends, there is no tax burden associated with buybacks, so they are considered a more tax-efficient way to return capital.

The main drawback of share repurchases is that unlike a dividend, which puts cash into the hands of shareholders, they rely on the competence of management to not overpay for their own stock. As with any stock, if you pay too high a price, you will likely see subpar or even negative returns on the investment. And the buybacks could end up destroying shareholder value instead of increasing it.

Given that Buffett is one of the greatest capital allocators of all time — and has been a lifelong advocate of value investing, which focuses on never overpaying for a stock — there probably isn’t much risk in the case of Berkshire.

Learn More: I’m a Self-Made Millionaire: 5 Stocks You Shouldn’t Sell

Should You Invest?

Copying Buffett might seem like a no-brainer given his extraordinary track record. So should you start buying shares of Berkshire Hathaway?

“The main investment thesis in Berkshire is still a bet on Warren Buffett. If you don’t believe in him and his team, then you have no reason to invest. It is as simple as that,” said Stephen Kates, CFP, a former wealth management advisor and the current principal financial analyst at Annuity.org.

“73% of [Berkshire’s] portfolio is made up of only five stocks, and Apple is by far the largest. Apple has been suffering lately … If you have serious doubts about Apple’s prospects, then investing in Berkshire may not be right for you because of the massive concentration,” Kates said.

Despite Apple’s trouble recently, Berkshire’s return has exceeded that of the S&P 500 so far this year. “It’s still hard to bet against Buffett,” Kates added.

Another thing that should be considered is Berkshire’s size. The Berkshire Hathaway investment portfolio contains well over $300 billion in assets under management, and that doesn’t include cash that isn’t disclosed. That means the universe of possible stocks that a retail investor can buy is much, much larger than that available to Berkshire.

For an investment to be impactful to a portfolio of that size, it has to measure in the tens of billions of dollars, making it essentially pointless for Berkshire to invest in midcap and small cap stocks. Even many large cap stocks are off the table, as Berkshire would be forced to buy a controlling stake, which comes with a host of additional considerations and drawbacks.

Betting On Buffett

The best investment choice for Berkshire Hathaway may not be the best investment choice for you. It will depend on what you think of Buffett and his team. At 93 years of age, Buffett won’t be making all of the portfolio decisions forever. It will also depend on your specific investing goals.

Having said that, history has shown us that you rarely go wrong when copying the Oracle of Omaha’s investment moves.

More From GOBankingRates

This article originally appeared on GOBankingRates.com: Warren Buffett Invested $74 Billion in This Stock — Should You Invest Too?

Yahoo Finance

Yahoo Finance