Wallace Weitz Adjusts Portfolio, Exits Markel Group with a -1.9% Impact

Insights from the Latest 13F Filing for Q1 2024

Wallace Weitz (Trades, Portfolio), a seasoned portfolio manager renowned for his nuanced approach to value investing, recently disclosed his first quarter portfolio adjustments for 2024. Weitz, who founded Weitz Value Fund, Weitz Hickory Fund, and Weitz Partners Value Fund in 1983, integrates the traditional principles of value investing with a focus on qualitative factors that influence a company's long-term success. His latest 13F filing reveals strategic entries and exits that reflect his evolving investment philosophy.

New Additions to the Portfolio

During the first quarter of 2024, Wallace Weitz (Trades, Portfolio) introduced a new position in his portfolio:

VeriSign Inc (NASDAQ:VRSN) was the standout addition, with Weitz purchasing 73,300 shares. This new holding now represents 0.71% of his portfolio, amounting to a total value of $13.89 million.

Significant Increases in Existing Positions

Weitz also strategically increased his stakes in several companies:

Charter Communications Inc (NASDAQ:CHTR) saw the most substantial increase, with Weitz adding 102,100 shares, bringing his total to 163,200 shares. This adjustment marks a 167.1% increase in share count and impacts 1.51% of his current portfolio, valued at $47.43 million.

Global Payments Inc (NYSE:GPN) also experienced a notable boost, with an additional 90,000 shares, bringing the total to 320,000. This represents a 39.13% increase in share count, with a total value of $42.77 million.

Complete Exits from Positions

Wallace Weitz (Trades, Portfolio) decided to exit completely from two holdings in the first quarter of 2024:

Markel Group Inc (NYSE:MKL): All 25,190 shares were sold, resulting in a -1.9% impact on the portfolio.

Liberty Latin America Ltd (NASDAQ:LILAK): The liquidation of all 1,221,500 shares caused a -0.48% impact on the portfolio.

Reductions in Key Holdings

Weitz also reduced his positions in several key stocks:

Linde PLC (NASDAQ:LIN) saw a significant reduction of 42,000 shares, resulting in an -85.89% decrease in shares and a -0.92% impact on the portfolio. Linde traded at an average price of $433 during the quarter and has returned 4.77% over the past three months and 6.19% year-to-date.

Alphabet Inc (NASDAQ:GOOG) was reduced by 102,850 shares, marking an -11.95% reduction in shares and a -0.77% impact on the portfolio. Alphabet traded at an average price of $144.34 during the quarter and has returned 14.61% over the past three months and 19.04% year-to-date.

Portfolio Overview and Sector Allocation

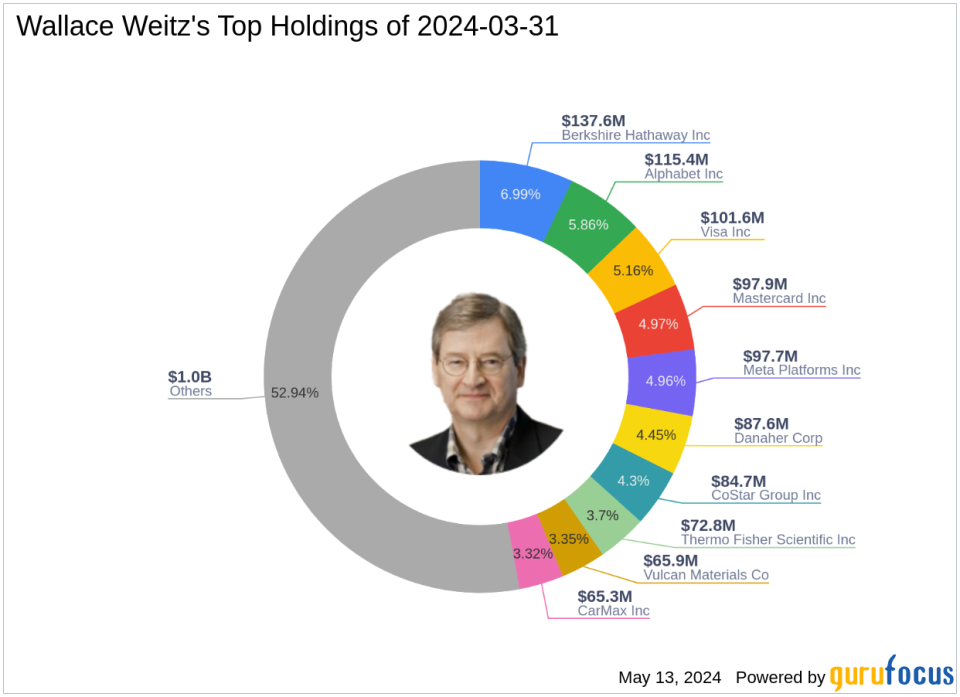

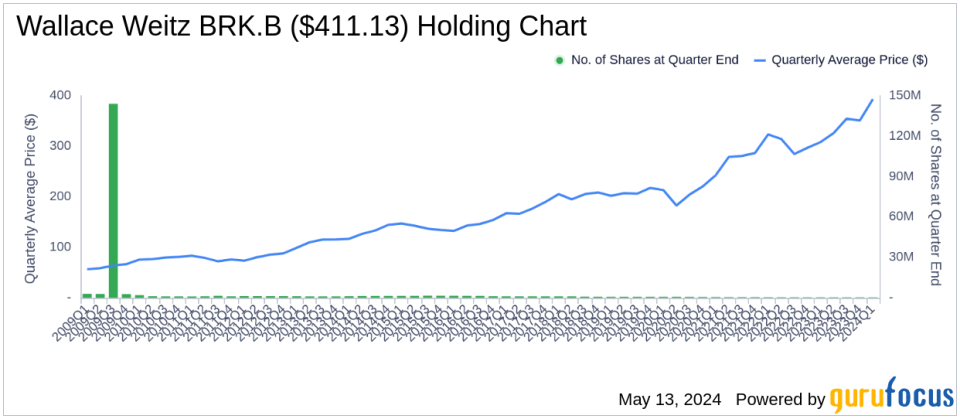

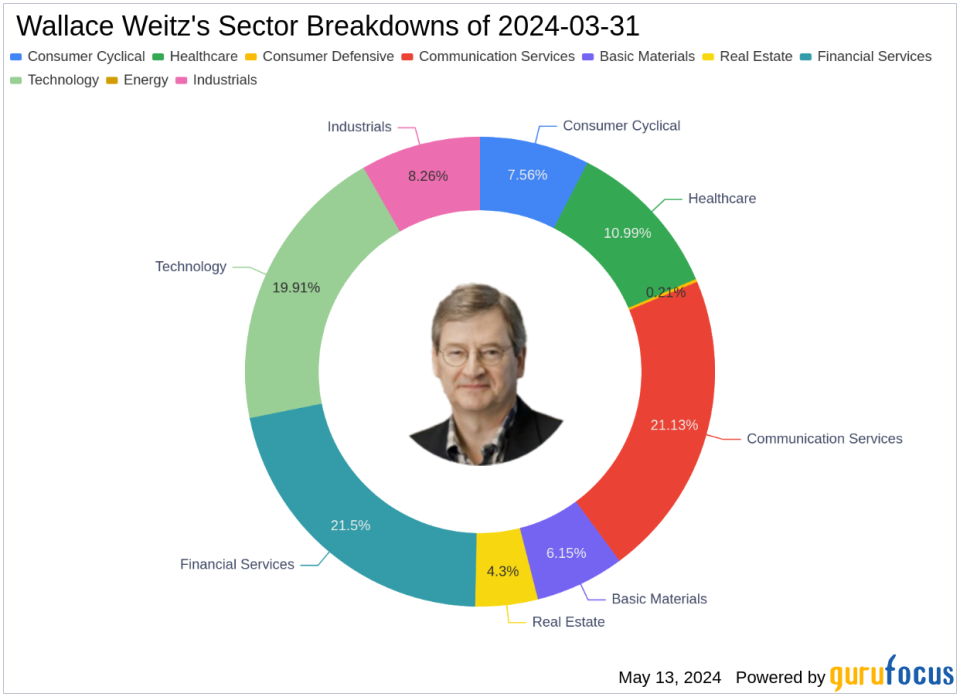

As of the first quarter of 2024, Wallace Weitz (Trades, Portfolio)'s portfolio comprised 52 stocks. The top holdings included 6.99% in Berkshire Hathaway Inc (NYSE:BRK.B), 5.86% in Alphabet Inc (NASDAQ:GOOG), 5.16% in Visa Inc (NYSE:V), 4.97% in Mastercard Inc (NYSE:MA), and 4.96% in Meta Platforms Inc (NASDAQ:META). The holdings are primarily concentrated across nine industries, including Financial Services, Communication Services, Technology, Healthcare, Industrials, Consumer Cyclical, Basic Materials, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance