Wall Street bets heavily on Democrats over GOP

The largest financial companies are betting big: on Democrats.

People and organizations tied to the four largest U.S. banks — JPMorgan Chase (JPM), Bank of America (BAC), Citigroup (C), and Wells Fargo (WFC) — have donated more money to Democrats in a tight race to take over the Senate, where Republicans control a narrow majority of 51 seats.

Data from the Center for Responsive Politics shows that Senate Democrats received three times more contributions from donors associated with the big four than Senate Republicans received.

The data does not mean that the companies directly donated money, only that individuals and organizations associated with those companies donated.

Incumbent Missouri Democrat Claire McCaskill, in a to-the-wire battle with Republican Josh Hawley, received $58,375 in individual and PAC contributions from Wells Fargo, the consumer bank still reeling from its fake accounts scandal.

Wall Street’s support of the Democrats is dissonant with the vision of possible 2020 hopefuls like Elizabeth Warren and Bernie Sanders, who have amped up the political rhetoric against large banking institutions. Both have advocated for more prudent oversight of the financial services industry.

But campaign donations show that the banking industry is rushing to the support of Democrats — particularly in purple states — after a number of moderate Democrats supported legislation rolling back portions of the post-crisis financial regulatory framework known as Dodd-Frank. In May, 16 Democrats and Independent Angus King joined Republicans in reducing regulatory and reporting requirements for banks with less than $250 billion in total assets.

Supporters of the bill argued that community banks were too constrained by the Obama-era regulations, and Democrats who voted in favor of it insisted that the legislation would not remove key safeguards to financial stability since it did not loosen rules on the largest U.S. banks, like JPMorgan Chase.

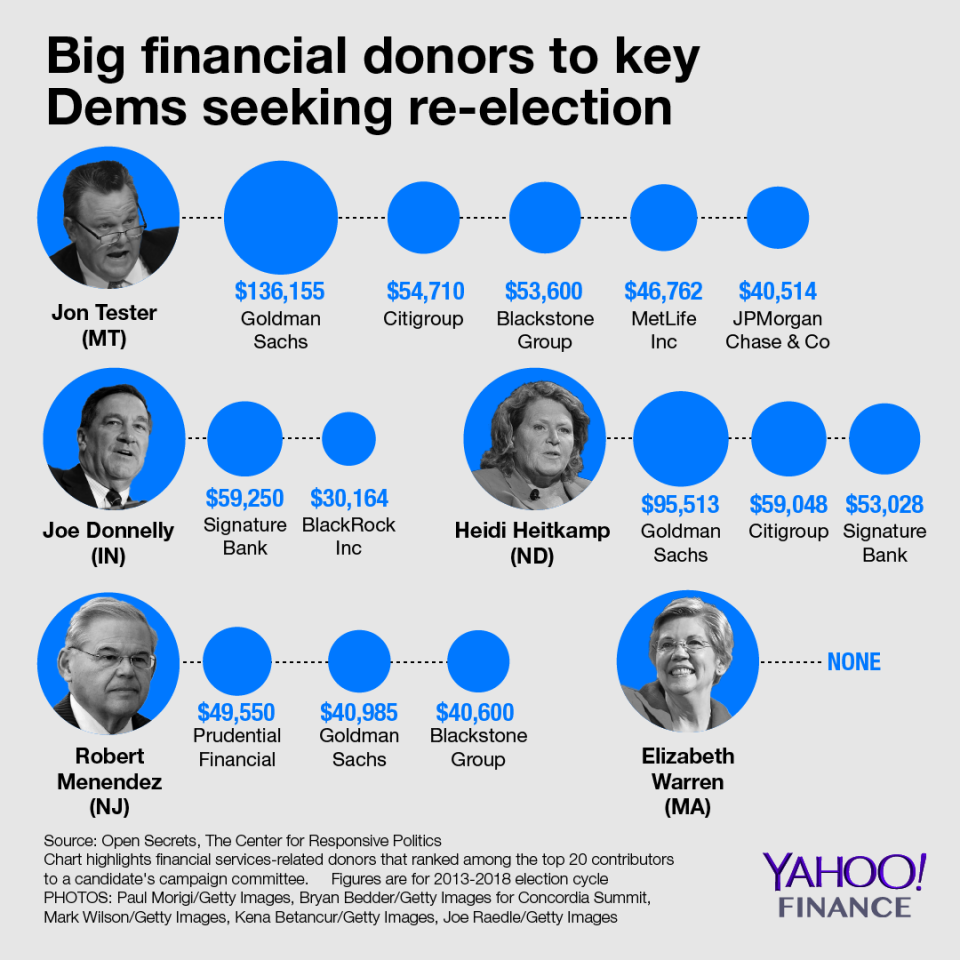

Four moderate Democrats on the Senate Banking Committee worked with Republicans to mint the legislation: Virginia’s Mark Warner, North Dakota’s Heidi Heitkamp, Montana’s Jon Tester, and Indiana’s Joe Donnelly. With the exception of Warner, all of them are up for reelection in the 2018 midterms, and donors associated with large financial companies have raised thousands of dollars to help their campaigns.

All three are in the challenging position of trying to keep their seats in states that Trump won in 2016.

Those Democrats have received large sums of money from the financial services industry. For example, among Tester’s top 20 donors in the 2013 to 2018 election cycle, five are large financial firms: Goldman Sachs (GS), Citigroup, Blackstone Group (BX), MetLife Inc (MET) and JPMorgan Chase.

TV ads

The American Bankers Association threw its support behind Tester’s reelection bid by funding a TV commercial touting his efforts to help local banks.

“Senator Tester put politics aside and voted to cut the red tape, ending the needless regulations and bureaucracy that were hurting Montana banks,” the ad said.

House Democrats are getting some help too; the ABA also made an ad supporting Florida’s Stephanie Murphy, who supported the House version of the same bill.

The only other Democrats on the Senate banking committee running for reelection: New Jersey’s Robert Menendez and Massachusetts’s Elizabeth Warren. Both opposed the legislation.

Menendez still has Prudential Financial (PRU), Goldman Sachs and the Blackstone Group among his top 20 donors. Warren had no financial services firms in her top donors, likely due to her strong views on financial regulation.

Although the largest U.S. banks — those defined as global systemically important banks — did not receive regulatory relief from the bill, the Federal Reserve recently decided to extend some relief to banks between $250 billion and $700 billion.

Under the proposal, U.S. Bancorp (USB), PNC Financial (PNC), Capital One (COF), and Charles Schwab (SCHW) will see reduced liquidity and funding requirements. In 2017-2018, the four companies donated about $32,000 to Tester, Heitkamp, and Donnelly’s campaigns combined.

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Read more:

Midterms unlikely to halt Trump administration’s regulatory rollbacks

Fed Vice Chair Quarles prefers ‘more gradual’ rate hikes

Prudential Financial to shed its post-crisis ‘too big to fail’ label

Yahoo Finance

Yahoo Finance