Wabtec (WAB) Reaches 52-Week High: What's Aiding the Stock?

Shares of Westinghouse Air Brake Technologies Corporation, operating as Wabtec Corporation (WAB), scaled a 52-week high of $170.83 in the trading session on May 20, 2024, before closing a tad lower at $170.65.

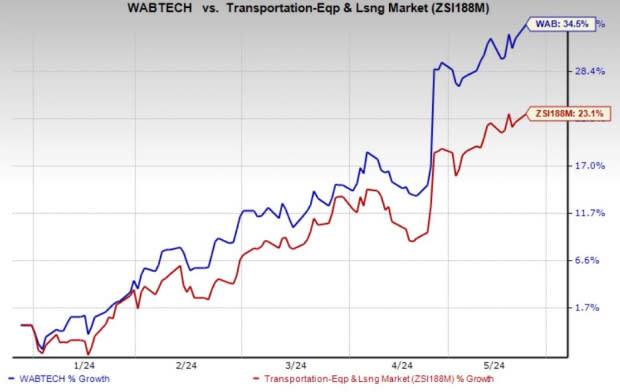

The company’s shares gained 34.5% so far this year, steadily outperforming the 23.1% rise of the industry it belongs to.

Image Source: Zacks Investment Research

Let’s find out the factors supporting the uptick.

Wabtec’s top line is benefiting from higher sales across its Freight and Transit segments. While the Freight segment benefits from growth in services and components, the transit segment gains from strong aftermarket and original equipment manufacturing sales. WAB is expected to continue its strong performance due to strong underlying demand and a robust backlog. The recent new order wins in Kazakhstan are expected to boost revenues further.

Driven by this encouraging backdrop, management raised its current-year revenues and earnings per share (EPS) guidance. Wabtec now expects sales in the $10.25-$10.55 billion band. The earlier guidance was in the range of $10.05-$10.35 billion. Adjusted EPS is now estimated to be between $7.00 and $7.40. The earlier guidance was in the $6.50-$6.90 range. The bullish 2024 guidance not only looks encouraging but also raises optimism about the stock.

Highlighting its pro-investor stance, Wabtec's management announced a 17.6% increase to its quarterly dividend (on Feb 14, 2024), thereby raising its quarterly cash dividend from 17 cents per share to 20 cents. Additionally, WAB’s board announced a $1 billion share buyback authorization.

WAB has been consistently making efforts to reward its shareholders through dividends and share buybacks, which are encouraging. In 2023, WAB rewarded its shareholders through a combination of cash dividends ($123 million) and share repurchases ($409 million). In first-quarter 2024, WAB rewarded its shareholders through a combination of cash dividends ($36 million) and share repurchases ($175 million). Such shareholder-friendly initiatives not only boost investor confidence but also positively impact the company's bottom line.

The positive sentiment surrounding the stock is evident from the fact that the Zacks Consensus Estimate for current-year earnings has been revised upward by 9.1% over the past 90 days. Further, Wabtec has an impressive earnings surprise history. The company's earnings outpaced the Zacks Consensus Estimate in three of the trailing four quarters (missed the mark in the remaining quarter), delivering an average surprise of 11.46%. Wabtec has an expected earnings growth rate of 22.64% for the current year.

Zacks Rank and Other Stocks to Consider

Wabtec currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks for investors’ consideration in the Zacks Transportation sector include GATX Corporation GATX and Trinity Industries, Inc. (TRN). Each stock currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

GATX has an encouraging earnings surprise history. The company has surpassed the Zacks Consensus Estimate in three of the last four quarters (missing the mark in the other). The average beat is 7.49%.

The Zacks Consensus Estimate for 2024 earnings has been revised 3% upward over the past 90 days. GATX has an expected earnings growth rate of 6.79% for 2024. Shares of the company have risen 18.4% in the past year.

Trinity raised 2024 EPS guidance to the range of $1.35 to $1.55 (which excludes items outside of the company’s core business operations) from $1.30 to $1.50 guided previously.

Over the past 30 days, the Zacks Consensus Estimate for TRN’s 2024 earnings has been revised 2.7% upward. For 2024, TRN’s earnings are expected to grow 8.70% year over year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Trinity Industries, Inc. (TRN) : Free Stock Analysis Report

Westinghouse Air Brake Technologies Corporation (WAB) : Free Stock Analysis Report

GATX Corporation (GATX) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance