Is Vulcan (VMC) Stock Worth Buying Ahead of Q1 Earnings?

Vulcan Materials Company VMC is scheduled to release first-quarter 2024 results on May 2, before the opening bell. The Zacks Consensus Estimate for Vulcan’s first-quarter earnings per share (EPS) is pegged at 80 cents, which moved down from 87 cents in the past seven days. The estimated figure suggests a decline of 15.8% from the year-ago quarter’s reported figure of 95 cents. Notably, Vulcan’s earnings topped the consensus mark in the last four quarters, the average surprise being 19.5%.

The consensus estimate for net sales is pegged at $1.53 billion, indicating a 7.4% decrease from the prior-year quarter’s figure of $1.65 billion.

In the last reported quarter, the company’s earnings beat the Zacks Consensus Estimate by 7.4%, and revenues beat the same by 0.5%. On a year-over-year basis, earnings of this aggregates producer increased 35.2%, and revenues rose 5.9%.

Our proven model does not conclusively predict an earnings beat for Vulcan this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat, which is not the case here. Currently, VMC has an Earnings ESP of -1.53% and a Zacks Rank #2. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Vulcan Materials Company Price and EPS Surprise

Vulcan Materials Company price-eps-surprise | Vulcan Materials Company Quote

Factors to Influence Q1

Vulcan's first-quarter revenues are anticipated to have experienced a year-over-year decrease, primarily due to reduced volumes caused by adverse weather conditions, a challenging comparison to the previous year's performance, and a reduced number of working days in March. Additionally, the quarter's concrete sales are anticipated to be lower following the sale of the Texas concrete business. The main challenges that affected aggregates volumes during this period were fewer working days, unfavorable weather conditions in key regions like the southeast and west, and the shipment delays that had boosted volumes in the same quarter of the prior year.

Nonetheless, quarterly performance is expected to have witnessed strong pricing gains across its product lines and strength in public construction. Higher non-residential construction activities and incremental federal funding from the Infrastructure Investment and Jobs Act are expected to have acted as a tailwind for VMC.

The Aggregates business, including crushed stone, sand and gravel and other aggregates (which accounted for 75.9% of total 2023 revenues), has been a major contributor to the top-line growth. Our model suggests that net sales from the Aggregates segment will grow 0.9% to $1.31 billion from a year ago.

Our model suggests net sales from the Asphalt Mix segment (15.2% of total revenues) to be $239.8 million, indicating 41.2% growth from a year ago. We also anticipate revenues from the Concrete segment (16.1% of total revenues) to decline 6.6% to $266.4 million from a year ago. The Calcium segment’s net sales are expected to be $1.9 million, suggesting a decline from $2.3 million a year ago.

We also predict Aggregates volumes to decline 4% and Concrete volumes to decline 57.4% year over year, whereas volumes for the Asphalt Mix unit are likely to grow 0.8% year over year.

Meanwhile, Aggregates price is likely to grow 11% in the quarter, while that for Asphalt Mix and Concrete to increase 2% and 0.8% year over year, respectively.

However, reduced residential demand, along with higher material expenses, the shortage of skilled laborers and rising wage costs, are expected to have impacted VMC’s first-quarter margins.

Investment Consideration

Despite a sluggish start, Vulcan's performance outlook is promising, especially given the increase in activity observed in March 2024, which is attributed to clearer weather conditions. This optimism is further supported by strategic acquisitions and strong selling prices in aggregates. Additionally, improvements in infrastructure and resilient performance in the residential sector, particularly with stronger single-family housing offsetting softer demand in multi-family dwellings, contribute to the positive outlook.

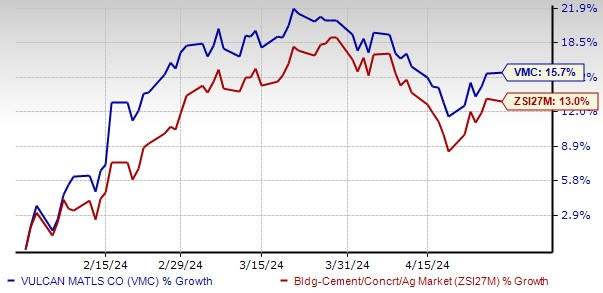

Image Source: Zacks Investment Research

Over the past three months, the company’s shares have gained 15.7%, outperforming the Zacks Building Products - Concrete and Aggregates industry’s growth of 13%.

In an environment marked by elevated interest rates and inflation, companies in the aggregates and cement sectors stand out as particularly resilient. Their primary operations are closely linked to infrastructure and heavy commercial markets, which tend to be less affected by fluctuations in interest rates. This resilience is further bolstered by ongoing government investment in infrastructure projects, providing a stable revenue stream. Additionally, the support of federal tax incentives like the IRA and CHIPS Act bolsters large private nonresidential projects, further fortifying the industry. Moreover, these companies possess the ability to adjust prices in response to increases in energy costs, thus maintaining their profitability even in challenging economic conditions.

As investors await VMC’s first-quarter earnings report, the company's solid pricing, accretive buyouts and high infrastructure spending paint a positive picture. Investors should consider the company's strong positioning in the market, strategic initiatives, and ability to navigate through industry challenges when making investment decisions. Over the past month, earnings projections for 2024 and 2025 have risen by 1.2% and 1.7%, respectively. This reflects analysts' growing optimism regarding the stock's potential for growth.

In conclusion, while short-term challenges may impact performance, Vulcan’s long-term prospects remain promising, making it a compelling investment opportunity ahead of first-quarter earnings.

Stocks With Favorable Combination

Here are some other companies in the Zacks Construction sector, which according to our model, have the right combination of elements to post an earnings beat in their respective quarters to be reported.

TopBuild BLD has an Earnings ESP of +1.47% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

BLD’s earnings for the to-be-reported quarter are expected to increase 4.6%. The company reported better-than-expected earnings in all the last four quarters, the average surprise being 12.4%.

Fluor Corporation FLR has an Earnings ESP of +1.23% and a Zacks Rank #3.

FLR’s earnings for the to-be-reported quarter are expected to grow 92.9%. The company reported better-than-expected earnings in three of the last four quarters and missed on one occasion, the average surprise being 47.9%.

Boise Cascade Company BCC has an Earnings ESP of +0.36% and has a Zacks Rank #3.

BCC’s earnings topped the consensus mark in three of the last four quarters and missed on one occasion, with the average being 20.4%. Earnings for the to-be-reported quarter are expected to decline 5.4% year over year.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fluor Corporation (FLR) : Free Stock Analysis Report

Vulcan Materials Company (VMC) : Free Stock Analysis Report

Boise Cascade, L.L.C. (BCC) : Free Stock Analysis Report

TopBuild Corp. (BLD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance