Viper Energy Inc (VNOM) Surpasses Q1 Earnings Estimates with Strong Production and Financial ...

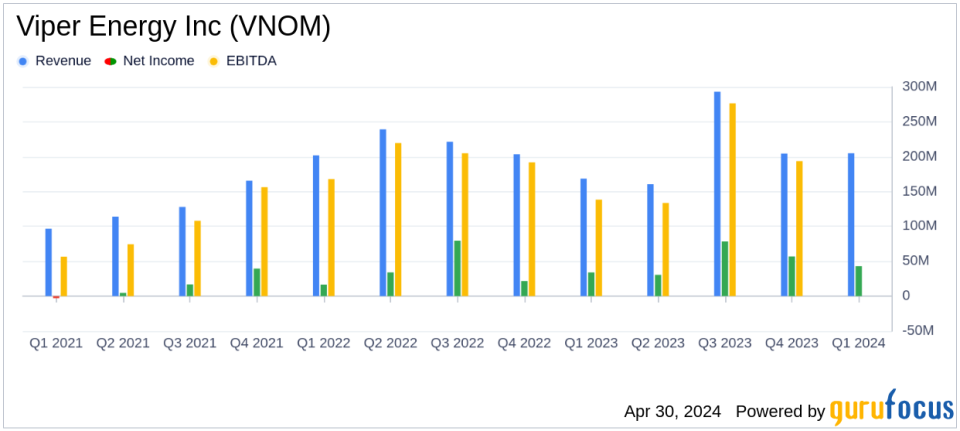

Net Income: $43.4 million, surpassed the estimated $39.05 million.

EPS: Reported at $0.49 per share, exceeding the estimate of $0.42.

Revenue: Recorded at $205.4 million, surpassing the expected $201.51 million.

Dividends: Declared a total dividend of $0.59 per Class A common share for Q1 2024, reflecting a 5.9% annualized yield based on recent share prices.

Production: Average daily production reached 46,132 boe/d, with guidance for Q2 2024 set at 46,500 to 47,250 boe/d.

Asset Sale: Announced the sale of non-Permian assets for approximately $90.3 million, expected to close on May 1, 2024.

Debt Position: Reported long-term debt standing at $1.1 billion as of March 31, 2024.

Viper Energy Inc (NASDAQ:VNOM), a subsidiary of Diamondback Energy, Inc. (NASDAQ:FANG), released its 8-K filing on April 30, 2024, revealing impressive first-quarter financial and operating results. The company reported a net income of $43.4 million, or $0.49 per common share, surpassing the analyst's estimated earnings per share of $0.42. This performance is underpinned by a robust production output and strategic asset management in the oil-rich Permian Basin.

Company Overview

Viper Energy Inc specializes in acquiring and managing mineral and royalty interests in oil and natural gas properties, primarily located in the Permian Basin. This region is known for its multiple oil and natural gas-bearing zones, making it a key area for energy production in the United States.

Operational Highlights and Strategic Moves

The first quarter of 2024 saw Viper Energy achieving an average production of 25,407 barrels of oil per day, contributing to a consolidated net income of $99.6 million. This period also highlighted a significant strategic move with the sale of Vipers non-Permian assets for approximately $90.3 million, expected to close by May 1, 2024. This sale aligns with Viper's focus on optimizing its asset portfolio and strengthening its core operations in the Permian Basin.

Financial Performance

Viper's financial strength was evident in its Q1 2024 results, with total operating income reaching $205.4 million. The company also declared a combined base and variable cash dividend of $0.59 per Class A common share, reflecting a 5.9% annualized yield based on the recent share price. This return of capital represents 75% of the cash available for distribution, underscoring Viper's commitment to delivering shareholder value.

Challenges and Forward-Looking Statements

Despite the positive outcomes, Viper Energy faces ongoing challenges such as volatile commodity prices and regulatory changes that could impact operations. However, the company's proactive management strategies, including cost control and strategic divestitures, position it well to navigate these uncertainties.

Guidance and Future Outlook

Looking ahead, Viper has updated its production guidance for Q2 and the full year of 2024, reflecting expected continued growth in production volumes. The company anticipates a Q2 average daily production of 26,000 to 26,500 barrels of oil per day, with a full-year projection slightly adjusted to account for the divested non-Permian assets.

"The first quarter was a strong start to the year for Viper and a period which uniquely highlighted the benefits of Vipers business model and high quality assets," stated Travis Stice, Chief Executive Officer of Viper.

Viper Energy's robust first-quarter performance, strategic asset optimization, and forward-looking production guidance reflect its strong positioning within the competitive oil and gas sector. As the company continues to refine its operations and asset base, it remains poised for sustained growth and profitability.

For further details on Viper Energy's financial performance and operational updates, please refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Viper Energy Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance