VIB Vermögen (ETR:VIH1) investors are sitting on a loss of 49% if they invested three years ago

While not a mind-blowing move, it is good to see that the VIB Vermögen AG (ETR:VIH1) share price has gained 17% in the last three months. But that doesn't change the fact that the returns over the last three years have been less than pleasing. Truth be told the share price declined 52% in three years and that return, Dear Reader, falls short of what you could have got from passive investing with an index fund.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

See our latest analysis for VIB Vermögen

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the unfortunate three years of share price decline, VIB Vermögen actually saw its earnings per share (EPS) improve by 1.7% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

It looks to us like the market was probably too optimistic around growth three years ago. However, taking a look at other business metrics might shed a bit more light on the share price action.

We note that, in three years, revenue has actually grown at a 12% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching VIB Vermögen more closely, as sometimes stocks fall unfairly. This could present an opportunity.

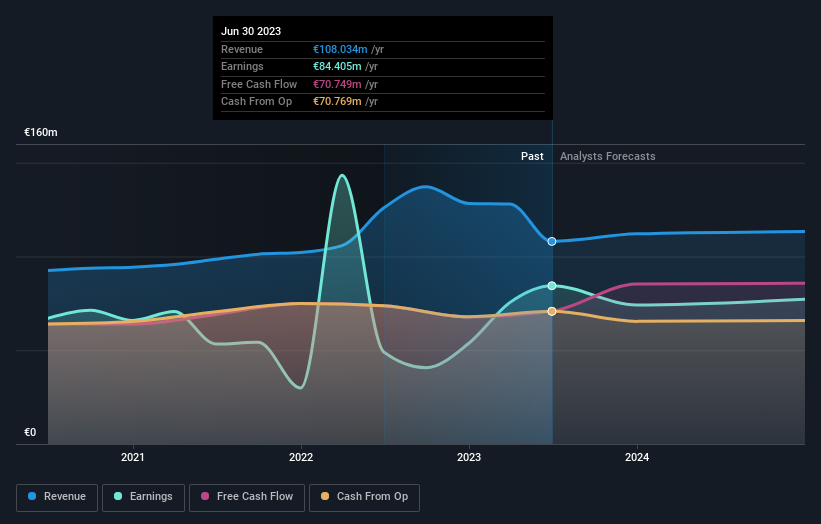

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We know that VIB Vermögen has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on VIB Vermögen

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between VIB Vermögen's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for VIB Vermögen shareholders, and that cash payout explains why its total shareholder loss of 49%, over the last 3 years, isn't as bad as the share price return.

A Different Perspective

VIB Vermögen shareholders are down 27% for the year, but the market itself is up 3.9%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - VIB Vermögen has 4 warning signs (and 2 which are concerning) we think you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finance

Yahoo Finance