Viatris' (VTRS) Q2 Earnings Beat, Revenues Miss Estimates

Viatris Inc VTRS reported adjusted earnings of 88 cents per share in the second quarter of 2022, easily beating the Zacks Consensus Estimate of 81 cents. In the year-ago quarter, the company reported earnings of 98 cents.

Total revenues came in at $4.12 billion, down 10% year over year. The top line missed the Zacks Consensus Estimate of $4.13 billion.

The U.S. dollar continued to strengthen across major currencies, impacting the top line.

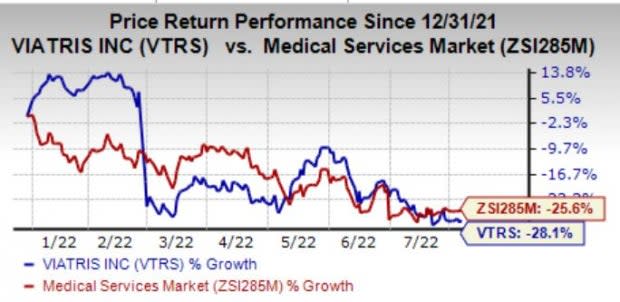

Viatris’ stock has lost 28.1% in the year so far compared with the industry’s decline of 25.6%.

Image Source: Zacks Investment Research

Quarter in Detail

Revenues include sales and other revenues. Sales of $4.1 billion were down 10% from the year-ago quarter.

The company reports results in four segments — Developed Markets, Emerging Markets, JANZ (Japan, Australia and New Zealand) and Greater China.

Developed market sales came in at $2.48 billion, down 6% from the year-ago quarter.

Sales from Emerging Markets came in at $650.9 million, down 25% year over year.

JANZ generated sales of $427.1million, down 15%.

Sales from Greater China came in at $548.3 million compared with $550.3 million a year ago.

On the basis of product category, Brands performed better than management expectations, driven by products such as EpiPen, Norvasc and Lipitor. It generated revenues of $2.48 billion.

Complex generics and biosimilars grew 7%, driven by the interchangeable Semglee launch in the United States. Revenues from the biosimilars portfolio to be contributed to Biocon Biologics totaled approximately $167 million in the quarter.

Viatris generated $84 million in new product revenues (revenues from products launched in 2022), primarily driven by the launch of interchangeable Semglee in the United States. It is on track to achieve approximately $600 million in new product revenues in 2022.

Adjusted gross margin came in at 58.6% compared with 58.5% in the year-ago quarter.

Other Updates

In February, Viatris announced a definitive agreement with Biocon Biologics Limited whereby it will sell its biosimilars portfolio to the latter. Under the terms of the deal, Viatris will combine its biosimilars portfolio with Biocon Biologics Ltd in exchange for pre-tax consideration of up to $3.335 billion.

Viatris will receive $3 billion in consideration in the form of a $2 billion cash payment and $1 billion of convertible preferred equity at the time of close. Viatris will own a stake of at least 12.9% of Biocon Biologics on a fully diluted basis.

Along with second-quarter results, management stated that its transaction with Biocon Biologics is progressing and is expected to close in the second half of 2022.

Viatris Inc. Price, Consensus and EPS Surprise

Viatris Inc. price-consensus-eps-surprise-chart | Viatris Inc. Quote

Guidance Update

Revenues are now projected between $16.2 billion and $16.7 billion (earlier estimate: $17 billion and $17.5 billion) due to an incremental currency headwind of approximately $800 million.

Our Take

Viatris reported mixed results in the second quarter, with revenues missing expectations due to the negative impact of the foreign exchange rate. Nevertheless, new products are likely to boost sales in the quarters ahead.

The company is now looking to reshape its business and has entered into a merger agreement with Biocon Biologics.

Zacks Rank & Stocks to Consider

Viatris currently carries a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the sector are Alkermes ALKS and Dynavax DVAX. While DVAX carries a Zacks Rank #1 (Strong Buy), Alkermes has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

ALKS’ earnings estimates for 2022 reversed from a loss of 14 cents to earnings of 20 cents in the past 60 days. Alkermes surpassed earnings in all the trailing four quarters, the average being 325.48%.

Dynavax’s earnings estimates have increased to $1.15 from $1.14 for 2022 over the past 60 days. Earnings of Dynavax have surpassed estimates in two of the trailing four quarters.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dynavax Technologies Corporation (DVAX) : Free Stock Analysis Report

Alkermes plc (ALKS) : Free Stock Analysis Report

Viatris Inc. (VTRS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance