Verizon (VZ) Upgrades Cat M Network With Voice Capabilities

Verizon Communications Inc. VZ has announced that it is upgrading its Cat M network by adding voice capabilities for Internet of Things (IoT) solutions. Following the news, its equity price rose 0.3% during the trading session to eventually close at $54.75 on Aug 30.

The communication services provider had first launched Cat M network in March 2017 to provide scale, coverage and security to customers looking for wireless access solutions for IoT. With the introduction of voice features, its nationwide Cat M network is able to support a broad base of IoT solutions with enhancements.

Verizon's network is built on a virtualized cloud environment, which enables rapid IoT solution deployment and nationwide scaling aimed at increasing IoT adoption for developers and businesses. The company maintains a strong leadership position in IoT technology including the deployment of 4G LTE, LTE Cat 1 and LTE Cat M1.

With this latest move, Cat M network will now provide voice access and serve applications using fixed IoT voice services. Mobile voice service is enabled through a feature called Connected Mode Mobility (CMM), currently being deployed with expected completion within the next month. With the completed deployment of CMM, Verizon’s Cat M network will support IoT solutions requiring less power and extended battery life.

IoT solution requirements vary in data rate, battery life and scalability requirements. For small IoT solutions with data rates below 100kbps, Narrowband IoT (NB-IoT) Guardband technology is appropriate, and for medium data needs Verizon has a nationwide Cat M network with voice capabilities. NB-IoT provides scale, coverage and security for customers seeking scalable and cost-effective wireless access solutions for IoT. Verizon maintains a strong leadership position in IoT technology and solutions. It has been aggressively forging ahead to expand its fiber optics networks to support 4G LTE and upcoming 5G wireless standards as well as wireline connections. It is collaborating with manufacturers to develop the IoT ecosystem and ensure that customers get the network access that best suits their needs.

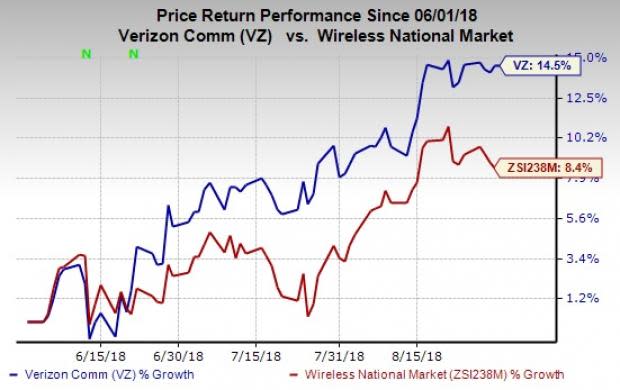

In the past three months, shares of Verizon have returned 14.5% compared with 8.4% growth for the industry.

Verizon currently has a Zacks Rank #3 (Hold). Better-ranked stocks in the industry include United States Cellular Corporation USM, Windstream Holdings, Inc. WIN and Aquantia Corp. AQ, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

United States Cellular has a long-term earnings growth expectation of 1%. It surpassed earnings estimates thrice in the trailing four quarters with an average positive surprise of 303.6%.

Windstream surpassed earnings estimates twice in the trailing four quarters with an average positive surprise of 23.5%.

Aquantia surpassed earnings estimates once in the trailing four quarters with an average positive surprise of 50%.

5 Companies Verge on Apple-Like Run

Did you miss Apple's 9X stock explosion after they launched their iPhone in 2007? Now 2018 looks to be a pivotal year to get in on another emerging technology expected to rock the market. Demand could soar from almost nothing to $42 billion by 2025. Reports suggest it could save 10 million lives per decade which could in turn save $200 billion in U.S. healthcare costs. A bonus Zacks Special Report names this breakthrough and the 5 best stocks to exploit it. Like Apple in 2007, these companies are already strong and coiling for potential mega-gains.

Click to see them right now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Verizon Communications Inc. (VZ) : Free Stock Analysis Report

Windstream Holdings, Inc. (WIN) : Free Stock Analysis Report

United States Cellular Corporation (USM) : Free Stock Analysis Report

Aquantia Corp. (AQ) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance