VeriSign Inc (VRSN) Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

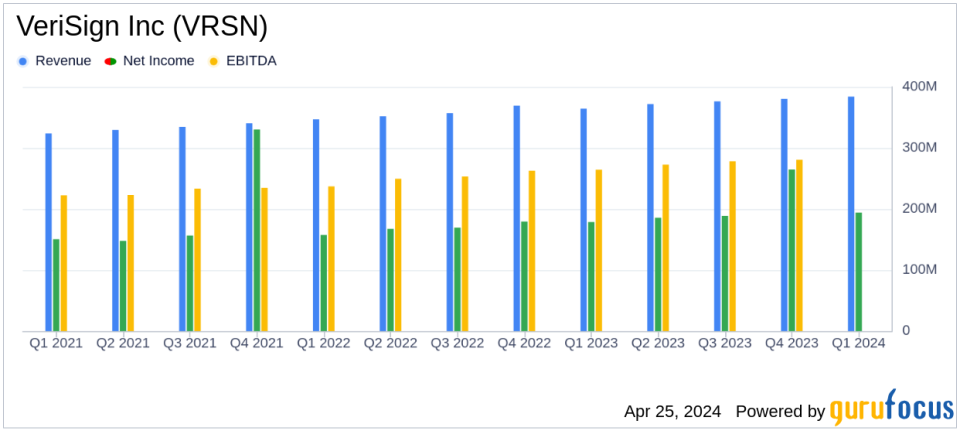

Revenue: $384 million, up 5.5% from $364.4 million in the same quarter of the previous year, surpassing estimates of $381.85 million.

Net Income: $194 million, an increase from $178.7 million in the same quarter of the previous year, exceeding estimates of $189.49 million.

Earnings Per Share (EPS): $1.92, up from $1.70 year-over-year, surpassing the estimate of $1.86.

Cash Flow from Operations: $257 million, slightly below the $259 million reported in the same quarter of the previous year.

Deferred Revenues: Totaled $1.28 billion as of March 31, 2024, marking an increase of $39 million from year-end 2023.

Share Repurchase: Repurchased 1.3 million shares for an aggregate cost of $260 million during the quarter.

Domain Name Registrations: Ended the quarter with 172.5 million .com and .net domain name registrations, a decrease of 1.3% from the end of the first quarter of 2023.

On April 25, 2024, VeriSign Inc (NASDAQ:VRSN), the sole authorized registry for key top-level domains like .com and .net, released its 8-K filing, announcing its financial results for the first quarter of 2024. The company reported a revenue of $384 million, a 5.5% increase from the previous year, surpassing the estimated $381.85 million. Net income rose to $194 million, with earnings per share (EPS) at $1.92, both exceeding analyst expectations of $189.49 million net income and $1.86 EPS.

VeriSign's operational performance was highlighted by an operating income of $259 million, up from $241 million in the same quarter last year. Despite a slight decrease in domain name registrations, with a 1.3% drop to 172.5 million for .com and .net domains, the company's financial health remains robust, underscored by a strong cash flow from operations at $257 million.

Financial and Business Highlights

The company ended the quarter with $925 million in cash, cash equivalents, and marketable securities. A notable activity in the quarter was the repurchase of 1.3 million shares for $260 million, reflecting confidence in the company's ongoing value. Deferred revenues also saw a healthy increase, totaling $1.28 billion as of March 31, 2024, which is a $39 million rise from the end of 2023.

However, the domain name base experienced a net decrease of 0.27 million names during the quarter, and the renewal rate for .com and .net slightly decreased to 73.2% from 73.3% a year earlier. These figures suggest a slight cooling in domain registration activities, which could be a point of focus for the company moving forward.

Operational and Strategic Insights

VeriSign operates two of the world's 13 root servers and provides root zone maintainer services, playing a crucial role in the global internet infrastructure. The slight decline in domain registrations and renewal rates may prompt strategic adjustments to enhance customer retention and attract new registrations.

Financially, VeriSign is well-positioned with a significant cash reserve and a strong share repurchase program, indicating a stable financial outlook. However, the company must navigate the challenges of a fluctuating domain registration market and potential shifts in internet usage patterns.

Looking Ahead

VeriSign's management remains committed to maintaining operational excellence and financial discipline. The company's focus on enhancing the security, stability, and resiliency of internet infrastructure, coupled with strategic investments in its core operations, positions it well for sustainable growth. Investors and stakeholders will likely watch how VeriSign adapts to the evolving market dynamics in the coming quarters.

For detailed financial statements and further information, visit VeriSign's investor relations page at https://investor.verisign.com.

Explore the complete 8-K earnings release (here) from VeriSign Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance