Value-Adding Tech Dividend Stocks To Buy Now

The technology sector is generally characterised as full of innovation, competition and growth. It is also known to be highly cyclical and volatile since companies tend to find it difficult to create sustainable competitive advantage. However, those that build successful economic moats are exceptionally profitable and some pay strong dividends as a result. If you’re a long term investor, these high-dividend tech stocks can boost your monthly portfolio income.

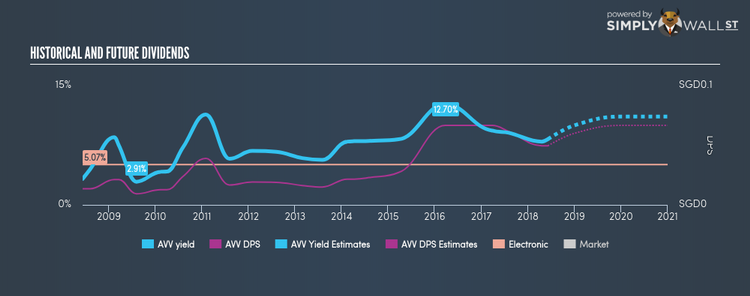

CEI Limited (SGX:AVV)

AVV has an alluring dividend yield of 8.27% and the company has a payout ratio of 19.13% , with the expected payout in three years being 100.00%. Despite some volatility in the yield, DPS has risen in the last 10 years from S$0.02 to S$0.074. Continue research on CEI here.

Excelpoint Technology Ltd (SGX:BDF)

BDF has a large dividend yield of 6.82% and has a payout ratio of 32.36% . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from US$0.012 to US$0.045. The company has a lower PE ratio than the SG Electronic industry, which interested investors would be happy to see. The company’s PE is currently 7.1 while the industry is sitting higher at 9.5. Continue research on Excelpoint Technology here.

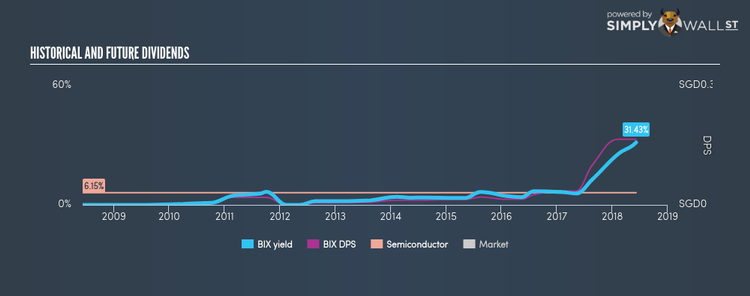

Ellipsiz Ltd (SGX:BIX)

BIX has a sumptuous dividend yield of 31.43% and their current payout ratio is 50.47% . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from S$0 to S$0.17. Ellipsiz’s earnings per share growth of 324.91% over the past 12 months outpaced the sg semiconductor industry’s average growth rate of 193.97%. More detail on Ellipsiz here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.

Yahoo Finance

Yahoo Finance