VALE's Q1 Iron Ore & Copper Output Increase Y/Y, Nickel Lags

Vale S.A. VALE reported iron ore production of 70.8 million tons (Mt) for the first quarter of 2024, which was up 6% year over year, attributed to improved operating performance at the S11D mine and higher third-party purchases.

During the quarter, the S11D mine attained its highest production figures since 2020, bolstered by ongoing asset reliability initiatives that ensured enhanced operational stability even amid the rainy season.

Pellet production rose 1.8% year over year to 8.5 Mt in the first quarter, aided by higher pellet feed availability. Iron ore fines sales improved 14.6% from the year-ago quarter to 52.5 Mt in the first quarter, while pellet sales were up 13.4% to 9.2 Mt.

The average realized iron ore fines price was $100.7 per ton in the first quarter, down 7.3% year over year and 14.9% sequentially, owing to provisional pricing adjustments due to lower-than-average forward prices on the last day of the quarter.

Copper Output Up, Nickel Lags

In the first quarter of 2024, Vale produced 81.9 kt of copper, which marked 22.2% year-over-year growth, benefiting from the steady ramp-up of Salobo 3 as well as better performance at Salobo’s 1 & 2 plants. Meanwhile, production at Sossego was impacted due to a scheduled maintenance shutdown and lower ore grades.

Vale sold 76.8 kt of copper in the quarter under discussion, which was up 22.5% from the year-ago quarter. The average realized price for copper operations only (Salobo and Sossego) was $7,687 per ton in the first quarter of 2024, 18.8% lower than $9,465 per ton in the first quarter of 2023. The average realized copper price for all operations (including copper sales originating from nickel operations) was $7,632 per ton.

Production of nickel dipped 3.7% year over year to 39.5kt in the January-March 2024 period. This reflects the impact of the planned furnace rebuild at Onça Puma. This was partially offset by stronger performance at the Canadian and Indonesian operations.

Nickel sales were recorded at 33.1 kt, down 17.5% from the year-ago comparable quarter’s figure. The average realized nickel price was $16,848 per ton, down 33% compared with $25,260 per ton in the year-ago quarter. This was mainly driven by a 36% year-over-year decrease in LME nickel reference prices.

Guidance for 2024

The company’s iron ore production guidance for 2024 is 310-320 Mt. Vale’s iron ore production guidance for 2023 was 321 Mt. Pellet production is projected to be between 38 Mt and 42 Mt for 2024, higher than the figure of 36.5 MT in 2023.

The copper production guidance is 320-355 kt. Copper production for 2023 was 326.6 kt.

VALE expects nickel production in 2024 between 160 kt and 175 kt. In 2023, the total production of nickel was recorded at 164.9 kt.

Vale’s peer, Rio Tinto Group RIO, reported a 2% decrease in its first-quarter 2024 iron ore production to 77.9 Mt (on a 100% basis) as planned ore depletion, predominantly at Yandicoogina, was partially offset by productivity gains across other operations.

Shipments for the quarter (on a 100% basis) were reported at 78 Mt, marking a 5% year-over-year drop. This was due to weather disruption at the ports as well as lower output at the mines.

Rio Tinto’s copper production was 156 thousand tons (on a consolidated basis), which was 7% higher than the year-ago quarter.

RIO expects Pilbara iron ore shipments (100% basis) between 323 Mt and 338 Mt in 2024. The midpoint of the range indicates a year-over-year dip of 0.4%.

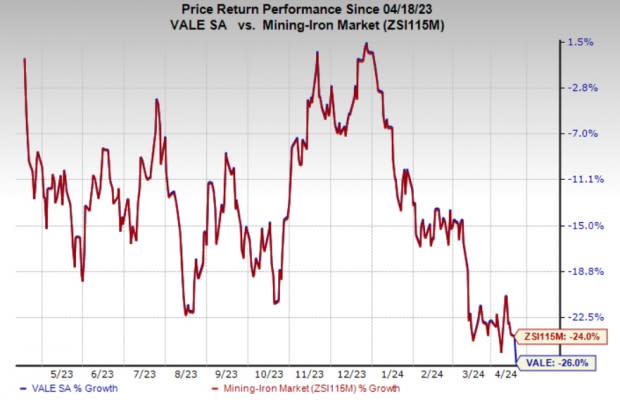

Price Performance

Shares of Vale have lost 26% in a year compared with the industry's 24% decline.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

Vale currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the Basic Materials space are Ecolab Inc. ECL and Carpenter Technology Corporation CRS. Each stock presently carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.39 per share, indicating an increase of 22.7% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.7%. ECL shares have gained 34% in a year.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.00 per share. The consensus estimate for 2024 earnings has moved 1% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 14.3%. CRS shares have gained 62% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

VALE S.A. (VALE) : Free Stock Analysis Report

Rio Tinto PLC (RIO) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance