Vail Resorts (MTN) Reports Ski Season Metrics, Skier Visits Fall

Vail Resorts, Inc. MTN reported certain ski season metrics for the period from the beginning of the ski season through Apr 14, 2024, and for the prior year period through Apr 16, 2023.

Ski Season Metrics

Season-to-date (through Apr 14, 2024) total skier visits fell 7.8% from the prior-year season-to-date period (Apr 16, 2023).

Season-to-date revenues from lift tickets, including a portion of season pass revenues for each period, increased 3.2% compared to the same period last year. Ski school revenues season to date increased by 7.0%, while dining revenues saw 2.4% growth from the prior season-to-date period. However, retail and rental revenues for North American resort and ski area stores experienced a 7.1% decline from the prior season-to-date period.

Kirsten Lynch, CEO of Vail Resorts said that despite a decrease in visitation, the company’s lift revenues saw an increase, fueled by the rise in pass sales secured prior to the season. Additionally, the company’s ancillary businesses thrived, showing notable growth in spending per visit in ski and ride school, dining, and rental services compared to the previous year.

Referring to the fiscal 2024 outlook, Lynch commented, despite late-season improvements, we anticipate concluding the year at or near the lower end of its Resort Reported EBITDA guidance range, as outlined on Mar 11, 2024. This is mainly influenced by the performance of Whistler Blackcomb during the months of March and April.

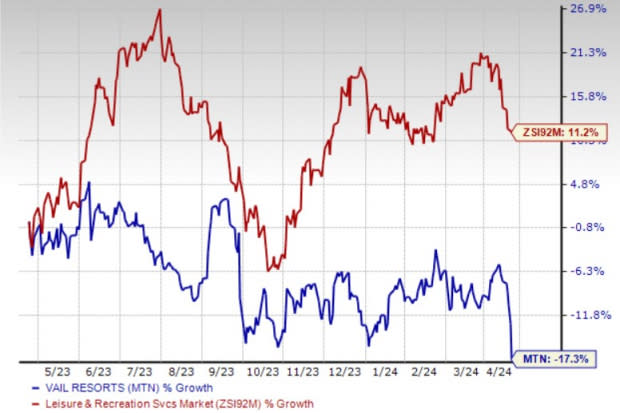

In the past year, shares of this Zacks Rank #5 (Strong Sell) company have declined 17.3% against the industry’s growth of 11.2%.

Image Source: Zacks Investment Research

Key Picks

Some better-ranked stocks in the Zacks Consumer Discretionary sector are as follows:

Trip.com Group Limited TCOM sports a Zacks Rank #1 (Strong Buy). TCOM has a trailing four-quarter earnings surprise of 53.1%, on average. Shares of TCOM have gained 34.1% in the past year. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for TCOM’s 2024 sales and earnings per share (EPS) indicates a rise of 18.2% and 1.8%, respectively, from the year-ago levels.

Royal Caribbean Cruises Ltd. RCL currently carries a Zacks Rank #2 (Buy). RCL has a trailing four-quarter earnings surprise of 26.4%, on average. Shares of RCL have surged 107% in the past year.

The Zacks Consensus Estimate for RCL’s 2024 sales and EPS indicates a rise of 14.7% and 47.9%, respectively, from the year-ago levels.

Hyatt Hotels Corporation H carries a Zacks Rank of 2. It has a trailing four-quarter earnings surprise of 17.8%, on average. Shares of H have increased 24.2% in the past year.

The Zacks Consensus Estimate for H’s 2024 sales and EPS indicates a rise of 3.5% and 25%, respectively, from the year-ago levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hyatt Hotels Corporation (H) : Free Stock Analysis Report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Vail Resorts, Inc. (MTN) : Free Stock Analysis Report

Trip.com Group Limited Sponsored ADR (TCOM) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance