USD/JPY Rally Eyeing Key Resistance Confluence Ahead of U.S. NFP

DailyFX.com -

Talking Points

USD/JPY rally eyeing near-term resistance confluence ahead of U.S. NFP

Updated targets & invalidation levels

Click Here to be added to Michael’s email distribution list.

USD/JPY 120min

Technical Outlook: A breach above the weekly opening range yesterday shifted the focus higher in USDJPY with the advance eyeing key near-term confluence resistance into 115.48. The pair has continued to respect these slope-lines which were derived from a pitchfork extending off the August & September lows. Heading into tomorrow’s U.S. Non-Farm Payrolls report, the immediate outlook remains constructive while above the weekly open which converges with former slope resistance at 112.75.

From a trading standpoint, the long-bias is at risk into this resistance confluence with a breach above August low at 116.08 needed to fuel the next leg higher targeting 118.10 and the 76.4% retracement at 119.43. Heading into the release I would be looking to fade strength into structural resistance with a pullback likely to offer more favorable long-entries. Near-term bullish invalidation rests with the weekly opening-range low / May high at 111.45- a break below this levels risks a more meaningful pullback with such a scenario targeting initial support targets at 107.76.

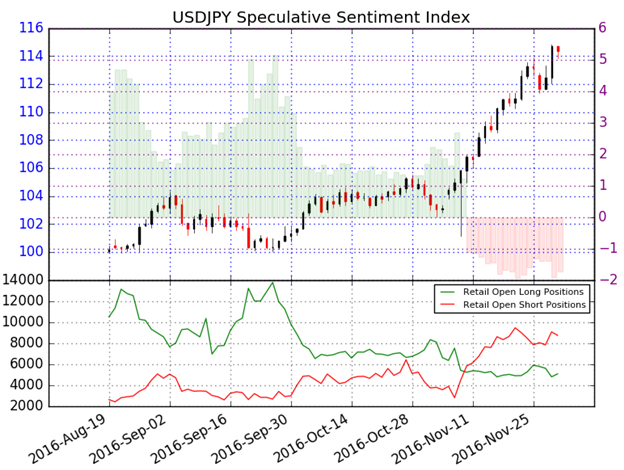

A summary of the DailyFX Speculative Sentiment Index (SSI) shows traders are net short USD/CAD- the ratio stands at -1.69 (37% of traders are long)- bullish reading

Long positions are 8.4% higher than yesterday and 3.2% below levels seen last week

Short positions are 1.7% lower than yesterday but 1.5% above levels seen last week

Market participation has continued to gather pace with open interest at 11.7% above its monthly average

While the current SSI profile remains constructive, it’s worth noting that the subtle shift in positioning towards the long-side suggests that the long-bias may be at risk heading near-term as price approaches confluence resistance with NFPs on tap tomorrow.

Relevant Data Releases

Looking for trade ideas? Review DailyFX’s 2016 4Q Projections

Other Setups in Play:

3Q GDP, OPEC to Drive USD/CAD Volatility- Shorts at Risk into 1.3370

Webinar: USD Rally Looks Tired Ahead of NFPs with Fed Hike Priced In

---Written by Michael Boutros, Currency Strategist with DailyFX

Join Michael for Live Weekly Trading Webinars on Mondays on DailyFX at 13:30 GMT (8:30ET)

FollowMichael on Twitter @MBForex or contact him at mboutros@dailyfx.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from IG.

Yahoo Finance

Yahoo Finance