USD/JPY Inching Towards Key Pivot

DailyFX.com -

Talking Points

Headway above 120.00 proving difficult

118.40 and 120.80 look critical

Unfamiliar with Gann Square Root Relationships? Learn more about them HERE.

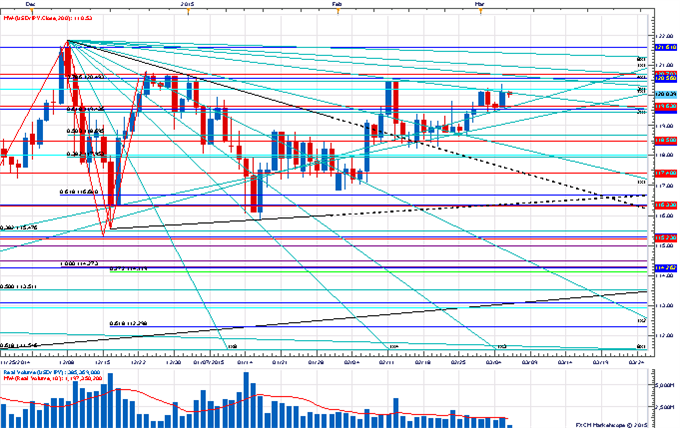

The “breakout” in USD/JPY from the multi-week triangle at the start of February has been a frustrating one. After an impulsive move to test 120.50 the exchange rate has made little headway trading in a sideways to higher range above key Gann support at 118.40. The 120.50/80 area which marks the 78.6% retracement of the December range and the late December cyclical highs remains critical resistance with a move through this zone desperately needed to re-instill upside momentum into the exchange rate and confirm that a new leg higher is truly underway. There is some risk that USD/JPY is setting up for a “false pattern break” to the downside and this risk rises the longer that USD/JPY fails to make headway above 120.00. However, so far support levels have held up remarkably well and it would probably take a move under 118.40 to set this negative scenario into motion.

To receive other reports from this author via e-mail, sign up to Kristian’s e-mail distribution list via this link.

USD/JPY Daily Chart: March 6, 2015

Charts Created using Marketscope – Prepared by Kristian Kerr

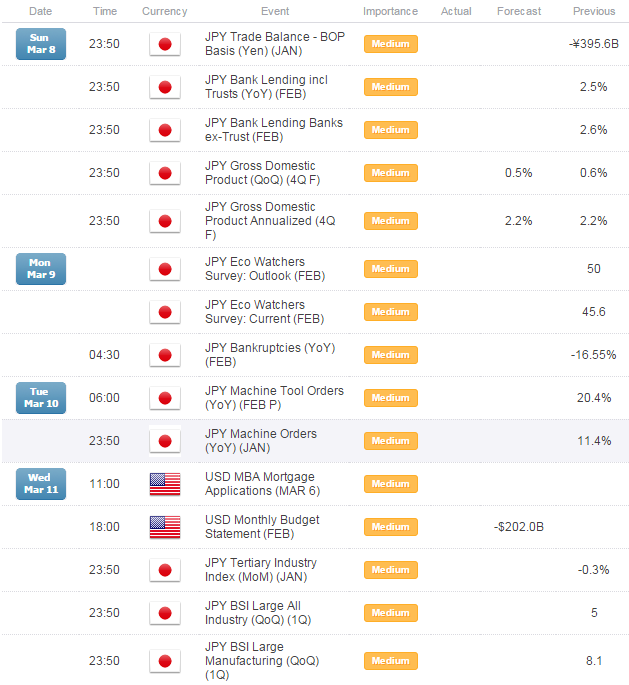

Key Event Risk in the Week Ahead:

LEVELS TO WATCH

Resistance: 120.50 (Fibonacci), 120.80 (Late December high)

Support: 119.60 (Gann), 118.40 (Gann)

Strategy: Buy USD/JPY

Entry: Buy USD/JPY if it closes above 120.80 within the next couple of trading days

Stop: Daily close below 120.20

Target: 122.00

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter at@KKerrFX.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance