USD/CAD- Trading Canada Employment Report

Trading the News: Canada Net Change in Employment

What’s Expected:

Time of release: 02/08/2013 13:30 GMT, 8:30 EST

Primary Pair Impact: USDCAD

Expected: 5.0K

Previous: 39.8K

DailyFX Forecast: 5.0K to 20.0K

Why Is This Event Important:

The Canadian economy is expected to add another 5.0K jobs in January and the ongoing improvement in the labor market should prop up the loonie as it raises the outlook for growth. Although the Bank of Canada (BoC) has softened its tone for a rate hike, another marked rise in employment may fuel bets for higher borrowing costs, and we may see central bank Governor Mark Carney adopt a more hawkish tone over the coming months as the economic recovery gathers pace.

Recent Economic Developments

The Upside

Release | Expected | Actual |

Gross Domestic Product (MoM) (NOV) | 0.2% | 0.3% |

Ivey Purchasing Manager Index s.a. (JAN) | 53.9 | 58.9 |

Retail Sales (MoM) (NOV) | 0.0% | 0.2% |

The Downside

Release | Expected | Actual |

Building Permits (MoM) (DEC) | 5.0% | -11.2% |

Existing Home Sales (MoM) (DEC) | -- | -0.5% |

International Merchandise Trade (NOV) | -0.60B | -1.96B |

The expansion in business investments paired with the ongoing rise in retail spending may prompt another marked rise in employment, and a positive development may increase the BoC’s scope to lift the benchmark interest rate from 1.00% as the outlook for growth and inflation picks up. However, the slowdown in the housing market along with the deterioration in global trade may push firms to scale back on hiring, and we may see the recent strength in the labor market taper off as the outlook for the world economy remains clouded with high uncertainty.

Potential Price Targets For The Release

As the USDCAD pivots around the 78.6% Fibonacci retracement from the 2007 low to the 2009 high around 0.9910, we should see the long-term triangle continue to take shape, and we may see a move back towards the key figure should the data highlight an improved outlook for the region. However, a dismal development should dampen the appeal of the Canadian dollar as market participants scale back bets for a rate hike, and we may see the dollar-loonie make another run at the 1.0100 figure should the employment report fall short of market expectations.

Projections for another rise in employment casts a bullish outlook for the loonie, and another uptick in employment may pave the way for a long Canadian dollar trade as it fuels bets for higher borrowing costs. Therefore, if the economy adds 5.0K jobs or more in January, we will need a red, five-minute candle following the release to establish a sell entry on two-lots of USDCAD. Once these conditions are met, we will set the initial stop at the nearby swing high or a reasonable distance from the entry, and this risk will generate our first target. The second objective will be based on discretion, and we will move the stop on the second lot to cost once the first trade hits its mark in order to preserve our profits.

On the other hand, the slowdown in global trade along with the slowdown in the housing market may push businesses to scale back on hiring, and a dismal print may dampen the appeal of the loonie as it limits the scope for a rate hike. As a result, if the print misses forecast, we will implement the same strategy for a long dollar-loonie trade as the short position laid out above, just in reserve.

Impact that Canada’s Employment report has had on CAD during the last month

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

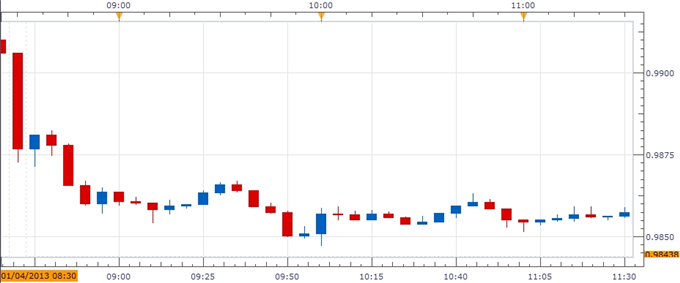

DEC 2012 | 01/04/2013 13:30 GMT | 2.5K | 39.8K | -40 | -32 |

December 2012 Canada Net Change in Employment

Canadian employment increased another 39.8K in December after expanding a revised 56.3K the month prior, while the jobless rate unexpectedly narrowed to 7.1% amid forecasts for a 7.3% print. Indeed, the better-than-expected print propped up the Canadian dollar, with the USDCAD falling back towards the 0.9850 figure, but we saw the pair consolidate during the North American trade as the pair ended the day at 0.9873.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com.

Follow me on Twitter at @DavidJSong

To be added to David's e-mail distribution list, please follow this link.

New to FX? Watch this Video

Questions? Comments? Join us in the DailyFX Forum

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance