S&P 500 posts record close as Wall Street cheers Fed's gradual plan to trim balance sheet

U.S. equities closed higher on Wednesday as investors cheered the Federal Reserve's plan for scaling back its massive $4.5 trillion balance sheet.

The central bank sees a system where it will announce cap limits on how much it will allow to roll off each month without reinvesting , according to the minutes from its May 3 meeting. Any amount it receives in repayments that exceeds the cap limit will be reinvested.

"The Fed provided more clarity here," said Matt Toms, chief investment officer of fixed income at Voya Investment Management. "They're implying the ability to modulate their balance-sheet reduction plan. It shows the Fed is not on auto-pilot and that they can adopt as needed."

The S&P 500 gained 0.25 percent, as real estate led advancers, to post a record close. The Dow Jones industrial average rose about 75 points, with Goldman Sachs contributing the most gains. The Nasdaq composite advanced 0.4 percent.

"Although they indicate that they want to trim the balance sheet, they're not locking themselves into a particular path," said Daniel Deming, managing director at KKM Financial. "That's why the market reacted positively to the minutes.

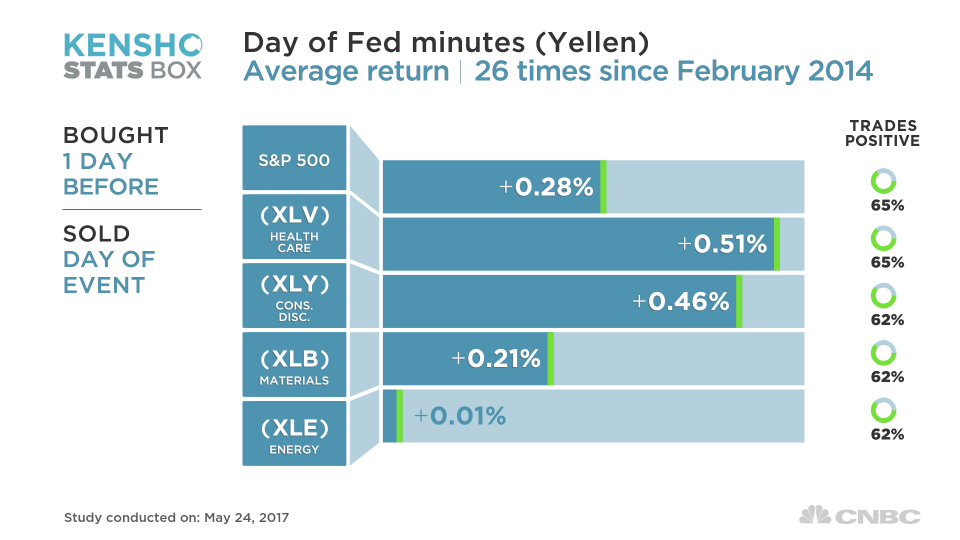

Historically, stocks have mostly posted gains on days when the Fed releases minutes since Janet Yellen became chair, according to Kensho. On average, the S&P 500 has gained 0.28 percent on those days, with health care, consumer discretionary and materials outperforming, Kensho data showed.

The Fed held off on raising rates earlier this month but most investors are expecting the central bank to hike again at its June 14 meeting. Market expectations for a June rate hike are 83.1 percent, according to the CME Group's FedWatch tool.

"The central-bank narrative has changed dramatically over the past few months. It's no longer easy money on the table, but rather a tightening path," said Adam Sarhan, CEO of 50 Park Investments.

Treasury yields fell after the minutes' release, with the benchmark 10-year note yield declined to 2.257 percent while the two-year yield slipped to 1.281 percent.

In other economic news, total mortgage application volume increased 4.4 percent last week on a seasonally adjusted basis from the previous week thanks largely to refinancings. Existing home sales slipped 2.3 percent in April, more than expected.

U.S. equities came into Wednesday's session riding a four-day winning streak, bouncing back from their biggest sell-off of the year. The S&P and the Dow closed above their May 16 closing levels, wiping out last Wednesday's losses.

"There are two pillars in the market right now. First, earnings were good. You can knock it any way you want but the earning season was good," said Phil Blancato, CEO of Ladenburg Thalmann Asset Management. "The second is this ying-yang data. As long as we continue to get mixed data, we will likely stay in this trading range."

Overseas, European stocks traded marginally higher, while Asian equity markets closed mostly higher despite Moody's downgrading China's credit rating for the first time since 1989.

"Bond issuers in the country (many of which have government backing) will pay the price. The mothership helps finance much of the banking and follow-on shadow banking system indirectly, this downgrade will leave a stain," said Larry McDonald, head of the U.S. macro strategies at ACG Analytics and author of The Bear Traps Report newsletter.

The Dow Jones industrial average rose 74.51 points, or 0.36 percent, to close at 21,012.42, with Goldman Sachs leading advancers and General Electric lagging.

The S&P 500 gained 5.97 points, or 0.25 percent, to end at 2,404.39, with materials leading eight sectors higher and telecommunications underperforming.

The Nasdaq advanced 24.31 points, or 0.4 percent, to close at 6,163.02.

About four stocks advanced for every three decliners at the New York Stock Exchange, with an exchange volume of 797.15 million and a composite volume of 3.372 billion at the close.

The CBOE Volatility Index (VIX) , widely considered the best gauge of fear in the market, traded near 9.89, dipping below 10 for the first time since May 10.

—CNBC's Jeff Cox contributed to this report.

Disclosure: CNBC's parent NBCUniversal is a minority investor in Kensho.

On tap this week:

Wednesday

Earnings: HP, Pure Storage

2:00 p.m. FOMC minutes

6:00 p.m. Dallas Fed President Robert Kaplan

Thursday

OPEC meets in Vienna

Earnings: Medtronic, Abercrombie and Fitch, Ulta Beauty, GameStop, Nutanix, Splunk, Best Buy, Hormel Foods, Toronto-Dominion Bank , Royal Bank of Canada

8:30 a.m. Jobless claims

8:30 a.m. Advance econ indicators

4:00 a.m. New York Fed Executive Vice President Simon Potter

10:00 a.m. Fed Gov. Lael Brainard

10:00 p.m. St. Louis Fed President James Bullard

Friday

8:30 a.m. Durable goods

8:30 a.m. Q1 (second read) Real GDP

9:45 a.m. Markit services PMI

10:00 a.m. Consumer sentiment

Yahoo Finance

Yahoo Finance