Will an Upside Surprise to Q1 GDP Quell China Slowdown Fears?

Talking Points:

First Quarter China GDP In-Line with Estimates

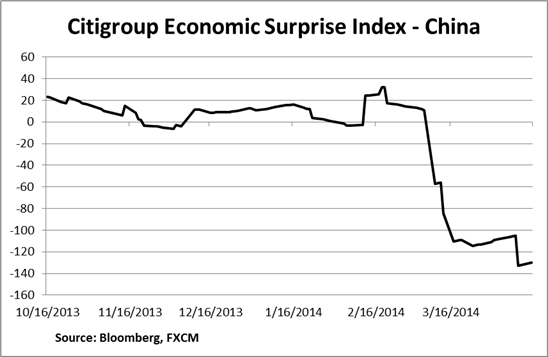

Citigroup Economic Surprise Index Shows Disappointing Chinese Data

Chinese Yuan: A Better Q1 GDP Outcome for Reassurance or Stimulus Motivation?

China’s economy grew an annual 7.4 percent in the first quarter of 2014, and beating analysts’ expectations calling for a print of 7.3 percent. The benchmark growth rate reported at its lowest level in 18-months, and significantly down from 7.7 percent in the previous quarter. China's economic momentum has slowed.

Earlier in the year Chinese Premier Li Keqian warned that the economy faces severe challenges in 2014. Key investment figures, retail sales and factory-sector activity slumped to multi-year lows early in 2014.

Aside from better-than-expected retail sales and growth domestic product the industrial production and fixed investment figures reported worse-than-expected. The recent better-than-expected GDP figure may not be enough to stall fears of an economic slowdown in the world’s second largest economy. For a complete rundown of the Chinese Economic Data visit the DailyFX Economic Calendar.

Figure 1

The recent round of Chinese data has largely been lackluster and the Citigroup Economic Surprise Index for China captures this well (figure 2). The surprise index measures data surprises relative to market expectations, and a negative reading means that data has reported worse-than-expected. Though there was some moderate improvement in March, the question is whether this improvement will deliver a 7.5 percent growth target for the whole year.

Figure 2

-- Written by David Maycotte, DailyFX Research Team. Questions, comments or concerns can be sent to dmaycotte@FXCM.com.

Get Real-Time Feedback on Your Trades withDailyFX on Demand.

Want to trade with proprietary strategies developed by FXCM? Find out how with Mirror Trader.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance