Unveiling 3 Leading Growth Companies In Germany With Up To 35% Insider Ownership

In recent weeks, Germany's market has shown signs of resilience, with the DAX index climbing 2.39%, reflecting a broader European uptick in business activity and investor confidence. In such an environment, growth companies with substantial insider ownership can be particularly compelling, as high insider stakes often align management’s interests with those of shareholders, potentially leading to more prudent and dedicated stewardship amidst fluctuating markets.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Growth Rating |

pferdewetten.de (XTRA:EMH) | 26.8% | ★★★★★★ |

Deutsche Beteiligungs (XTRA:DBAN) | 35.2% | ★★★★★☆ |

init innovation in traffic systems (XTRA:IXX) | 39.7% | ★★★★★☆ |

YOC (XTRA:YOC) | 24.8% | ★★★★★☆ |

Beyond Frames Entertainment (DB:8WP) | 10.9% | ★★★★★☆ |

Alelion Energy Systems (DB:2FZ) | 37.4% | ★★★★★☆ |

Stratec (XTRA:SBS) | 30.9% | ★★★★☆☆ |

HomeToGo (XTRA:HTG) | 11.4% | ★★★★☆☆ |

Friedrich Vorwerk Group (XTRA:VH2) | 18% | ★★★★☆☆ |

elumeo (XTRA:ELB) | 25.8% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Nagarro

Simply Wall St Growth Rating: ★★★★☆☆

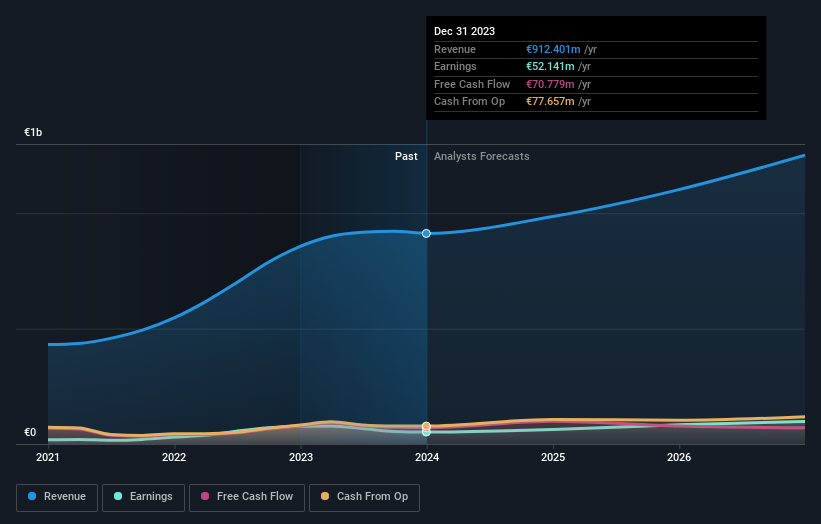

Overview: Nagarro SE operates globally, offering digital product engineering and technology solutions across North America, Central Europe, and other regions, with a market capitalization of approximately €0.94 billion.

Operations: The company generates €912.40 million in revenue from its computer services segment.

Insider Ownership: 12.3%

Nagarro SE, a German growth company with significant insider ownership, is trading at 44.2% below its estimated fair value, suggesting potential undervaluation. The company's revenue is expected to grow by 12% annually, outpacing the German market forecast of 5.5%. However, its profit margins have declined from last year's 9% to 5.7%. Despite high debt levels, Nagarro's Return on Equity is projected to be robust at 26.1% in three years. Recent events include a stock buyback completion and active participation in industry conferences, indicating ongoing strategic initiatives and market engagement.

Delve into the full analysis future growth report here for a deeper understanding of Nagarro.

Our expertly prepared valuation report Nagarro implies its share price may be lower than expected.

Hypoport

Simply Wall St Growth Rating: ★★★★☆☆

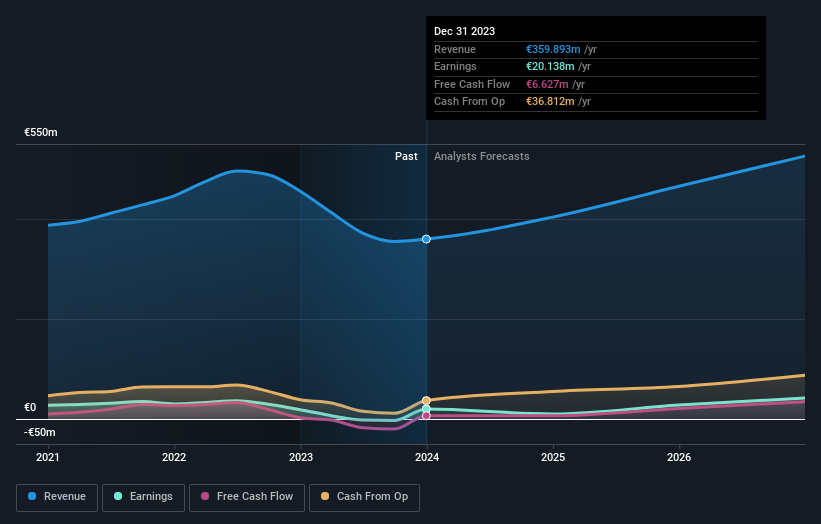

Overview: Hypoport SE is a technology-based financial service provider in Germany, with a market capitalization of approximately €1.65 billion.

Operations: The company generates revenue through its Credit Platform (€156.61 million), Private Clients (€81.92 million), Insurance Platform (€65.37 million), and Real Estate Platform (€57.43 million).

Insider Ownership: 35.1%

Hypoport SE, a German growth company with notable insider ownership, is poised for robust expansion with earnings forecasted to increase by 31.82% annually. Despite this, its Return on Equity is expected to remain low at 10%. Recent financial results show a slight improvement in net income from €18.69 million to €20.14 million year-over-year, with sales decreasing from €455.45 million to €359.89 million. The company continues to focus on strategic growth as evidenced by recent board meetings discussing preliminary business figures.

Stratec

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stratec SE operates in Germany and internationally, designing and manufacturing automation and instrumentation solutions for in-vitro diagnostics and life sciences, with a market cap of approximately €522.10 million.

Operations: The company generates its revenue by designing and manufacturing automation and instrumentation solutions for in-vitro diagnostics and life sciences across Germany, the European Union, and other international markets.

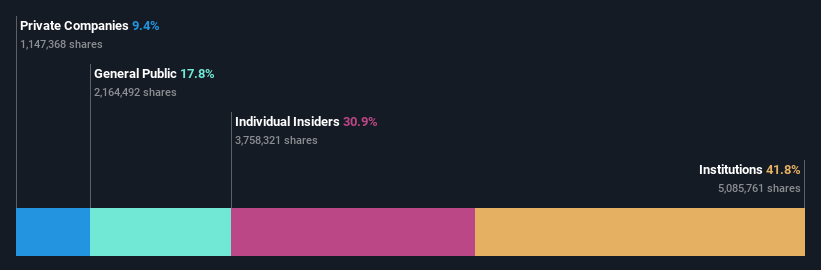

Insider Ownership: 30.9%

Stratec SE, a German company with significant insider ownership, is trading at a substantial discount to its estimated fair value. While its profit margins have declined from last year, earnings are expected to grow by 21.36% annually over the next three years, outpacing the German market's growth. Recent financials reveal a downturn in quarterly and annual sales and net income, alongside a reduced dividend proposal, indicating some operational challenges despite growth prospects.

Where To Now?

Click this link to deep-dive into the 21 companies within our Fast Growing Companies With High Insider Ownership screener.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities.

Companies discussed in this article include DB:NA9 XTRA:HYQ and XTRA:SBS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance