Unlock Steady Income With These 3 Canadian Dividend Stocks Yielding Up To 4.2%

Canada's main stock index recently achieved a new all-time high, buoyed by signs of economic growth and notable gains in the resource sectors, despite mixed performances across other areas. In this climate of decent growth and moderated inflation concerns, dividend stocks emerge as appealing options for investors seeking steady income streams.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

IGM Financial (TSX:IGM) | 6.58% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.92% | ★★★★★★ |

Enghouse Systems (TSX:ENGH) | 3.49% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.82% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 4.08% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 3.66% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 3.96% | ★★★★★☆ |

Goodfellow (TSX:GDL) | 6.60% | ★★★★★☆ |

Acadian Timber (TSX:ADN) | 6.82% | ★★★★★☆ |

Secure Energy Services (TSX:SES) | 3.49% | ★★★★★☆ |

Click here to see the full list of 40 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

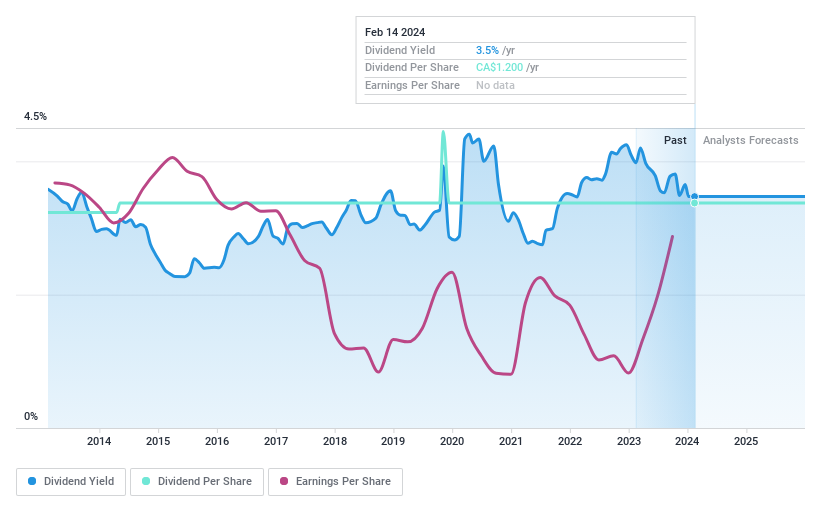

K-Bro Linen (TSX:KBL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: K-Bro Linen Inc. is a company that offers laundry and linen services to healthcare institutions, hotels, and other commercial organizations across Canada and the United Kingdom, with a market capitalization of approximately CA$372.86 million.

Operations: K-Bro Linen Inc. generates CA$320.88 million in revenue primarily from its laundry and linen services catered to the healthcare and hospitality sectors.

Dividend Yield: 3.3%

K-Bro Linen has shown a robust financial performance with sales reaching CAD 320.88 million and net income at CAD 17.61 million for the year ended December 31, 2023, marking significant growth from the previous year. The company sustains its commitment to shareholders through consistent dividend payments, recently affirming a monthly dividend of CAD 0.10 per share, alongside executing a share buyback program, repurchasing shares worth CAD 6.5 million. Despite a lower dividend yield of 3.34% compared to the top Canadian dividend payers and trading below analyst price targets suggesting potential undervaluation, K-Bro's dividends are well-covered by earnings and cash flows with payout ratios of 72.7% and 43.4%, respectively, indicating sustainable shareholder returns amidst expanding operations evidenced by securing a larger credit facility for future growth initiatives.

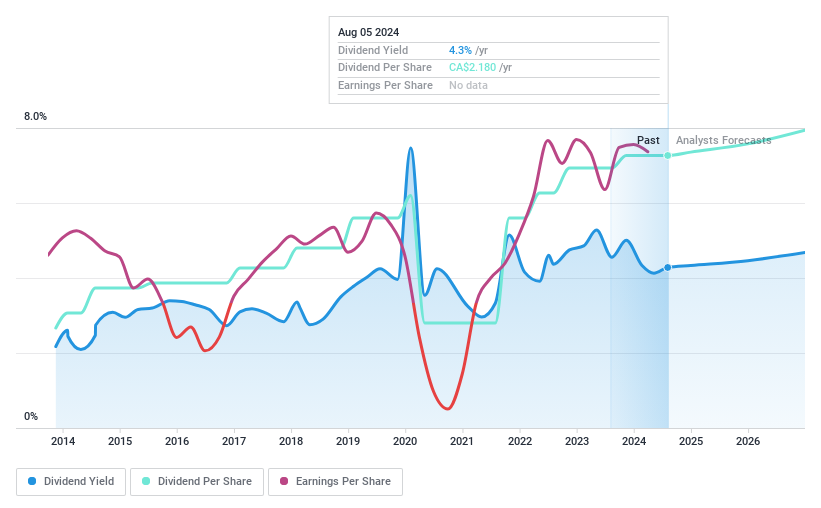

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc. is an integrated energy company with operations in Canada, the United States, and internationally, boasting a market cap of approximately CA$65.17 billion.

Operations: Suncor Energy's revenue streams are primarily from Oil Sands at CA$23.41 billion, Refining and Marketing at CA$31.07 billion, and Exploration and Production contributing CA$2.20 billion.

Dividend Yield: 4.2%

Suncor Energy's dividend sustainability is underscored by a cash payout ratio of 43.8% and an earnings payout ratio of 33.2%, indicating solid coverage by both cash flows and earnings despite its dividend yield of 4.23% being below the Canadian market's top quartile. However, its decade-long history reveals volatility in dividend payments, alongside an unstable track record that raises concerns about reliability. Recent activities include a significant share repurchase program, affirming quarterly dividends at CAD$0.545 per share, amidst facing investor activism challenges regarding environmental commitments and financial transparency on climate transition impacts, potentially affecting future shareholder value propositions.

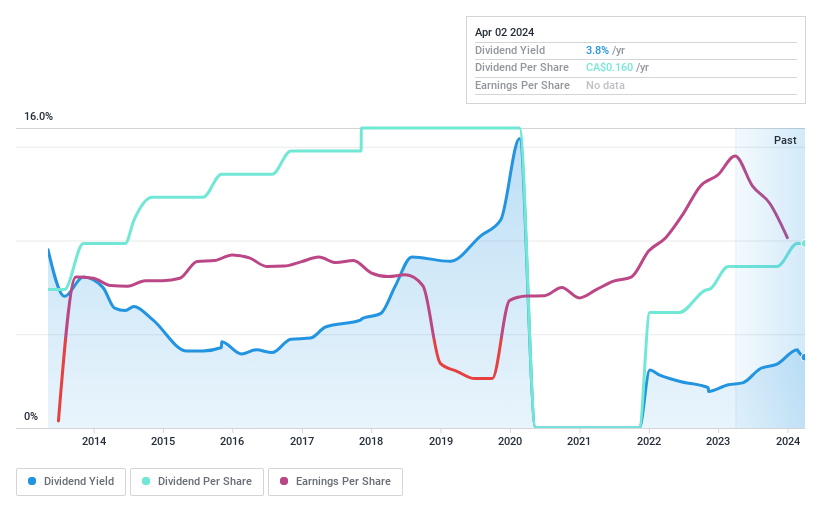

Supremex (TSX:SXP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Supremex Inc. specializes in the manufacturing and marketing of envelopes, paper-based packaging solutions, and specialty products for a diverse clientele including corporations, resellers, government entities, SMEs, direct mailers, and solutions providers mainly in Canada and the United States, with a market capitalization of CA$106.00 million.

Operations: Supremex Inc. generates its revenue from two main segments: envelopes, bringing in CA$213.57 million, and packaging & specialty products, accounting for CA$88.62 million.

Dividend Yield: 3.8%

Supremex Inc. reported a year-over-year increase in sales to CAD 302.19 million and a decrease in net income to CAD 17.33 million, affecting its basic earnings per share which dropped to CAD 0.67 from CAD 1.09 previously. Despite this, the company maintains a conservative payout ratio of 20.9%, ensuring dividends are well-covered by earnings and cash flows, with a recent dividend increase to $0.04 per share demonstrating confidence in financial health amidst a challenging profit margin scenario (5.7% down from last year's 10.4%). However, concerns linger over its high debt levels and the sustainability of its dividend payments given an unstable track record over the past decade and a dividend yield (3.77%) that is below the top tier of Canadian dividend payers (6.34%).

Summing It All Up

Get an in-depth perspective on all 40 Top Dividend Stocks by using our screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore small companies with big growth potential before they take off.

Fuel your portfolio with fast-growing stocks poised for rapid expansion.

Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance