Universal Health (UHS) Q1 Earnings Beat on Rising Patient Days

Universal Health Services, Inc. UHS reported first-quarter 2024 adjusted earnings per share (EPS) of $3.70, which beat the Zacks Consensus Estimate by 17.8%. The bottom line rose 58.1% year over year from the year-ago period.

Net revenues amounted to $3.8 billion in the quarter under review, which rose from $3.5 billion a year ago. The top line outpaced the consensus mark by 2%.

The strong quarterly results of UHS were supported by a growing patient base at its acute care facilities, resulting in substantial contributions from the segment, and increased same-facility-adjusted patient days also contributed positively to the outcomes. However, the upside was partly offset by lower admissions in its behavioral healthcare facilities and rising expenses related to salaries, wages and benefits.

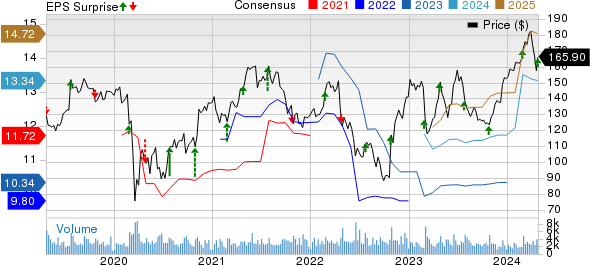

Universal Health Services, Inc. Price, Consensus and EPS Surprise

Universal Health Services, Inc. price-consensus-eps-surprise-chart | Universal Health Services, Inc. Quote

Quarterly Operational Update

Adjusted EBITDA net of NCI rose 24.9% year over year to $525.8 million in the first quarter and came higher than our estimate of $463.1 million.

Total operating costs of $3.5 billion increased 8.3% year over year and came in higher than our estimate of $3.4 billion. The figure rose due to higher salaries, wages and benefits, other operating expenses, supplies costs and lease and rental expenses.

Segmental Update

Acute Care Hospital Services

In the first quarter, adjusted admissions (adjusted for outpatient activity) advanced 4.5% year over year on a same-facility basis. Adjusted patient days rose 3.4% year over year. Net revenues stemming from Universal Health’s acute care services improved 9.6% year over year on a same-facility basis.

Behavioral Health Care Services

Adjusted admissions declined 0.8% year over year on a same-facility basis in the quarter under review. Meanwhile, adjusted patient days increased 2% year over year, lower than our model estimate of 2.4%. On a same-facility basis, net revenues derived from the behavioral healthcare services of UHS increased 10.4% year over year.

Financial Update (as of Mar 31, 2024)

Universal Health exited the first quarter with cash and cash equivalents of $112.1 million, which decreased from $119.4 million at 2023-end. As part of the $1.2 billion revolving credit facility of UHS, net of outstanding borrowings and letters of credit, there remains an aggregate available borrowing capacity of $733 million at the first-quarter end.

Total assets of $14.05 billion inched up from the 2023-end figure of $13.97 billion.

Long-term debt amounted to $4.7 billion, which decreased from $4.8 billion as of Dec 31, 2023. Current maturities of long-term debt totaled $127.5 million.

Total equity increased from the 2023-end level of $6.2 billion to $6.3 billion.

In the first quarter of 2024, UHS generated cash flows from operations of $396.4 million, which increased from the prior-year quarter of $290.8 million. The growth came on the back of higher net income.

Share Repurchase Update

Universal Health bought back shares worth roughly $125.1 million in the first quarter. It had a leftover repurchase capacity of around $298 million as of Mar 31, 2024.

2024 Guidance

Management earlier expected net revenues between $15.411 billion and $15.706 billion for 2024. The midpoint of the outlook implies 8.9% growth from the 2023 reported figure.

Adjusted EBITDA, net of NCI, was estimated to be in the range of $1.931-$2.019 billion. The midpoint of the guidance suggests a 13.4% improvement from the 2023 figure. UHS projects adjusted EPS in the range of $13-$14. The midpoint of the forecast indicates a rise of 28.1% from the 2023 figure.

Depreciation and amortization were anticipated to be $605.2 million. Interest expenses are estimated at around $196.3 million. Capital expenditures are expected to be between $850 million and $1 billion for 2024.

Zacks Rank & Key Picks

Universal Health currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Medical Sector Releases

Of the Medical sector players that have reported first-quarter 2024 results so far, the bottom-line results of UnitedHealth Group Incorporated UNH, Elevance Health, Inc. ELV and Molina Healthcare, Inc. MOH beat the Zacks Consensus Estimate.

UnitedHealth Group reported first-quarter 2024 adjusted EPS of $6.91 per share, which beat the Zacks Consensus Estimate by 4.2%. The bottom line rose 10.4% year over year. Revenues amounted to $99.8 billion, which improved 8.6% year over year in the quarter under review on the back of strong performance in its UnitedHealthcare and Optum business lines. The top line outpaced the consensus mark of $99.2 billion.

Elevance Health reported first-quarter 2024 adjusted EPS of $10.64, which surpassed the Zacks Consensus Estimate by 0.9%. The bottom line climbed 12.5% year over year. Operating revenues rose 0.9% year over year to almost $42.3 billion in the quarter under review. However, the top line missed the consensus mark by 0.4%.

Molina Healthcare reported first-quarter 2024 adjusted EPS of $5.73, which surpassed the Zacks Consensus Estimate by 5%. However, the bottom line declined 1.4% year over year. Operating revenues rose 21.9% year over year to almost $9.9 billion in the quarter under review and outpaced the consensus mark by 4.3%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

UnitedHealth Group Incorporated (UNH) : Free Stock Analysis Report

Universal Health Services, Inc. (UHS) : Free Stock Analysis Report

Molina Healthcare, Inc (MOH) : Free Stock Analysis Report

Elevance Health, Inc. (ELV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance