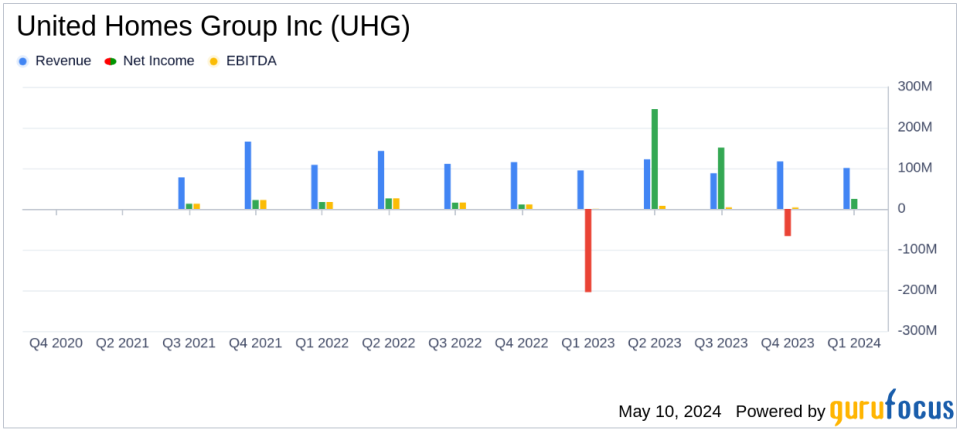

United Homes Group Inc Reports Solid Revenue Growth Amidst Strategic Expansions in Q1 2024

Revenue: $100.8M, up by 6.3% year-over-year from $94.8M.

Net Income: $24.9M, a significant recovery from a net loss of $204.5M in Q1 2023.

Earnings Per Share (EPS): $0.44 per diluted share, compared to a loss of $5.44 per diluted share in the prior year.

Average Sale Price (ASP): Increased to approximately $335,000 from $314,000 in Q1 2023, up 6.7%.

Gross Profit Margin: Reported at 16.0%, down from 17.7% in Q1 2023.

Adjusted Gross Profit Margin: Slightly improved to 20.4% from 20.2% in the previous year.

Adjusted EBITDA: $7.3M, down from $8.5M in Q1 2023.

On May 10, 2024, United Homes Group Inc (NASDAQ:UHG), a prominent homebuilder in the Southeast, disclosed its financial results for the first quarter of 2024 through its 8-K filing. The company reported a substantial recovery with a net income of $24.9 million, a significant turnaround from a net loss of $204.5 million in the same quarter of the previous year. This improvement was primarily attributed to a change in the fair value of derivative liabilities.

Company Overview

United Homes Group Inc operates primarily in South Carolina, North Carolina, and Georgia, focusing on high-quality, affordable homes for the entry-level and first-move-up markets. Employing a land-light strategy, UHG emphasizes partnerships and acquisitions to bolster its market presence and operational efficiency.

Financial Performance Insights

The first quarter saw UHG achieving a revenue of $100.8 million, up from $94.8 million in Q1 2023, driven by an increase in the average sale price of production-built homes from $314,000 to approximately $335,000. Despite a slight decrease in home closings from 328 to 311 year-over-year, the company managed to expand its gross profit margin on an adjusted basis from 20.2% to 20.4%.

However, the gross profit percentage saw a decline from 17.7% to 16.0%, impacted by volatile interest rates and increased costs associated with acquisitions. Selling, general, and administrative expenses as a percentage of revenues were slightly up, standing at 16.9%, including costs related to stock-based compensation and transaction-related expenses.

Strategic Developments and Market Expansion

During the quarter, UHG expanded its operations in the Myrtle Beach market through the acquisition of Creekside Custom Homes, LLC. Additionally, the company entered into a definitive agreement with Developers Capital Fund LLC to create a land fund up to $150 million, enhancing its capacity for future land development.

CEO Michael Nieri highlighted the strategic partnerships aimed at reducing capital and risk associated with land development, allowing UHG to concentrate on its core homebuilding activities. The company's land-light strategy, coupled with favorable market conditions such as low existing home inventory and strong employment trends, supports its growth trajectory despite challenges posed by interest rate volatility.

Operational and Financial Metrics

UHG reported a robust liquidity position with $92.0 million available as of March 31, 2024, comprising cash and undrawn revolver capacity. This financial stability supports UHG's strategic initiatives and operational needs. The company's adjusted EBITDA for the quarter was $7.3 million, slightly down from $8.5 million in the prior year's quarter, reflecting the competitive and economic pressures on operational efficiency.

Conclusion

United Homes Group Inc's first quarter of 2024 reflects a period of strategic realignment and recovery. With a focus on expanding its geographic footprint and enhancing operational efficiencies through strategic acquisitions and partnerships, UHG is poised to capitalize on the growing demand in its key markets. The company's ability to navigate economic uncertainties and leverage its land-light strategy underscores its potential for sustained growth in the competitive homebuilding market.

For detailed financial figures and further information, refer to UHG's full earnings release and financial statements available on their SEC filings.

Explore the complete 8-K earnings release (here) from United Homes Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance