Under Armour just announced another round of layoffs (UAA)

J. Meric/Getty Images

Under Armour on Thursday announced an update to its massive, $200 million restructuring effort.

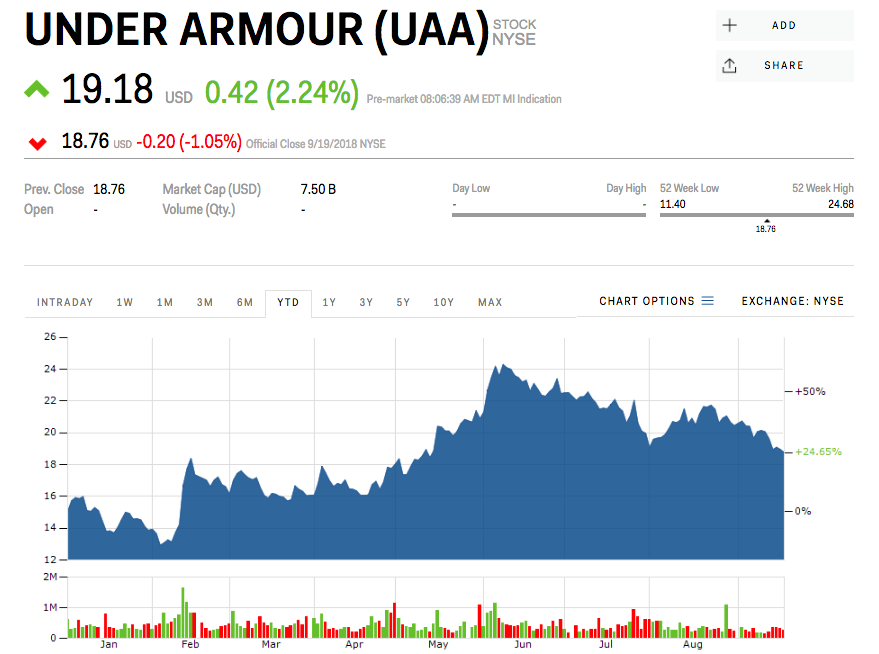

Shares fell about 1% after the company said it will spend $10 million to cull its workforce by 3%.

Under Armour said Thursday that it will spend $10 million on severance payments not previously reported as it works to reduce its global workforce by 3%, or about 400 jonbs.

It’s the second round of layoffs in the past year for the struggling athletic brand, which cut about 140 jobs at its Baltimore headquarters last August, when it first announced the $200 million restructuring plan. The layoffs should be completed by the end of the first quarter of 2019 (March 31, 2019), it said.

"In our relentless pursuit of running a more operationally excellent company, we continue to make difficult decisions to ensure we are best positioned to succeed," David Bergman, Under Armour's chief financial officer, said in a press release. "This redesign will help simplify the organization for smarter, faster execution, capture additional cost efficiencies, and shift resources to drive greater operating leverage as we move into 2019 and beyond."

Under Armour also said its operating loss for the full year of 2018 will be approximately $60 million. It had previously forecast a range between $50 million and $60 million. Adjusted operating income could be slightly higher, between $140 million and $160 million, where the previous window had been between $130 million and $160 million.

"Bulls see UAA undergoing a transformation to become a better operator to go along with its strong brand," Jay Sole, an analyst at UBS, said following the first round of layoffs and second-quarter earnings. "By doing so, bulls think UAA can drive much better EBIT margin over time."

Shares of the company fell about 1% in early trading following the announcement, but closed up more than 6% when the trading session had ended Thursday. That's likely because most of the bad news has already been priced into the stock, Sole said.

"The last two years have shown, in our view, it takes nothing less than large misses to get the stock to drop significantly," he continued.

Markets Insider

NOW WATCH: Why horseshoe crab blood is so expensive

See Also:

SEE ALSO: Under Armour is facing an identity crisis that could throw the company's turnaround into a tailspin

Yahoo Finance

Yahoo Finance