Ultragenyx (RARE) to Seek Accelerated Nod for Rare Disease Drug

Ultragenyx Pharmaceutical Inc. RARE announced that it is planning to seek accelerated approval for its AAV gene therapy candidate UX111, which is being developed for the treatment of Sanfilippo syndrome type A (MPS IIIA), after a successful meeting with the FDA.

At the meeting, the company reached an agreement with the regulatory body to submit a biologics license application (BLA) seeking accelerated approval for UX111 using heparan sulfate (HS) in the cerebrospinal fluid (CSF) as a surrogate endpoint.

The company will finalize the details of the above BLA and discuss the same in a pre-BLA meeting with the FDA. The BLA is likely to be filed in late 2024 or early next year.

RARE gained the FDA alignment on using CSF HS as a relevant biomarker to enable accelerated approval for UX111 in Sanfilippo syndrome.

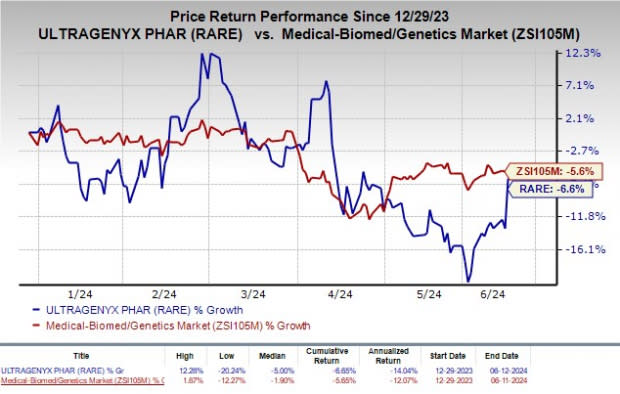

Shares of Ultragenyx have lost 6.6% so far this year compared with the industry’s decline of 5.6%.

Image Source: Zacks Investment Research

The BLA for UX111 will be based on the data from the ongoing pivotal Transpher A study, which is evaluating the safety and efficacy of UX111 in children with MPS IIIA, a rare central nervous system disorder.

UX111 is designed to treat the underlying sulfamidase (SGSH) enzyme deficiency, which is responsible for the abnormal accumulation of HS in the brain that leads to progressive cell damage and neurodegeneration in children with MPS IIIA.

In February, Ultragenyx announced positive data from the modified intention to treat group (mITT) in the Transpher A study.

The data from the study showed that treatment with UX111 resulted in rapid and sustained decreases in levels of HS in CSF in patients with MPS IIIA.

It was also observed that sustained reduction in CSF HS exposure over time was correlated with improved long-term cognitive development. Fifteen out of the seventeen patients treated with UX111 in the mITT group had both a reduction in toxic CSF HS exposure and an improvement in cognitive function.

Zacks Rank & Stocks to Consider

Ultragenyx currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the healthcare sector are Acrivon Therapeutics, Inc. ACRV, Aligos Therapeutics, Inc. ALGS and Minerva Neurosciences, Inc. NERV, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for Acrivon Therapeutics’ 2024 loss per share have narrowed from $3.42 to $2.47. Loss per share estimates for 2025 have narrowed from $3.36 to $2.55. Year to date, shares of ACRV have surged 53.4%.

ACRV’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining one occasion, the average surprise being 3.56%.

In the past 60 days, estimates for Aligos Therapeutics’ 2024 loss per share have narrowed from 84 cents to 73 cents, while loss per share estimates for 2025 have narrowed from 82 cents to 71 cents. Year to date, shares of ALGS have plunged 23.2%.

ALGS’s earnings beat estimates in three of the trailing four quarters and missed the same on the remaining occasion, the average surprise being 7.83%.

In the past 60 days, estimates for Minerva Neurosciences’ 2024 loss per share have narrowed from $3.57 to $1.89. Loss per share estimates for 2025 have narrowed from $4.54 to $3.60. Year to date, shares of NERV have declined 47.6%.

NERV’s earnings beat estimates in one of the trailing four quarters while missing the same on the remaining three occasions, the average negative surprise being 54.43%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ultragenyx Pharmaceutical Inc. (RARE) : Free Stock Analysis Report

Minerva Neurosciences, Inc (NERV) : Free Stock Analysis Report

Aligos Therapeutics, Inc. (ALGS) : Free Stock Analysis Report

Acrivon Therapeutics, Inc. (ACRV) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance