The Ultimate CPF Guide 2022: Contributions, Interest Rates, Minimum Sums & Calculators

Can you really say that you know where your money goes every month? If you don’t understand what’s happening to that precious chunk of your salary that goes into your CPF accounts through CPF contributions, never to be seen again, then the answer is no.

But not to worry, understanding how CPF works is tedious, but it isn’t rocket science. And by the end of this article you’ll know how much of your money is going into your CPF accounts, what’s happening to it and what you can do with it.

Contents

What is CPF and why do we have it?

The Central Provident Fund, or CPF, was set up to play one of the most important functions in Singapore’s social security system.

The main purpose of CPF is to ensure that Singaporeans have enough money for retirement, to pay for medical bills when they fall ill, and to buy a home with.

And one of the chief ways these goals are achieved is by forcing people to put away a percentage of their income every month in CPF accounts set up for these purposes.

That’s why, if you’re an employee, your take-home pay is lower than your official salary. A percentage of your salary is automatically deducted as CPF contributions every month and deposited into your CPF accounts.

The rationale is that if Singaporeans weren’t forced to save money in their CPF accounts, some people would spend all their money and then be in trouble when the time came to pay for their retirement or medical bills. CPF also ensures that the home ownership rate in Singpaore continues to be relatively high, since it can only be used to pay for home purchases and not rent.

The Central Provident Fund (CPF) is a mandatory savings scheme for Singaporeans. A percentage of your income is put away as CPF contributions or “forced savings” every month. What is CPF and why do we have it? CPF Contribution Take-home pay What can I use it for? Retirement Medical Bills Buy a home

What are the CPF contribution rates in 2022 for Singaporean employees/employers?

For salaried employees, CPF contributions are made automatically.

Every month, when paying out your salary, your employer is required to withhold the portion of your pay that needs to go into your CPF accounts. That portion will be paid into your CPF accounts as your employee’s contribution.

In addition to the employee’s contribution, there is also an employer’s contribution. This is the amount your employer is required to pay into your CPF accounts out of their own pocket, above and beyond your stipulated salary.

From 1 January 2022, total CPF contribution rates for ages 55 and above will be increased. Here’s how much (by percentage of your wage) each person contributes:

Age of employee | CPF contribution by employer | CPF contribution by employee | Total CPF contribution rate |

Up to 55 years old | 17% | 20% | 37% |

55 to 60 years old | 14% | 14% | 28% |

60 to 65 years old | 10% | 8.5% | 18.5% |

65 to 70 years old | 8% | 6% | 14% |

Above 70 years old | 7.5% | 5% | 12.5% |

Note on CPF contributions for 55 & above: Over the next 10 years, CPF contributions for older workers will be gradually adjusted upwards to meet the full contribution rate of 37% (employee + employer). According to the Budget 2022, CPF contribution rate for 60 to 65-year-olds will be increased to 20.5% from January 2023 onwards.

By the way, if you’re self-employed, none of the above applies to you. Any CPF contributions are voluntary EXCEPT Medisave contributions, which you’ll be prompted to pay after filing your taxes each year.

Example

Let’s say you are a 30-year-old earning a monthly salary of $5,000.

Every month, your employee’s contribution to CPF will be 20% of your wage. That means that $1,000 will be deducted from your salary every month and deposited into your CPF accounts.

Your take-home pay after CPF deductions is thus $4,000.

In addition, your employer is forced to make an employer’s contribution to your CPF accounts worth 17% of your salary, which adds up to $850. This is in addition to the $5,000 salary he’s paying every month.

The total amount of CPF contributions going into your account every month is thus $1,850.

She is 30 years old and has a monthly salary of $5,000 Meet Sara. Every month, She takes home $4,000 (80% of $5,000) goes to her CPF accounts $1,000 (20% of $5,000) Her employer contributes an additional $850 (17% of $5,000) Sara gets a total of $1,850 in CPF savings each month.

What is the CPF contribution cap for employees?

Did you know there’s a limit to how much you can contribute to your CPF accounts each month? This is known as the CPF Wage Ceiling which is a form of CPF contribution cap. There are two parts to this: the Ordinary Wage Ceiling and the Additional Wage Ceiling.

The Ordinary Wage Ceiling is a CPF contribution cap on your monthly salary and is currently capped at $6,000. This means that the first $6,000 of your monthly salary is subject to CPF contributions. Any amount above that won’t have a portion deducted for CPF. It also means your employer doesn’t need to contribute to your CPF account for amounts above $6,000.

The Additional Wage Ceiling is a CPF contribution cap on your additional wages, such as your bonuses. The formula for calculating the Additional Wage Ceiling is $102,000 – Ordinary Wages subject to CPF for the year.

So for example, say you earn $7,500 a month, and earn an annual bonus of $15,000. Only the first $6,000 of your monthly income will be subject to CPF contributions. As for your annual bonus, the Additional Wage Ceiling is $102,000 – $6,000 x 12 = $30,000. This means that your entire annual bonus is also subject to CPF contributions as it is below the CPF contribution cap.

is the max. amount subject to CPF $ 30,000 Additional Wage Ceiling $ 7,500 a month Let’s figure out your CPF contribution caps: $ 15,000 in a year Your Salary Your Bonus Ordinary Wage Ceiling This is a CPF contribution cap on your monthly salary . $ 7,500 $ 6,000 How this applies to you: will be subject to CPF Contributions $ 6,000 This is a CPF contribution cap that applies to your additional wages , like bonuses. – Ordinary Wages subject to CPF for the year max. will not be touched by CPF $ 1,500 $ 102,000 Additional Wage ceiling = How this applies to you: – $ 72,000 ($6,000 × 12) $ 102,000 = $ 30,000 Your Additional Wage ceiling is is your bonus for the year $ 15,000 Your annual bonus is less than the cap. This means that your entire annual bonus will be subject to CPF contributions. If you earn $7,500 a month,

What CPF accounts do you have?

All Singaporeans and PRs have the following CPF accounts, which are opened to contain money for several purposes:

CPF account | What you can use it for |

Ordinary Account (OA) | Can be used for housing, higher education, and investing. Anything left over is to be used for retirement. |

Special Account (SA) | To be saved for retirement. Can also be invested to a certain degree. |

Medisave Account (MA) | To pay for hospitalisation, other approved medical expenses and to pay for MediShield / Integrated Shield plans. |

Retirement Account (RA) | You only get an RA when you turn 55. At that age, your OA and SA will merge to form your RA, which will contain your retirement savings. |

Ordinary Account (OA) Used to pay for: • Housing • Education • Some investments Special Account (SA) Used to pay for: • Some investments Medisave Account Used to pay for: • Healthcare and medical bills • Premiums for some types of insurance After you turn 55 After you turn 55, your OA and SA will merge to form your retirement account, with the money to be used as retirement income Retirement Account (RA)

What are the monthly CPF allocation rates in 2022 for these accounts?

By now you should already have a rough idea of how much money goes into your CPF accounts every month.

Once the money is paid into CPF, it is divided between your various accounts in the following way, as long as your monthly wages are $750 and above. The amounts here refer to the percentage of your pay:

Age of employee | CPF allocation for Ordinary Account | CPF allocation for Special Account | CPF allocation for Medisave |

Up to 35 years old | 23.0% | 6.0% | 8.0% |

35 to 45 years old | 21.0% | 7.0% | 9.0% |

45 to 50 years old | 19.0% | 8.0% | 10.0% |

50 to 55 years old | 15.0% | 11.5% | 10.5% |

55 to 60 years old | 12.0% | 5.5% | 10.5% |

60 to 65 years old | 3.5% | 4.5% | 10.5% |

65 to 70 years old | 1.0% | 2.5% | 10.5% |

Above 70 years old | 1.0% | 1.0% | 10.5% |

From 1 January 2022, changes for CPF allocation include a heavier weightage for MediSave for ages 55 and upwards. Also, you’ll notice the inclusion of a brand new “Above 70 years old” age bracket… which is pretty sad, right?

Anyway, when you’re young and strong, more money goes into your OA, and less into your Medisave account, since you’re presumably more likely to need your OA money to buy housing and less likely to fall seriously ill.

However, as you get older, the allocation rates evolve. More money starts going into your SA in order to prepare you for retirement, as well as your Medisave account, since your healthcare needs are likely to rise.

But once you hit the age of 55, your OA and SA contribution rates fall, since you’ve (hopefully) accumulated enough for retirement. Your Medisave contributions continue to remain high since you’re now older and frailer.

Priorities Age Building a life Preparing for retirement Medical needs Ordinary Account Medisave Special Account

When can you use the money in your CPF accounts?

While there is no hard and fast rule as to how to get utility of your CPF accounts before you retire, here are some common ways Singaporeans use that painstakingly-saved cash.

Using the money in your OA to buy a home: Whether you’re looking for an HDB home or forking out the cash for private property, you can use the money in your OA to pay for part of your property, subject to withdrawal limits and the compulsory cash portion that must be paid. You can also use the money in your OA to make your monthly home loan repayments. You can also get CPF Housing Grants to help defray the cost of your property if you meet certain criteria.

Using the money in your OA to pay for education: The CPF Education Scheme lets you use the money to pay for your or a family member’s tuition fees if taking a full-time subsidised diploma or degree course at local unis, polys or ITEs.

Using the money in your OA and SA to invest: The CPF Investment Scheme lets you use some of the money in your OA and SA for certain investments like shares, Unit Trusts, investment-linked insurance, Singapore Government Bonds and ETFs. Of course, there’s no guarantee that you’ll be able to beat CPF’s interest rates.

Using the money in your Medisave account to buy an Integrated Shield plan: Integrated Shield plans, which are private health insurance plans meant to boost your MediShield Life, is highly recommended if you can afford it. Part of the premiums can be paid for with Medisave.

Housing Ordinary Account • Pay for a portion of your property • Pay for monthly home loan repayments • Get CPF Housing Grants You can… Education Ordinary Account • Pay for your or a family member’s tuition fees You can… Invest • Use your OA and SA for certain investments You can… Ordinary Account Special Account Insurance • Pay a part of your Integrated Shield Plan premiums You can… Medisave

What is the CPF Retirement Sum and how does it affect you?

You’ve probably heard mutterings about this evil thing called the CPF Retirement Sum, and how it’s getting higher every year. It used to be called the CPF Minimum Sum, which both upset and confused Singaporeans, and so the decision was made to rename it to the CPF Retirement Sum.

But what the heck is it really, and how does it affect you?

First, you have to understand the two main retirement payout programmes available.

The older CPF Retirement Sum Scheme requires you to have a minimum amount in your CPF accounts when you retire, to ensure you receive monthly payouts that can support a basic standard of living. How much you get each month depends on how much you have in your RA.

The newer CPF LIFE (Lifelong Income For The Elderly) scheme will give you monthly payouts for the rest of your life. So you don’t have to worry about outliving your CPF savings if you become immortal… so long as you are able to accumulate enough before starting your payouts.

Singaporeans will be automatically enrolled in CPF LIFE, as long as they fulfil the following conditions:

Factor | Automatically enrolled in CPF LIFE? |

Citizenship | Singapore citizen or PR |

Birth year | 1958 or after |

CPF RA balance | $60,000 (6 months before payout eligibility age) |

Those who are older or who don’t satisfy the RA requirements can apply to join the CPF LIFE scheme if they wish by logging into the my cpf Online Services website using their Singpass and sending an online application.

You can choose to start receiving your monthly payouts between the ages of 65 and 70.

What is the Retirement Sum and how does it affect you? There are two retirement payout programmes: Retirement Sum Scheme CPF LIFE You’ll receive a monthly payout to support a basic standard of living during retirement. You get payouts only until your Retirement Account balance is depleted . You choose a Retirement Sum to meet — this will determine how much you get in monthly payouts. CPF LIFE will give you monthly retirement payouts for the rest of your life . So, how do I get in on CPF LIFE ? You don’t choose the CPF Life, the CPF Life chooses you. You are automatically enrolled if: You are a Singapore Citizen or Permanent Resident born in 1958 or after. AND Depending on when you turn 55 , you have the following balance in your Retirement Account Take note If you’re older OR don’t satisfy the RA requirements, you will have to apply to join the CPF LIFE scheme ! 1 Jan 2013 30 Apr 2016 $ 40,000 At least in your RA when you reach 55 years old OR $ 60,000 At least in your RA 6 months before you reach your payout eligibility age $ 60,000 At least in your RA 6 months before you reach your payout eligibility age 1 May 2016 onwards

What are the retirement payouts under CPF LIFE Scheme?

When you turn 55, your OA and SA will merge to form your RA. You will be able to withdraw a lump sum, leaving the Retirement Sum behind in your RA to form your retirement income.

As you can probably imagine, the rising cost of living makes it necessary to raise the CPF Retirement Sums every year. Here are the CPF Retirement Sums from 2016 to 2022. CPF has not published any Retirement Sums beyond that yet.

Year of 55th birthday | Basic Retirement Sum | Full Retirement Sum | Enhanced Retirement Sum |

2016 | $80,500 | $161,000 | $241,500 |

2017 | $83,000 | $166,000 | $249,000 |

2018 | $85,500 | $171,000 | $256,500 |

2019 | $88,000 | $176,000 | $264,000 |

2020 | $90,500 | $181,000 | $271,500 |

2021 | $93,000 | $186,000 | $279,000 |

2022 | $96,000 | $192,000 | $288,000 |

Your monthly payouts when you turn 65 will depend on whether the amount you’ve managed to accumulate in your RA meets the Basic, Full or Enhanced Retirement Sum (whichever is highest).

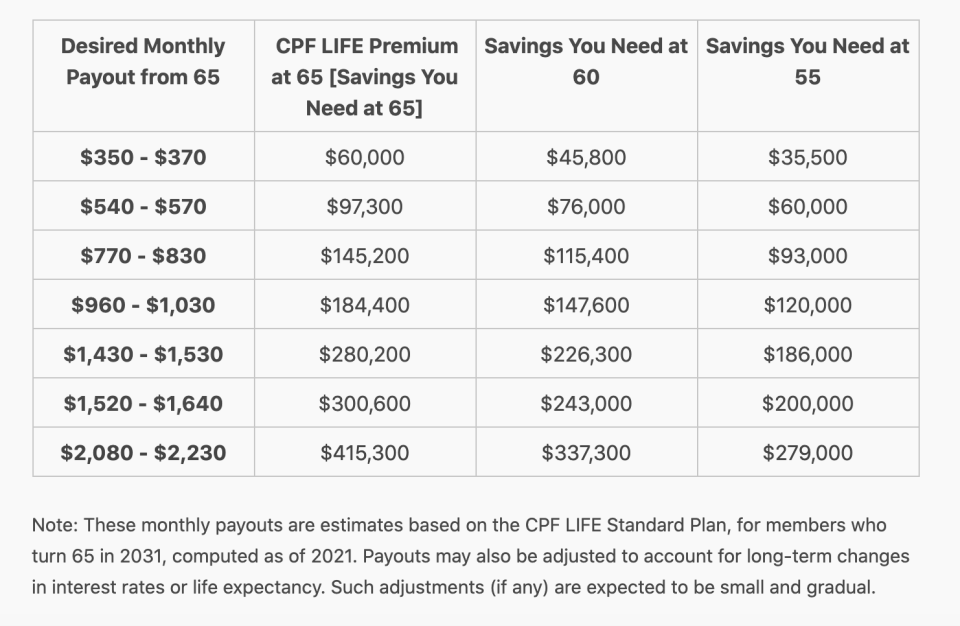

Here’s a screenshot from the CPF website with some indicative payouts for different retirement savings amounts. These payouts will continue all your life, even if end up living a crazy long life and your account technically runs out of money.

Now, how much of your money do you actually get to withdraw in a lump sum when you turn 55?

Under normal circumstances, you will be required to leave at least the Full Retirement Sum in your CPF. You can withdraw the rest if you wish.

If your savings fall below this amount, your property can count towards the Full Retirement Sum (although you will need to meet the Basic Retirement Sum in CPF savings).

Regardless of which sum applies and how much excess you have, you’re allowed to withdraw at least $5,000 at age 55.

How can I start getting money from the CPF LIFE scheme? You can choose to start receiving your monthly payouts between the ages of Here’s what happens: Age 55 65-70 1 Your OA and SA will merge to form your RA Special Account (SA) Retirement Account (RA) Ordinary Account (OA) 2 Choose a Retirement Sum Basic Full Enhanced Pick from 3 types of Retirement Sums. The Full and Enhanced Retirement Sums are simply multiples of the Basic Sum 3 You can withdraw a lump sum If you meet the Full Retirement Sum , Max. Lump sum amount Full Retirement Sum Retirement Account If you meet the Basic Retirement Sum , and put a CPF property charge on your property, Max. Lump sum amount = Basic Retirement Sum – Retirement Account If you meet the Enhanced Retirement Sum , Max. Lump sum amount Enhanced Retirement Sum Retirement Account Take note If you sell your property, you’ll need to pay back the pledged amount , along with any CPF money used with interest back into your CPF RA. ! Smart Tip! You can choose to leave more in your Retirement Account for bigger payouts! Age 65 You can start receiving payouts depending on which Retirement Sum you’ve chosen. Payouts will continue even after your account runs out of money. Take note If you don’t meet the Basic Retirement Sum, your monthly retirement payouts will be pro-rated based on how much you have. !

What is the CPF interest rate?

As you might know, leaving your cash in a bank account means that its value will get eroded over time, since bank account interest rates tend to be so pathetic that they probably can’t effectively hedge against inflation.

The money in your CPF accounts earns interest, too, but thankfully at much better rates than your typical bank account. At the moment, the interest rates are as follows:

Account name | Current interest rate |

Ordinary Account | 2.5% |

Special Account | 4% |

Medisave Account | 4% |

Retirement Account | 4% |

As you can see, your SA offers a much higher interest rate than the OA.

There is one way to get a much better interest rate on your OA savings, and that is to transfer money from your OA into your SA.

The catch, obviously, is that once your money goes into your SA, there is no going back. You can’t transfer it back into your OA, and as you can’t use the money in your SA to buy property or pay for education, the chief purpose of that money can only be for retirement.

So before making any transfers from OA to SA, make sure you absolutely do not need the money for housing or education.

You can also earn an extra 1% interest on the first $60,000 of your account balances (with up to $20,000 from your OA). If you are aged 55 and above, you can earn an additional 1% interest on the first $30,000 of your account balance (with up to $20,000 from your OA). This is basically to encourage you to keep your money in your CPF account, and to maximise it by leaving it in your SA or RA.

Just in case you’re thinking of gaming your CPF contribution and earning loads of interest, note that there is an Annual Limit to how much you can contribute. The maximum CPF contribution is known as the Annual Limit, and is currently set at $37,740.

How to make CPF nominations

That cash in your CPF accounts is your money, you say. So when you die, you should be able to will it to whomever you like, right?

Well, here’s news for you: the money in your CPF account cannot be distributed through a will. So even if you write a beautiful will bequeathing all your assets to the SPCA, it will not apply to your CPF savings.

To work around that, the CPF Nomination Scheme lets you specify who will receive your CPF savings when you die, and how much.

To make a nomination, you simply have to submit a CPF Nomination Form with all the necessary supporting documents. It can be submitted in person at a CPF Service Centre after booking an appointment, or by post.

Don’t panic; your CPF money won’t vanish if you didn’t make a nomination. The Public Trustee’s Office will distribute your money to your next-of-kin (according to the law of intestacy). However, the Office will charge a fee for this administrative work.

CPF Calculators

Still not sure how much CPF money you should be receiving or how much you can use?

These CPF calculators do the job for you.

CPF Contribution Calculator for Singapore citizens and PRs in their 3rd year and onwards – Check how much your CPF contributions are supposed to be.

CPF LIFE Payout Estimator – If you’re at least 40 years old (born in 1981 or earlier), estimate how much you can receive in monthly retirement payouts.

CPF Housing Withdrawal Limits Calculator – Find out how much you can use to pay for your home.

Self-Employed Medisave Contribution Calculator – For self-employed folks to check how much they need to fork out for Medisave.

CPF Retirement Calculator — Figure out if you’re on track for the retirement lifestyle you want with this simple financial planning calculator.

How to contact CPF

If you have any problems, it’s easy to get in touch with CPF online.

Through MyCPF: Use your Singpass to log into the my cpf Online Services portal. From there, you can access information about your CPF account including your account balance, and if you have any questions, you can submit a query via “My Mailbox”.

Submit webform: Alternatively you can submit an enquiry via the webform here.

CPF hotline: Call 1800-227-1188 (if you’re calling from Singapore) or +65-6227-1188 (if you’re calling from overseas). CPF’s phone line operates from Mon to Fri from 8am to 5.30pm.

Visit in person: If all else fails, you can make an appointment to visit the CPF Service Centres in Tanjong Pagar, Bishan, Tampines, Jurong or Woodlands. Note that services for employers and self-employed are not available at the service centres.

Found this article useful? Share it with anyone else who needs to understand CPF.

The post The Ultimate CPF Guide 2022: Contributions, Interest Rates, Minimum Sums & Calculators appeared first on the MoneySmart blog.

MoneySmart.sg helps you maximize your money. Like us on Facebook to keep up to date with our latest news and articles.

Compare and shop for the best deals on Loans, Insurance and Credit Cards on our site now!

The post The Ultimate CPF Guide 2022: Contributions, Interest Rates, Minimum Sums & Calculators appeared first on MoneySmart.sg.

Original article: The Ultimate CPF Guide 2022: Contributions, Interest Rates, Minimum Sums & Calculators.

© 2009-2018 Catapult Ventures Pte Ltd. All rights reserved.

Yahoo Finance

Yahoo Finance