UBS: In 2017, the 'slayer of bull markets' will remain at bay

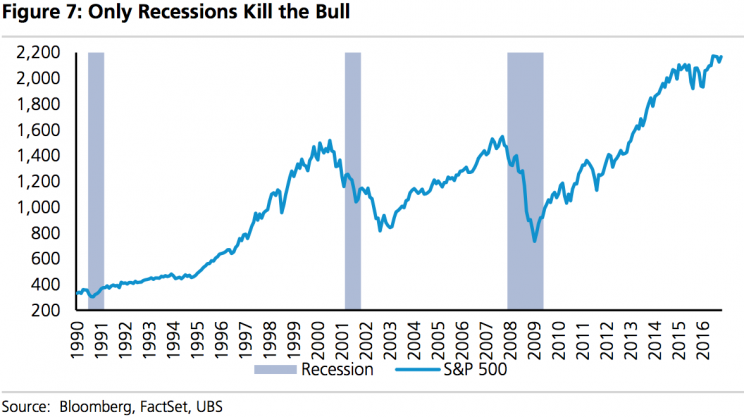

The S&P 500 (^GSPC) is within points of its all-time high. This comes as the bull market in stocks — the second longest bull market ever — is well into its seventh year.

“Age alone does not end the Bull,” UBS’s Julian Emanuel said on Friday. “We expect US equities to be buoyed by the broad health of corporate balances sheets and the prospect for solid economic growth driving improved corporate earnings.”

In a research note outlining his outlook for 2017, Emanuel said he expected the S&P 500 to reach 2,300 by the end of the year on earnings per share of $126.

The “Slayer of Bull markets” remains at bay

Critical to Emanuel’s call is the assumption that the US economy avoids recession for years to come. He characterizes recessions as the “slayer of bull markets.”

President-elect Donald Trump will inherit a robust economy. Some warn that he’s doomed to oversee the next recession.

However, Emanuel’s colleague, economist Drew Matus, sees a durable and resilient US economy, which will grow 2.4% in 2017 and 2.5% in 2018.

“The expansion is likely to persist as the lack of any obvious significant imbalances in the economy suggests it would take a sustained shock of significant proportions to push the economy into a recession,” Matus said Wednesday. “Consider that the past two recessions took either an ongoing pattern of moderate shocks (2001) or the near collapse of the financial system (2008). It is difficult to see what would drive either possibility given the current state of the US economy, in particular, the health of the US consumer.”

With Trump on his way to the White House, Wall Street’s strategists have concluded that the stock market can expect more good news than bad.

“While there are a lot of unknowns, it seems reasonable to conclude that regulation is more likely to decrease than increase and stimulus (i.e., fiscal expansion) is likely to be a key theme under the incoming Administration – both supportive for overall growth,” Emanuel said.

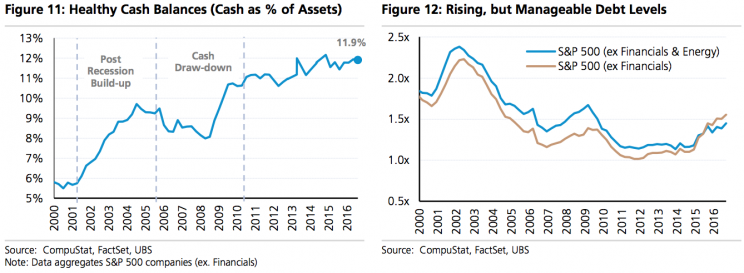

In addition to this favorable business backdrop, big companies have financial flexibility. Emanuel notes that cash levels are elevated and debt levels are manageable.

Emanuel joins his Wall Street peers in forecasting very modest gains for the stock market in 2017. JPMorgan’s Dubravko Lakos-Bujas sees the S&P climbing to 2,300 early next year. Citi’s Tobias Levkovich sees the S&P reaching 2,250 by mid-2017 and 2,325 by year end. Goldman Sachs’ David Kostin sees the S&P sliding to 2,100 this year before topping out at 2,200 next year. Deutsche Bank’s David Bianco is the bull of the bunch, calling for the S&P to rally to 2,350.

–

Sam Ro is managing editor at Yahoo Finance.

Read more:

Yahoo Finance

Yahoo Finance