Uber Technologies Inc (UBER) Q1 2024 Earnings: Surpasses Revenue Estimates with Robust Growth

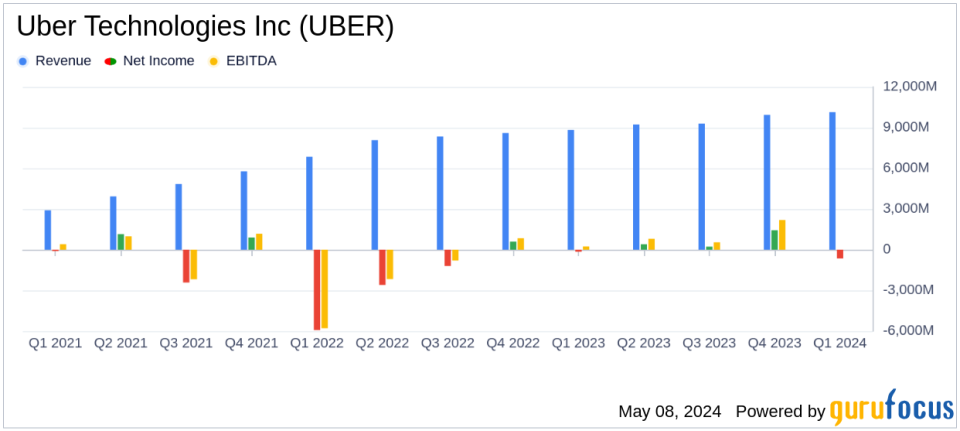

Revenue: Reported at $10.1 billion, marking a 15% increase year-over-year, aligning with estimates of $10,112.14 million.

Net Loss: Recorded a net loss of $654 million, including significant unrealized losses from equity investments, contradicting the estimated net income of $503.10 million.

Adjusted EBITDA: Achieved $1.4 billion, an 82% surge from the previous year, demonstrating strong profitability improvements.

Free Cash Flow: Generated $1.4 billion, indicating robust operational efficiency and cash generation capabilities.

Gross Bookings: Grew by 20% year-over-year to $37.7 billion, driven by a 25% increase in Mobility Gross Bookings and an 18% rise in Delivery Gross Bookings.

Trips: Increased by 21% year-over-year to 2.6 billion, reflecting continued growth in platform engagement and usage.

Monthly Active Platform Consumers (MAPCs): Expanded by 15% year-over-year to 149 million, showcasing growing consumer adoption and platform reach.

On May 8, 2024, Uber Technologies Inc (NYSE:UBER) disclosed its financial results for the first quarter of 2024, revealing significant growth and operational achievements. The company's detailed performance was outlined in its 8-K filing. Uber, known for its dynamic platform that connects riders with drivers and facilitates food deliveries, operates in over 63 countries and serves more than 150 million users monthly.

Fiscal Performance Highlights

Uber's Q1 2024 results demonstrated a robust year-over-year growth with Gross Bookings surging by 20% to $37.7 billion, and an impressive 21% increase on a constant currency basis. This growth was driven by a 25% increase in Mobility Gross Bookings and an 18% rise in Delivery Gross Bookings. The company's revenue saw a 15% increase to $10.1 billion, aligning closely with analyst estimates of $10,112.14 million.

Despite facing challenges from business model changes which impacted revenue growth by 8 percentage points, Uber managed a significant turnaround in its operational income, reporting $172 million compared to a loss in the previous year. However, the company recorded a net loss of $654 million, influenced by a $721 million net headwind from the revaluation of equity investments.

Strategic Achievements and Operational Efficiency

Uber's CEO, Dara Khosrowshahi, highlighted the consistent, profitable growth, underpinned by a record $1.4 billion in Adjusted EBITDA, an 82% increase year-over-year. This growth is attributed to an expanded user base and increased trip frequency, with Monthly Active Platform Consumers (MAPCs) growing by 15% to 149 million and trips increasing by 21% to 2.6 billion.

The company also reported strong cash flow metrics, with operating cash flow reaching $1.4 billion and free cash flow also at $1.4 billion. This financial health supports Uber's ongoing investments in innovation and market expansion, including autonomous mobility and delivery services, enhancing long-term growth prospects.

Future Outlook

Looking ahead to Q2 2024, Uber anticipates Gross Bookings to be between $38.75 billion and $40.25 billion, representing an 18% to 23% growth on a constant currency basis. Adjusted EBITDA is expected to be between $1.45 billion and $1.53 billion, marking a significant year-over-year increase. These projections reflect Uber's confidence in its operational strategies and market demand.

Conclusion

Uber's Q1 2024 performance underscores its resilience and adaptability in a dynamic market. With strategic expansions and a robust financial position, Uber is well-poised to maintain its growth trajectory and strengthen its market leadership. Investors and stakeholders can anticipate continued progress as the company advances its multi-year growth framework and capitalizes on emerging opportunities.

For detailed insights and further information, visit Uber's investor relations website or consult their latest financial filings.

Explore the complete 8-K earnings release (here) from Uber Technologies Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance