Do U.S. Elections Matter to Singapore’s Stock Market?

It makes sense that the American political calendar moves the U.S. stock market. What makes less sense is that history suggests that the U.S. election cycle may have an even bigger effect on Singapore’s stock market – as well as the rest of Asia’s. The economic cycle and market valuations generally play a bigger role than the presidential election in U.S. stock markets performance. But presidential politics matter in the context of the clear cycle of expected policy changes, economic stimulus, hope that real change is coming – followed by the usual disappointment in the whole political process. All of these feed in to stock market performance. How it works in the U.S. A U.S. president serves a four-year term and can only serve a maximum of two terms. Each four-year term can be split into the post-election year (the president’s first year in office, starting in January); the midterm year (year 2 of the presidency); the pre-election year (year 3, or 2015 in this cycle) and the election year (year 4, or 2016 for this cycle). As shown below, since 1928 the U.S.-based S&P 500 has gained an average of 12.8% during pre-election years (year 3, or the calendar year before the year of the presidential election). The most recent pre-election year was 2015 and the S&P 500 was down about 1%, breaking with tradition. The strong performance during the pre-election year has happened over 21 election cycles – suggesting it’s more than just coincidence.

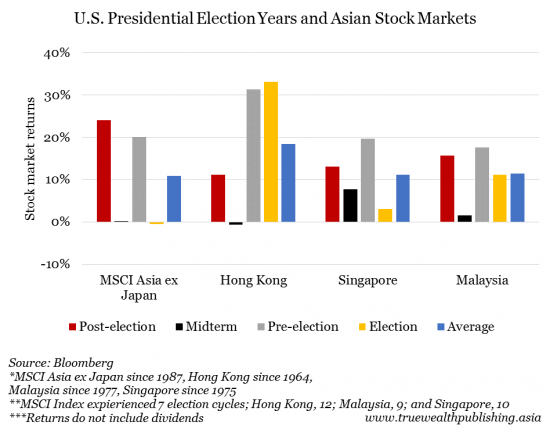

Singapore – and Asia’s – markets may be even more affected The American presidential cycle appears to play an even bigger role in Asian markets, including Singapore’s. The STI has seen significant outperformance in the American pre-election year. Since 1975, STI returns have averaged 19% the calendar year before the year of a U.S. presidential election. The year after an election, or the post-election year, has also produced strong returns for the STI – an average of 13%. The MSCI Asia ex Japan Index also likes pre-election and post-election years. It’s moved up 20% and 24% respectively, on average, those years (data available since 1988). But it’s flat during midterm and election years.

Why the effect on Asian markets? Why would Singapore, and other Asian, stock markets seem to be so influenced by the American presidential election cycle? It could partly be due to the small sample size. Asian stock markets haven’t been in existence that long and haven’t seen that many presidential election cycles – Singapore’s STI has only seen 10. When there are fewer data points, it’s easier for the results to be skewed by historically unusual returns (like 2008’s big losses). But that’s not the whole story. It could be that global investor sentiment is affected by what happens in U.S. politics. And this may affect smaller, relatively less liquid markets like Singapore’s more than other larger markets. Especially since a smaller absolute amount of money invested or withdrawn can have an outsized effect on small markets. Whatever the case, the numbers tell us that we shouldn’t be surprised that this year’s markets have been uninspiring – it’s an election year. And election years are consistently weak for every market we looked at. But, post-election years have historically seen above average performance for the STI and the MSCI Asia ex Japan Index. If the pattern holds, then, get ready for better stock market performance next year.

Kim Iskyan

Yahoo Finance

Yahoo Finance