5 Business Sectors That Turned Contractionary In Q12023 (According To The OCBC SME Index)

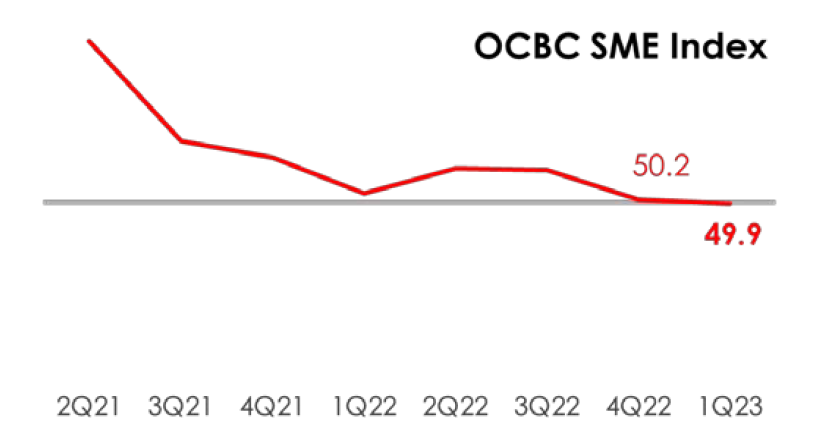

The OCBC SME Index, which provides a barometer of SME business health and performance, contracted to 49.9 in 1Q2023. This indicates a deterioration relative to the same period a year ago after the last eight consecutive quarters of expansion. This is consistent with the MTI’s advance estimates, which show Singapore’s economy contracted in 1Q23 by 0.7% on a quarter-on-quarter basis.

Of the 11 business sectors that the OCBC SME Index tracks, 6 still show expansionary readings, such as Building & Construction, Business Services, and F&B. Despite the positive numbers, some sectors, like manufacturing, which is our biggest contributing sector, saw a decline of 0.8 points in 1Q23 compared to the previous quarter, showing signs of a slowing economy.

However, the weakness has been more telling in these 5 business sectors, which has dragged the overall index down.

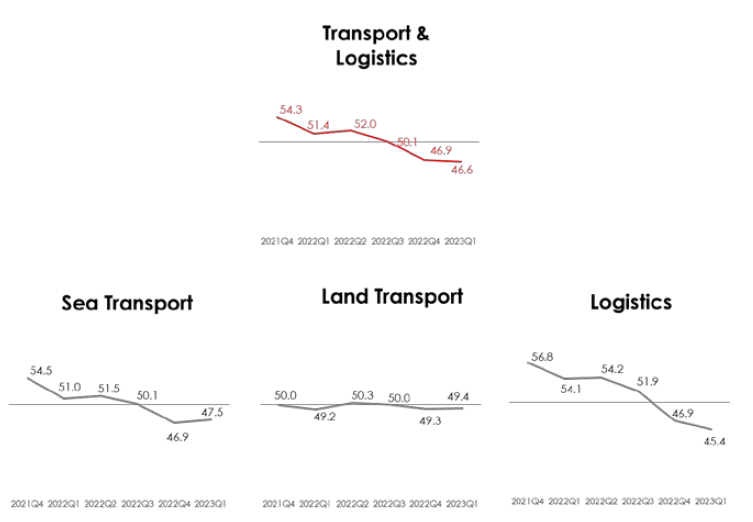

Contractionary Sector: #1 Transport & Logistics

OCBC SME Index Score: 46.6

With an index score of 46.6, Transport & Logistics was the worst-performing sector in 1Q2023, as it extended its decline since 2022.

The sector comprises the sea transport, land transport, and logistics segments. Of which, the logistics segment had fared the worst, with a decline of 1.5 points in 1Q2023 compared to last quarter, which could be a result of slowing demand for global trade.

Despite the poor performance, the OCBC report mentioned that more than half of the business owners (53%) expected to see an improvement in their business in the next 6 months.

Contractionary Sector: #2 Wholesale Trade

OCBC SME Index Score: 47.1

| 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

Wholesale Trade | 52.7 | 51.4 | 52.1 | 51.0 | 48.3 | 47.1 |

The wholesale trade, which represents the import and export of goods, is the second worst-performing sector. It is also the second-largest sector of our economy, accounting for 18%, or $90 billion, of our GDP in 2021.

While the sector saw strong expansion in 2021, it moved into a contractionary phase in 4Q22 and has continued with its poor performance with an index score of 47.1 in 1Q23. This could be indicative of the slowing global trade that has affected the sector.

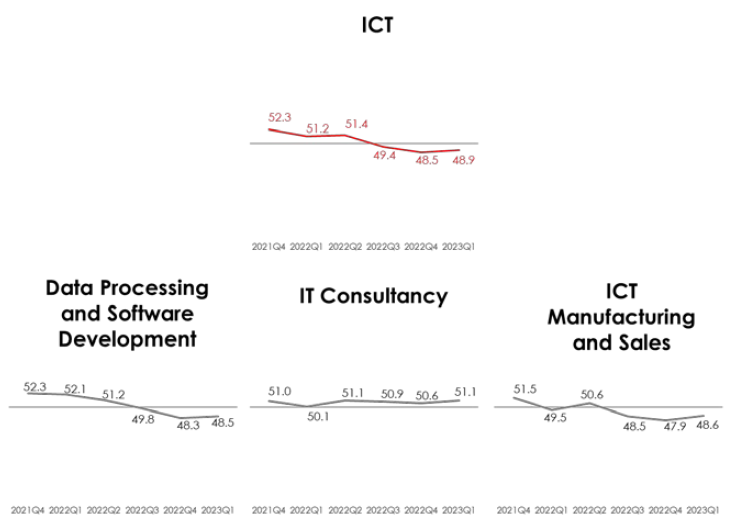

Contractionary Sector: #3 Information, Communication And Technology (ICT)

OCBC SME Index Score: 48.9

ICT used to be one of the stronger performing sectors in 2021, but it has since suffered from poor performance, with an index score of 48.9 in 1Q23 due to the cooling of the tech industry and the slump in the global chip industry since 2022.

Of the three business segments that make up the sector, only the IT Consultancy is in expansionary territory with a score of 51.1, while the other two segments, data processing and software development, and ICT manufacturing and sales, have continued their poor performance over the last three consecutive quarters, which has dragged the overall sector.

Contractionary Sector: #4 Resources

OCBC SME Index Score: 49.3

| 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

Resources | 53.1 | 50.1 | 51.7 | 51.1 | 48.8 | 49.3 |

Despite the lack of natural resources on our island, we are a leading global hub for agri-commodities, metals, and minerals. Though the sector still shows a contractionary reading of 49.3, it has improved compared to the previous 4Q22, where it had an index score of 48.8.

Contractionary Sector: #5 Retail

OCBC SME Index Score: 49.7

| 4Q21 | 1Q22 | 2Q22 | 3Q22 | 4Q22 | 1Q23 |

Retail | 51.5 | 49.8 | 51.0 | 50.9 | 49.6 | 49.7 |

Retail is the fifth sector to have shown a contractionary reading of 49.7 in 1Q23. The sector was included under the progressive wage model (PWM) on 1 September 2022, which required employers to pay lower-wage workers progressive wages and at least the local qualifying salary (LQS) requirement to their local workers.

Like the other sectors, it also saw a contraction in 4Q22, which has extended to 1Q23.

Business Outlook For 2023

According to MAS, Singapore’s GDP is projected to grow around 0.5-2.5% this year compared to last year’s estimates of 3.6%, given the global slowdown in trade due to supply chain disruptions and ongoing geopolitical tensions. It expects both trade-oriented sectors to contract further and the pace of expansion in domestic-oriented sectors to moderate as demand may dampen due to higher consumer prices and interest rates.

This is in contrast to the expectations of the 950 SME business owners polled in the OCBC SME Business Outlook. About 47% of the business owners expected an improvement in their business performance for the next two quarters, while 37% expected it to remain the same, compared to the 17% that expected a decline in performance.

The post 5 Business Sectors That Turned Contractionary In Q12023 (According To The OCBC SME Index) appeared first on DollarsAndSense Business.

Yahoo Finance

Yahoo Finance