What Tuesday's wild market ride tells us about where stocks might go next

Tuesday was a wild day in the U.S. stock market.

When investors got to the office after a three-day holiday weekend, futures were soaring higher after a big rally into the long weekend on Friday. At the start of trading, the Dow broke 26,000 for the first time, the S&P 500 topped 2,800, and the major averages brought their year-to-date gains up to 5%.

By day’s end, however, markets had turned negative across the board with each of the major indexes losing more than 1% from their intraday highs by the close.

This big intraday swing in markets sent the VIX towards a two-month high, and coming alongside a broad crash in cryptocurrency prices it started to feel a bit like the exuberant markets that came to define the early part of 2018 had begun to roll over.

But data from Bespoke Investment Group published Tuesday afternoon shows that while the kind of intraday swings we saw Tuesday are somewhat rare, they do not necessarily portend large downturns in the market in the weeks or months to come.

Since 1982, Bespoke notes that there have been 30 prior instances in which the S&P 500 rallied more than 0.5% to a new all-time high before losing 1% from its daily highs to the closing price.

In week that followed these occurrences, the median return for the S&P 500 is 0.16%, while the median return over the one- and three-month periods that follow clocked in at 1.23% and 3.42%. On average, the benchmark index is also higher over these periods. The average return for the index following days like we saw on Tuesday exceeds the index’s average return after all days since 1983.

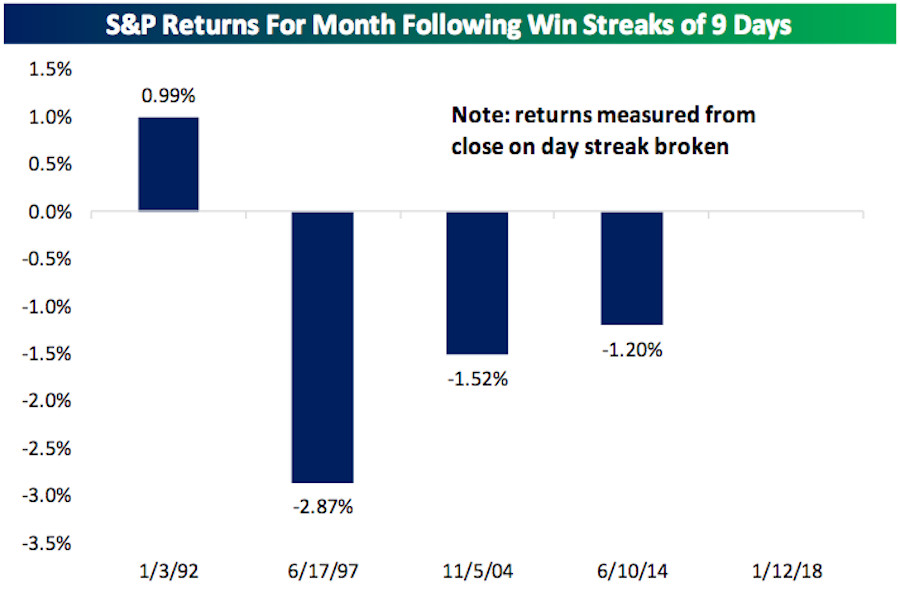

And while the stock market’s intraday swing on Tuesday caught the attention of investors, the decline also marked the end of a nine-day winning streak for the benchmark index.

And the outlook for stocks after these streaks break is a little bit more mixed.

Since 1982, there have been just five winning streaks of this length for the S&P 500, and after the previous four stocks were lower in the month that followed, according to Bespoke. Only the 1991-92 winning stretch saw the stock market gain 1% in the month following the end of that winning run.

The firm writes that this data, “does suggest that short-term, the equity market won’t climb as quickly,” adding that, “nothing here suggests selling everything, but aggressive positioning isn’t likely to be rewarded over the last month.”

On Wednesday, stocks were rallying again with the Dow closing in on 26,000 once again. At midday, each of the major indexes was up better than 0.5% with the blue chip index up almost 200 points.

And while these data sets are somewhat in conflict with each other, the message is consistent — one wild day of trading doesn’t signal that the top is in for markets, and over time, stocks usually go up.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance