TSX Growth Companies With Insider Ownership As High As 20%

The Canadian market has shown promising growth, with a 1.3% increase over the past week and an impressive 9.1% rise over the last year, complemented by an anticipated annual earnings growth of 13%. In such a flourishing environment, stocks with high insider ownership can be particularly appealing, as they often indicate that company leaders have a vested interest in the company's success.

Top 10 Growth Companies With High Insider Ownership In Canada

Name | Insider Ownership | Earnings Growth |

goeasy (TSX:GSY) | 21.7% | 15.9% |

Aritzia (TSX:ATZ) | 19% | 51.6% |

Payfare (TSX:PAY) | 15% | 63.8% |

Allied Gold (TSX:AAUC) | 22.4% | 73.5% |

Rivalry (TSXV:RVLY) | 11.7% | 61.8% |

ROK Resources (TSXV:ROK) | 16.6% | 135.9% |

Silver X Mining (TSXV:AGX) | 14.3% | 133.8% |

Ivanhoe Mines (TSX:IVN) | 13.1% | 36.4% |

Almonty Industries (TSX:AII) | 12.6% | 76.2% |

UGE International (TSXV:UGE) | 35.4% | 57.8% |

We're going to check out a few of the best picks from our screener tool.

Green Thumb Industries

Simply Wall St Growth Rating: ★★★★☆☆

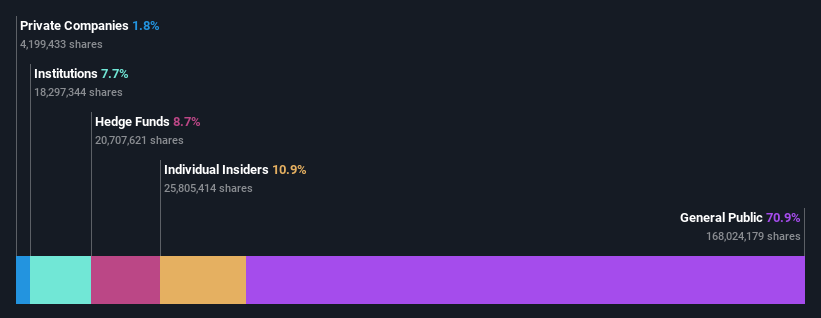

Overview: Green Thumb Industries Inc. operates in the United States, focusing on the manufacturing, distribution, marketing, and sale of cannabis products for both medical and recreational use, with a market capitalization of approximately CA$4.14 billion.

Operations: The company generates revenue through the manufacturing, distribution, marketing, and sale of cannabis products for both medical and recreational purposes in the U.S.

Insider Ownership: 10.9%

Green Thumb Industries, a growth company with high insider ownership in Canada, reported a significant increase in Q1 2024 earnings to US$31.08 million from US$9.14 million year-over-year, alongside an expansion with the opening of its 16th Florida location. Despite this positive momentum and insider buying activity, the forecasted return on equity remains modest at 7.5%. The company's revenue and earnings are expected to grow above market rates at 10.4% and 25.3% per year respectively, although it is trading below its estimated fair value by 39.5%.

North American Construction Group

Simply Wall St Growth Rating: ★★★★★☆

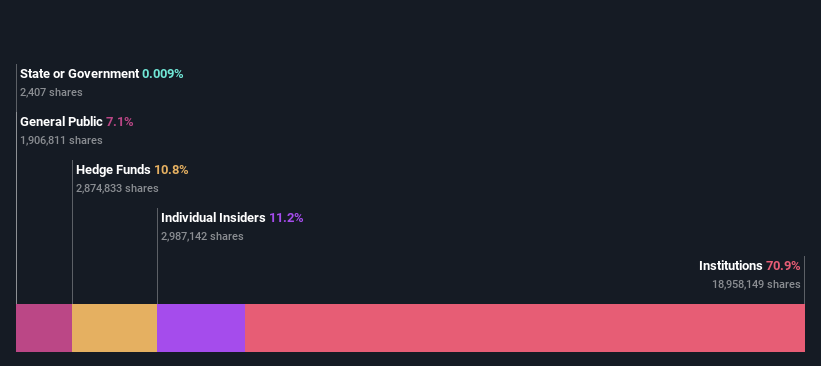

Overview: North American Construction Group Ltd. operates primarily in mining and heavy civil construction services across Australia, Canada, and the United States, with a market capitalization of approximately CA$750.83 million.

Operations: The company generates its revenue by providing mining and heavy civil construction services across Australia, Canada, and the United States.

Insider Ownership: 11.2%

North American Construction Group, a Canadian growth company with high insider ownership, is experiencing robust forecasted earnings growth at 44.81% annually, outpacing the market significantly. Despite this strong growth potential and higher-than-market revenue increase projections of 17.4% per year, its profit margins have declined from last year's figures. The stock is currently trading well below its estimated fair value by 66.9%, indicating potential undervaluation despite some financial strains like poor coverage of interest payments by earnings.

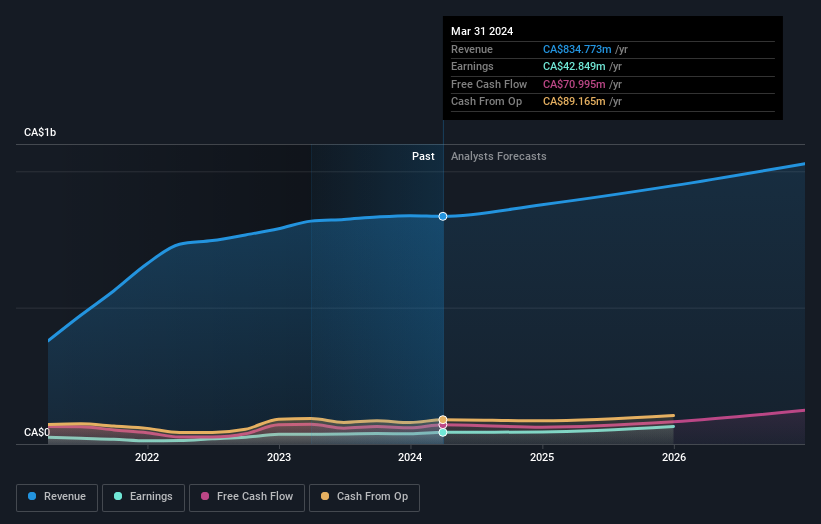

Savaria

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation specializes in accessibility solutions for the elderly and physically challenged, operating in Canada, the United States, Europe, and internationally, with a market cap of approximately CA$1.23 billion.

Operations: The company operates in accessibility solutions across multiple regions, generating a market capitalization of approximately CA$1.23 billion.

Insider Ownership: 20.1%

Savaria, a Canadian company with high insider ownership, has shown promising growth, with earnings rising by 13.1% annually over the past five years and projected to grow at 24.87% annually in the coming years. Recent financials indicate a solid performance, with Q1 2024 net income increasing to CA$11.05 million from CA$6.04 million year-over-year and sales expected to reach approximately CA$1 billion in 2025. The firm consistently pays dividends, recently declaring CA$0.0433 per share, reinforcing its shareholder commitment amidst substantial insider buying over the past three months.

Make It Happen

Click through to start exploring the rest of the 30 Fast Growing TSX Companies With High Insider Ownership now.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include CNSX:GTII TSX:NOA and TSX:SIS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance