TSMC's Record Sales Surge: What's Behind the Sudden Spike?

Taiwan Semiconductor Manufacturing Co (NYSE:TSM) experienced a 60% surge in April sales to 236 billion New Taiwan dollars ($7.3 billion), driven by ongoing demand for artificial intelligence and signs of recovery in consumer electronics.

The world’s largest contract chipmaker is projected to boost sales by about a third this quarter, following a 34.3% increase in revenue growth in March, primarily fueled by the relentless demand for AI semiconductors.

The global smartphone market, particularly competitive in China, has grown again in the first quarter, potentially increasing orders for TSMC’s core mobile chips, Bloomberg reports.

Also Read: Intel’s New Venture in Japan: Pioneering Automation in Chip Manufacturing by 2028

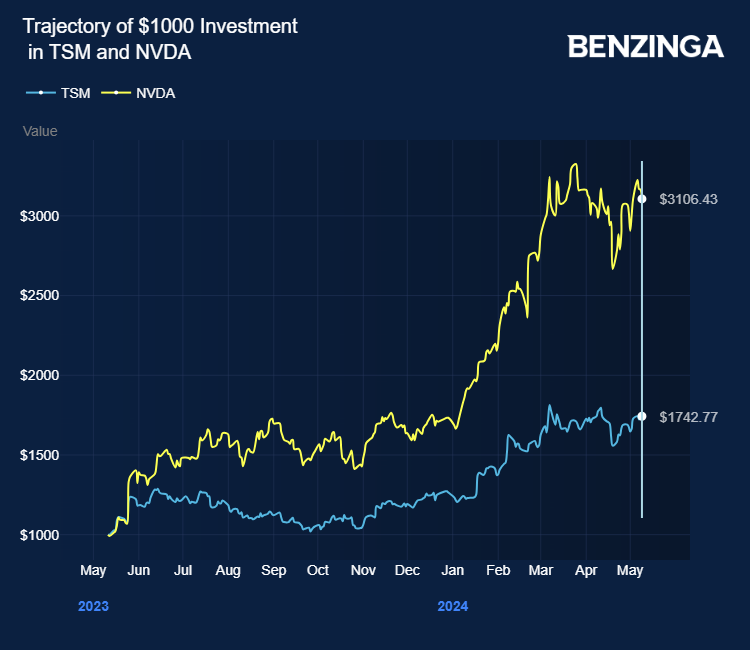

Based in Hsinchu, TSMC navigated a year of subdued demand for personal electronics, which Nvidia Corp’s (NASDAQ:NVDA) highly sought-after AI chips helped mitigate.

The company’s shares reached a record high in April, as it continues to benefit from the rise of AI technology. It is the exclusive producer of Nvidia’s most advanced training chips.

In April, TSMC shared plans to initiate production of its new “A16” chip manufacturing technology in the second half of 2026. Analysts told Reuters that TSMC’s latest technologies could contest Intel Corp’s (NASDAQ:INTC) February assertions of outpacing TSMC with its new “14A” technology.

Additionally, TSMC unveiled a novel technology that enhances the speed of AI chips by delivering power to computer chips from the backside, set to be available in 2026.

TSMC stock gained over 68% in the last 12 months. Investors can gain exposure to the stock via VanEck Semiconductor ETF (NASDAQ:SMH) and IShares Semiconductor ETF (NASDAQ:SOXX).

Price Action: TSM shares were trading higher by 2.98% at $147.02 premarket at the last check on Friday.

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo by Jack Hong via Shutterstock

"ACTIVE INVESTORS' SECRET WEAPON" Supercharge Your Stock Market Game with the #1 "news & everything else" trading tool: Benzinga Pro - Click here to start Your 14-Day Trial Now!

Get the latest stock analysis from Benzinga?

This article TSMC's Record Sales Surge: What's Behind the Sudden Spike? originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Yahoo Finance

Yahoo Finance