TScan Therapeutics Inc (TCRX) Reports Increased Revenue and Expands Clinical Pipeline

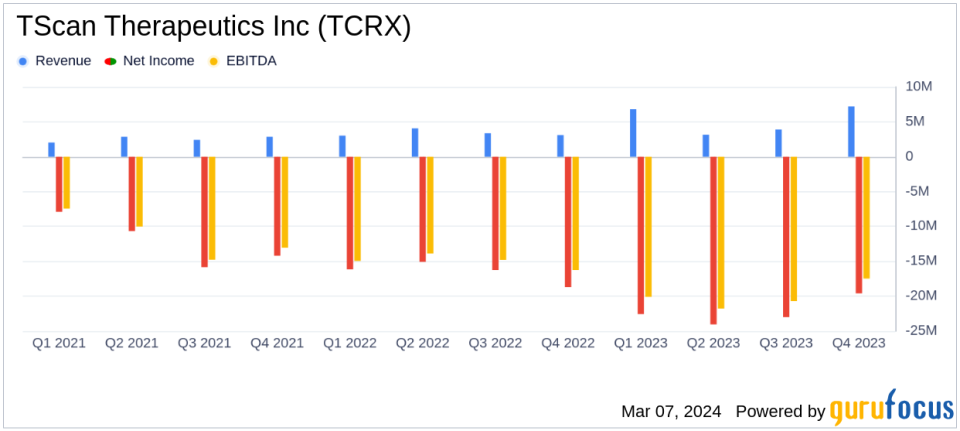

Revenue Growth: Q4 revenue rose to $7.2 million from $3.1 million in the same period last year, with full-year revenue reaching $21.0 million compared to $13.5 million in 2022.

R&D Investments: R&D expenses increased to $22.4 million in Q4 and $88.2 million for the full year, reflecting clinical trial and personnel costs.

G&A Expenses: General and administrative expenses slightly increased to $6.2 million in Q4 and $26.4 million for the full year.

Net Loss: Net loss for Q4 was $19.6 million, with a full-year net loss of $89.2 million, including net interest income.

Cash Position: Cash, cash equivalents, and marketable securities totaled $192.0 million, funding operations into 2026.

Share Count: Issued and outstanding shares totaled 47,829,529 as of December 31, 2023.

On March 6, 2024, TScan Therapeutics Inc (NASDAQ:TCRX) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 31, 2023, along with a comprehensive business update. The biopharmaceutical company, which specializes in T-cell receptor (TCR) engineered T cell therapies for cancer treatment, reported significant progress in its clinical pipeline and financial growth.

Financial Performance and Clinical Advancements

TScan Therapeutics Inc (NASDAQ:TCRX) highlighted its clinical advancements, including positive data from its Phase 1 study of TSC-100 and TSC-101 for treating hematologic malignancies. The company also announced the clearance of two additional INDs for its Solid Tumor Program, marking a significant step forward in its clinical development.

From a financial perspective, TScan reported a substantial increase in revenue for both the fourth quarter and the full year, primarily due to the timing of research activities related to a collaboration agreement with Amgen. However, the company also saw an increase in research and development expenses, driven by clinical trial costs, personnel expansion, and facilities growth. General and administrative expenses also rose slightly due to legal and professional fees.

Strategic Business Developments

Alongside its financial results, TScan Therapeutics Inc (NASDAQ:TCRX) provided updates on its business developments. The company is actively enrolling patients in its solid tumor clinical trial and anticipates initial data in 2024. TScan also expanded its leadership team with key appointments and promotions, reflecting its commitment to advancing its strategic objectives.

The company's cash position remains strong, with sufficient funding to support operations into 2026. This financial stability is crucial as TScan continues to invest in its clinical programs and expand its ImmunoBank, a repository of therapeutic TCRs targeting diverse cancer antigens.

Analysis of Financial Tables

The condensed consolidated balance sheet data indicates a healthy increase in total assets from $199.1 million in 2022 to $272.1 million in 2023. The company's total liabilities and stockholders' equity also reflect this growth, with stockholders' equity rising from $99.4 million to $150.9 million.

The condensed consolidated statements of operations reveal the specifics behind the revenue growth and increased expenses. The net loss per share for the full year 2023 was $1.36, compared to $2.75 in the previous year, showing a reduction in loss per share despite the overall net loss.

TScan Therapeutics Inc (NASDAQ:TCRX) is poised for continued growth and development in the biotechnology industry. With a strong financial foundation and promising clinical advancements, the company is well-positioned to deliver innovative cancer therapies to patients in need.

For a detailed view of TScan Therapeutics Inc (NASDAQ:TCRX)'s financials and business updates, investors and interested parties can access the full 8-K filing.

Explore the complete 8-K earnings release (here) from TScan Therapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance