Trump Tax Cut Extension Won't Pay for Itself: Analysis

Although some of the more enthusiastic true believers continue to insist that tax cuts pay for themselves through higher growth, the economic data has long proved otherwise. As policymakers gear up for a fight over the expiration of the 2017 Trump tax cuts at the end of next year, a new set of analyses bring that point home once again.

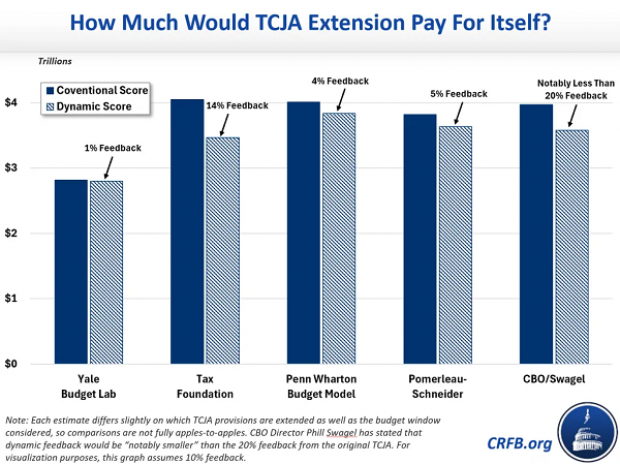

Reviewing reports and comments from five different sources, analysts at the nonpartisan Committee for a Responsible Federal Budget found that an extension of the Trump tax cuts would have a fairly modest effect on economic growth, with an estimated change in long-run output in a range between a 0.5% reduction and a 1.1% increase. The result would be just a trickle of extra tax revenue, equal to between 1% and 14% of the cost.

One reason for the modest effect on growth is that tax cuts set to expire in 2025 are largely for individuals, while the corporate tax cuts included in the 2017 tax law, which theoretically have a larger effect on growth, were permanent and thus not part of the extension analysis. Another reason is that the extension of the tax cuts will increase the debt overall, which most economic models assume affects growth negatively.

“While almost no tax cut would pay for itself,” the analysts at CRFB write, “the dynamic effects of extending the TCJA would be particularly modest due to the composition of the expiring tax cuts and the high economic cost of growing the national debt.”

chart-TCJA-extension-CRFB-06062024-600.png

Yahoo Finance

Yahoo Finance